Don’t trust Putin’s rouble price, say traders

Currency traders are shunning Russia’s local rouble exchange rate over fears of its crumbling credibility in a further blow to the country’s economy.

Financial contracts will be priced in the weaker offshore exchange rate after the local rate was artificially inflated by capital controls which were installed by the central bank to stop money rushing for the exit.

The Trade Association for the Emerging Markets recommends that traders make the switch when pricing certain derivative contracts from early next month, given the gap between the rouble’s exchange rate locally and abroad, according to Bloomberg.

It is another sign that investor trust in Vladimir Putin’s Russia is collapsing as businesses and traders shun the country en masse. Economists have warned that foreign investment into Russia will be permanently damaged by the Kremlin’s actions as businesses boycott the country.

The rouble is trading weaker abroad but the gap between the two rates has narrowed. Refinitiv data suggests the local rate is at 69.4 per dollar while it is 67.9 offshore, a 2pc difference.

Capital controls, measures to stop money leaving the country, have helped the rouble rebound rapidly after it crashed following Russia’s invasion of Ukraine. After halving in value against the dollar in the first weeks of the war, the rouble has clawed back all of its losses.

Scope Ratings analyst Levon Kameryan said the rouble’s “fortunes are increasingly disconnected from the health of the Russian economy”.

He said the recovery in the currency can be explained by inflows of money for energy and the central bank’s capital controls and higher interest rates.

“Efforts of the Central Bank of Russia to prevent capital flight through capital controls and higher interest rates, while they are working for now, come at a cost of tighter financial conditions,” Mr Kameryan said.

“We project Russia’s economic output to contract by at least 10pc this year, the steepest decline since 1994, and stagnate in 2023, knocking the economy back to levels last seen on the eve of the global financial crisis of 2008.”

On Monday, the Russian finance ministry admitted the country is facing a 12pc plunge in GDP this year, the largest slump since 1994 when its economy was adjusting to capitalism following the collapse of the Soviet Union.

New figures from the Kremlin on Wednesday suggested that Russian inflation eased for a second consecutive week as household demand is squeezed.

Prices increased by just 0.1pc in the seven days to May 6, levels not seen since early January, according to the country’s statistician. However, Moscow said the inflation rate is at 18pc compared to a year earlier.

It came as economists warned that imports into the country almost halved in March and will collapse further as it heads into recession.

The Kremlin has suspended the publication of trade data but figures from trading partners point to a 45pc plunge in March, according to Capital Economics.

Liam Peach, Russia economist at Capital Economics, said: “The slump in Russian imports in March is the first sign of a broader collapse in domestic demand due to Western sanctions and we think this slump will deepen in the second quarter.”

As the EU mulls an embargo on Russian oil, the Institute of International Finance said a ban would have a huge impact on the country’s exports. It predicted that a ban could cut Russia exports by $155bn over the next two years.

“The final impact over 2022-24 will largely depend on Russia’s ability to redirect exports,” said IIF economist Benjamin Hilgenstock.

The European Commission has put forward proposals for an oil embargo to ramp up the pressure on the Kremlin. However, a vote to ban Russian oil needs unanimous approval and has been delayed amid opposition from Hungary.

Its government has warned that the proposals would be devastating for the Hungarian economy given the country imports 65pc of its oil supply from Russia.

Prime minister Viktor Orbán said last week on the plans: “We cannot accept a proposal that ignores this circumstance. This proposal in its current form is like an atomic bomb dropped on the Hungarian economy.”

05:02 PM

Wrapping up

That’s all from us today, thank you for following! Before you go, check out the latest stories from our reporters:

04:56 PM

AXA, Unilever to join new €1bn euro regenerative agriculture fund

Insurer Axa and consumer goods group Unilever plan to invest €100m (£86m) each into a new €1bn regenerative agriculture fund to be managed by Tikehau Capital.

The companies said they signed a preliminary agreement to establish a new private equity “impact” fund dedicated to enhancing biodiversity and mitigating climate change by scaling up regenerative farming, which companies and governments see as a way to help meet targets to lower greenhouse gas emissions.

Proponents say regenerative farming can fight climate change by rebuilding soil organic matter and restoring degraded soil biodiversity, drawing carbon dioxide from the atmosphere and improving the water cycle.

04:34 PM

Moderna boss earns $700,000 salary in just one day after quitting abruptly

A top executive at a leading Covid vaccine manufacturer earned $700,000 in just one day after he quit abruptly amid an investigation at his former employer. Hannah Boland writes:

Jorge Gomez took over as chief financial officer at Moderna on Monday but stepped down from the post a day later after his previous employer, Dentsply Sirona, announced it had launched an internal investigation into financial reporting.

Dentsply disclosed that it had been made aware of “allegations regarding certain financial reporting matters” by current and former employees.

As part of the investigation, which kicked off in March, its audit and financial committees are looking into the incentives used to sell products to distributors and how they were disclosed.

It is also scrutinising allegations that certain former and current members of senior management directed the use of incentives to achieve executive compensation targets.

04:11 PM

FTSE 100 records best session in more than a month

The FTSE 100 has ended higher as energy and mining shares rallied on the back of higher commodity prices and Compass Group posted a strong earnings report.

The blue-chip index closed 1.4pc higher to record its best session in more than a month.

Compass Group jumped 7.4pc to the top of the index, after the catering company raised its annual revenue forecast and announced a £500m share buyback following a strong first half.

“A lot of corporates so far have been pretty successful in passing on the higher costs to consumers and we’ve seen UK stocks being relatively attractive because they are relatively cheap and you’re still earning a decent return,” said Stuart Cole, head macro economist at Equiti Capital.

“However, if you look at the BRC (British Retail Consortium) figures this week they are showing that consumers are starting to curtail their spending as the cost of living crisis bites and real income is severely eroded.”

03:49 PM

London start-up raises $150m for carbon capture projects

A London-based start-up that makes small, modular units to capture carbon emissions from smokestacks has raised $150m (£121m) from investors that include the venture arms of Chevron, Saudi Arabian Oil and Samsung.

Carbon Clean Solutions has tested its technology at more than 40 sites around the world, and says it can capture as much as 97pc of carbon dioxide released by steel and cement factories and power plants.

The company has been developing the technology for more than a decade and is now ready to scale up, according to chief Aniruddha Sharma. For climate startups, “the hardest thing is actually getting the tech out there and commercialized,” Sharma said.

Carbon capture technology is more than a century old. It was commercialised by gas companies to separate CO2 that sometimes was found mixed with natural gas. In the 1970s, rather than releasing the CO2, companies found a use for the greenhouse gas: it could be injected into an aging field to increase oil production.

⚡Announcement ⚡

Carbon Clean has raised $150m – the largest funding round for a point source carbon capture company. https://t.co/X3wEzjZOMh— Carbon Clean (@carbonsolu) May 11, 2022

03:29 PM

UniCredit holds talks to offload Russian unit

UniCredit is in preliminary talks for the sale of its Russian unit after it was approached by interested buyers, marking what could be the second major exit by a large European bank.

The Italian bank has attracted unsolicited interest from financial institutions as well as firms interested in obtaining a bank license from within Russia, Bloomberg reported. Early stage talks with potential non-sanctioned buyers started recently.

The bank is also still considering other options besides a sale.

UniCredit, Austria’s Raiffeisen Bank and France’s Societe Generale are the top three Western European lenders in Russia. SocGen has already agreed to sell its Rosbank unit to the investment firm of Russia’s richest man, taking a hit of about €3bn (£2.5bn) to exit the heavily sanctioned nation, while Raiffeisen said it has also been approached by unsolicited buyers.

03:08 PM

Jamie Dimon makes homeworking concession

Even the most inflexible bosses are softening their return-to-office expectations.

JP Morgan chief Jamie Dimon has been one of the most vocal critics of remote work, arguing that it’s no substitute for the spontaneous idea generation that results from bumping into colleagues at the coffee machine.

But in his annual letter to shareholders last month, the head of America’s biggest bank allowed that working from home “will become more permanent in American business,” and estimated that about 40pc of his 270,000-person workforce would work under a hybrid model, which includes days in the office and at home.

Soon after Dimon’s missive, one of the bank’s senior technology executives told some teams that they could cut back from three days in the office per week to two, citing internal feedback.

03:02 PM

Handing over

That’s all from me for today – thanks for following! Handing over now to Giulia Bottaro.

02:44 PM

‘Unacceptable behaviour’ and sexism has increased, says Aviva boss

Aviva’s chief executive has revealed that sexism and “unacceptable behaviour” has got worse and more “overt” the more senior she has become boss.

Lucy Burton has the story:

Amanda Blanc, who joined the FTSE 100 group in 2020 as its first female chief executive, made the comments after she suffered a torrent of sexist abuse at the company’s annual general meeting earlier this week.

She wrote in a LinkedIn post: “I would like to tell you that things have got better in recent years but it’s fair to say that it has actually increased – the more senior the role I have taken, the more overt the unacceptable behaviour.”

One individual investor said at the meeting on Monday that Ms Blanc is “not the man for the job” while another asked whether she should be “wearing trousers” as he mentioned some of her predecessors.

A third small investor expressed appreciation for the gender diversity at the insurance giant’s board before saying: “They are so good at basic housekeeping activities, I’m sure this will be reflected in the direction of the board in future”.

Responding to the comments, Ms Blanc said that after 30 years working in finance she is “pretty used to sexist and derogatory comments” and has picked up her fair share of “misogynistic scars”.

However, she said sexist comments are now becoming more public and she fears gender equality remains a “long way off”.

02:14 PM

Top EU official backs Marshall-style plan for Ukraine

A top EU official has thrown his weight behind a multi-trillion-euro package to rebuild Ukraine akin to the post-war Marshall Plan.

Werner Hoyer, president of the European Investment Bank, said Europe must not be left alone to foot the vast bill that he predicted could run into the trillions.

Under the post-Second World War Marshall Plan, the US granted Europe the present-day equivalent of some $200bn over four years in economic and technical assistance.

Addressing the need for a similar programme for Ukraine, Mr Hoyer said the cost of rebuilding the country had been discussed at recent meetings at United Nations, the International Monetary Fund and World Bank in Washington.

He told Reuters: “What will it cost to rebuild, reconstruct Ukraine? Figures were flying around the room… but one thing is quite clear to me: We are not talking about millions but trillions.”

02:02 PM

Oil prices surge on China and inflation fears

Oil prices have jumped this afternoon as investors digested easing Covid cases in China and more signs of stubborn inflation in the US.

Benchmark Brent crude rose 4.3pc to just shy of $107 a barrel, while West Texas Intermediate was close behind at $105.

Infections in Shanghai and Beijing dropped yesterday, providing some cautious optimism after lockdowns sparked fears of falling demand from China.

Meanwhile, US consumer prices rose by more than expected in April as Russia’s war in Ukraine continues to fuel inflation.

01:49 PM

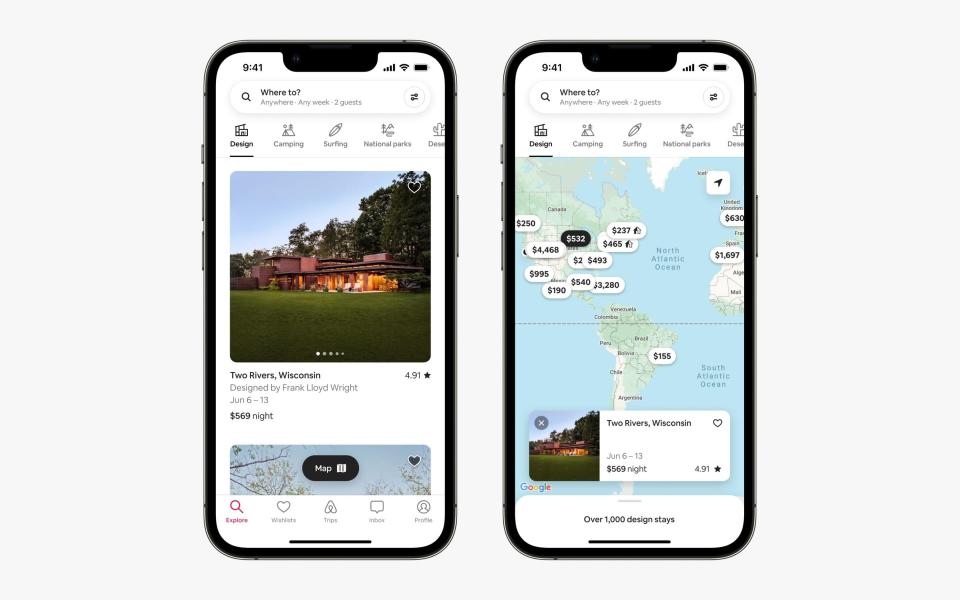

Airbnb decides to stop asking customers where they want to go

Airbnb will suggest properties holidaymakers may want to visit instead of asking them to enter a destination as it tackles claims it is contributing to over-tourism.

James Titcomb has more details:

The company has unveiled what it called the biggest change in its history to direct tourists away from hotspots and towards far-flung locations.

Brian Chesky, Airbnb’s chief executive, said it would “redistribute” tourism and help to prevent throngs of travellers flocking to cities such as Venice and Paris during peak times.

“Over tourism isn’t too many people in the world travelling, I think over tourism is too many people going to the same place at the same time,” he said. “We’re trying to spread everyone out over as many dates and many locations as possible.”

The overhaul will see Airbnb’s app and website change from demanding that users enter a destination and date before showing properties, which the company says has been standard practice among travel websites for 25 years.

Instead, users will scroll through categories such as treehouses, mansions, beaches and vineyards, although prospective tourists will still be able to search by date and location if they wish.

01:35 PM

Wall Street slides after inflation data

US stocks fell at the opening bell after the latest US inflation figures came in higher than expecting, fuelling expectations of aggressive interest rate rises by the Federal Reserve.

The benchmark S&P 500 was down 0.3pc, while the Dow Jones lost 0.1pc. The tech-heavy Nasdaq lost 0.8pc.

01:27 PM

Bitcoin drops below $30,000

Bitcoin has dropped below $30,000 to its lowest level in nearly a year after US inflation data came in hotter than expected.

The world’s largest cryptocurrency fell more than 6pc to trade as low as $29,085 — its weakest since June.

Analysts view $30,000 as a key threshold, with many predicting that losses could accelerate once the digital coin falls below it.

Elsewhere in crypto markets, the TerraUSD stablecoin continued to plummet, trading at less than 30 cents. Backers of the coin are reportedly trying to raise about $1.5bn to shore up the token after it crashed from its dollar peg.

01:06 PM

Chinese consumer prices surge to five-month high

Meanwhile, Chinese consumer prices are also soaring. Tom Rees has more:

Stockpiling sparked by lockdowns and more supply chain woes pushed Chinese inflation up to a five-month high last month as Beijing digs in on its ‘zero Covid’ strategy.

A surge in food and energy bills boosted consumer price growth from 1.5pc in March to 2.1pc in April, a faster than expected pick up in costs for households.

The uptick was driven by the country’s strict ‘zero Covid’ stance as demand was driven by panicking shoppers stocking up after Beijing put swathes of its biggest cities into lockdown.

Economists estimate that energy bills in China have increased by more than a third in the last 12 months, helping to push the consumer price index to its highest level since November.

The National Bureau of Statistics said the cost of fresh vegetables jumped by 24pc compared to a year earlier, fruit rose by 14pc and eggs increased in cost by 12pc. Overall costs of food, tobacco and alcohol climbed by 1.9pc as pork prices fell by a third.

12:57 PM

More reaction: 0.75pc rate rise may be back on the table

Seema Shah at Principal Global Investors says the punchy numbers could push the Fed into an aggressive interest rate rise.

Confirmation of a peak in annual inflation after the seemingly never-ending upward path could be welcomed by markets. But more likely, markets will be dismayed – this is another upward inflation surprise and suggests that the deceleration is going to be painstakingly slow.

The focus will soon start shifting from where inflation peaked to where it plateaus, and we fear that it will plateau at an uncomfortably high level for the Fed.

We expect headline inflation to only fade to 5.5pc by year-end. With companies still displaying impressive pricing power, inflation expectations elevated, the labour market red hot and supporting strong wage growth, and shelter inflation still rising, the pressure on the Fed is going to remain intense.

A couple more prints like this and a 0.75pc rate rise may be back on the table.

12:52 PM

Reaction: Too early to declare victory against inflation

Richard Carter at Quilter Cheviot says the pressure is still on the Fed to get inflation under control.

The drop in US CPI to 8.3pc last month may be welcomed by markets with investors beginning to hope that the peak in inflation is behind us.

However, the numbers were still worse than expected and it is far too early to declare victory with inflation likely to remain high for some time to come while energy prices could also rise further if the Ukraine war escalates.

Furthermore, while it is hoped US inflation has peaked, other countries cannot say the same thing and this has become a global problem.

The pressure is also still very much on the Federal Reserve to raise interest rates and get inflation under control. Nevertheless, attention is now beginning to turn to a sharp slowdown that is predicted for the global economy and markets are increasingly becoming concerned by this.

While the Federal Reserve is now in aggressive tightening mode they may be forced to change tact very quickly as it is very fluid picture right now. As a result, volatility will reign supreme over the coming months and until we see inflation under control and thus investors need to be patient when identifying potential opportunities.

12:49 PM

Reaction: Core inflation numbers ‘concerning’

Gregory Daco, chief economist at EY Parthenon, says the acceleration in the core consumer price index is “concerning”.

??Focus on sequential core CPI momentum!

?#CPI +0.3% (slower m/m)

?Core CPI +0.6% (faster m/m)

?Food +0.9%

⛽️Energy -2.7% (gas -6.1%)?Goods -0.3%

?New +1.1%

?Used -0.4%

?Apparel -0.8%?Services +0.8%

?Shelter +0.5%

⚠️Rent +0.6%

⚠️ OER +0.5%

? +18.6%

?Hotels 2.0% pic.twitter.com/fXzeFzmSdW— Gregory Daco (@GregDaco) May 11, 2022

12:45 PM

Price rises grip US economy

While the latest report shows US inflation is likely to have peaked, the figures highlight the breadth of price increases in the economy.

Some of the largest contributors to the monthly increase included shelter, food, airfares and new vehicles.

Core CPI, which strips out volatile food and energy prices, rose by a bigger-than-expected 6.2pc year on year.

When combined with solid wage growth, the numbers suggest inflation will remain elevated for some time longer.

12:36 PM

US inflation tops forecasts

US consumer prices rose by more than expected in April in a sign that soaring prices are persisting across the economy.

The consumer price index rose 8.3pc last month on the previous year. This was down from March’s peak of 8.5pc, but still ahead of forecasts and among the highest readings in decades.

Core CPI, which excludes food and energy, increased 0.6pc from a month earlier and 6.2pc from April 2021, according to the Labor Department.

12:13 PM

Apollo plans $1bn financing for Musk’s Twitter deal

Apollo Global Management is said to be in talks to lead a preferred financing for Elon Musk’s $44bn takeover of Twitter.

The funding, arranged by Morgan Stanley, will exceed $1bn and may include Sixth Street Partners among other firms, Bloomberg reports.

Shares in Twitter closed at $47.26 each yesterday – below the offer price of $54.20 – with traders growing more skeptical that the world’s richest man will complete the deal.

That’s despite Musk revealing last week he’s getting $7.1bn in equity commitments from investors including Larry Ellison, Sequoia Capital and Qatar.

He persuaded Saudi Prince Alwaleed bin Talal to roll his $1.9bn of Twitter stock into the privatised company and is seeking to do the same with Twitter co-founder Jack Dorsey.

11:28 AM

Boris Johnson told ministers to ‘go faster’ over cost-of-living crunch.

Boris Johnson has urged his government to “go faster” in coming up with ways to tackle a cost of living crisis.

Asked about a meeting of ministers yesterday, the Prime Minister’s spokesman said:

The prime minister urged ministers to go faster and be as creative as possible in ensuring that the government is doing absolutely everything on this important issue.

You can expect us to say more on this in the days to come. What I am trying to guide away from is some of the speculation we saw about things like an emergency Budget. As I made clear… there are no plans for that.

11:23 AM

US futures rise ahead of inflation data

US futures pushed higher as investors awaited a key inflation report for signs of whether the Federal Reserve’s efforts to tame surging inflation are working.

Data due this afternoon may show inflation moderated in April but stayed above 8pc.

Traders will use this information to weigh whether the Fed can continue with its half-point hikes as expected or will need to opt for a 75 basis point increase.

Futures tracking the S&P 500 rose 0.9pc, while the Dow Jones gained 0.8pc. The tech-heavy Nasdaq jumped 1.1pc.

11:19 AM

Russian car sales suffer record plunge

Russian car sales plummeted by the most on record last month as sanctions undermined domestic production and most car brands halted operations in the country.

Sales dropped 79pc to 32,706 vehicles in April, according to the Association of European Businesses. That’s the biggest drop since the European trade group began reporting the data in 2006.

The April figures didn’t include sales from BMW, Mercedes-Benz or General Motors.

Sanctions have hobbled the domestic car industry as parts supplies dried up, leading to forced shutdowns.

Meanwhile, almost every foreign car maker with production facilities in Russia – including Volkswagen, Ford and Mazda – has suspended work in the country, while others stopped importing vehicles.

The crash highlights the extend of the economic hit to Russia, which is facing its deepest contraction in nearly three decades.

11:01 AM

UN urged to intervene over P&O Ferries sackings

Unions have urged the UN to step in on behalf of the 800 workers who were sacked by P&O Ferries, saying the UK had broken international law by failing to stop the layoffs.

The unions argue that the Government’s failure to enforce relevant labour laws and punitive sanctions was a serious violation of the International Labour Organization’s principles concerning the freedom of association and collective bargaining.

The Government has also contravened international treaties the UK is bound by, they said.

Stephen Cotton, general secretary of the International Transport Workers’ Federation, said:

P&O Ferries’ CEO has admitted the company behaved illegally when it fired 800 seafarers without warning in March, and he has told parliament he would do the same again.

P&O Ferries has behaved in the most calculated and egregious way and expects to get away with it.

In the Queen’s Speech this week, the Government unveiled new laws that will require all ferry operators using UK ports to pay seafarers the minimum wage.

10:47 AM

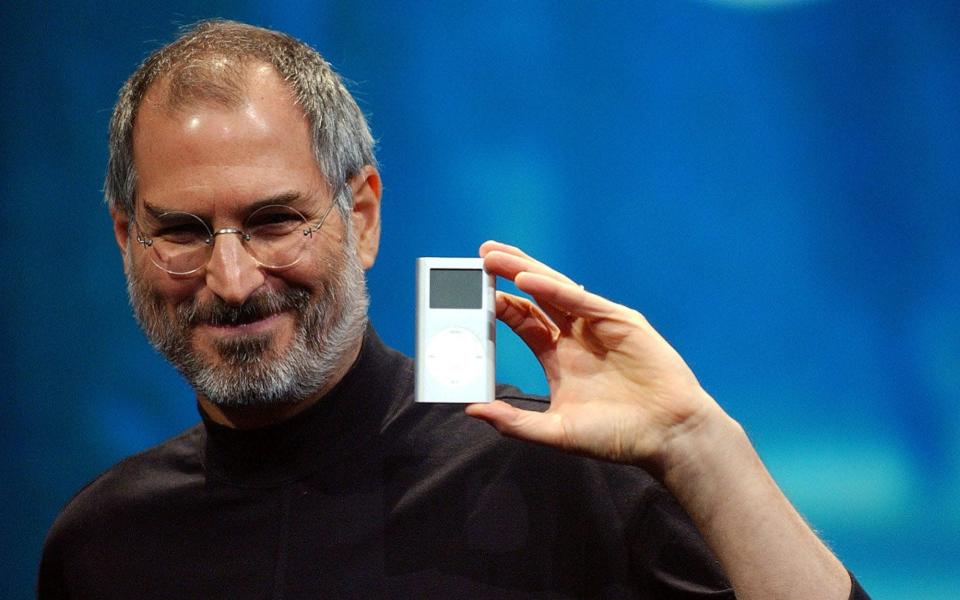

Apple to stop making iPods after 21 years

Apple is discontinuing its iPod personal music players after more than two decades, marking yet another departure from founding chief Steve Jobs’ legacy, writes Gareth Corfield.

The iconic MP3 player, first released in 2001, was as widely used in its day as smartphones are today, holding up to a thousand songs in its first version.

Apple said new iPods would continue to be available “as supplies last” but warned that no new devices are being made.

The firm added that Apple Music is available on all of its other devices, including the iPhone – another Steve Jobs invention from the early 2000s.

10:38 AM

Europe to drop face mask mandate on flights and in airports

Face masks will no longer have to be warned in airports and on flights across Europe, regulators have said.

The move, confirmed by the European Union Aviation Safety Agency and European Centre for Disease Prevention and Control, will come into force on May 16.

Rules are expected to vary after the mandatory ban is dropped, however, with individual airlines able to set their own requirements.

Airlines have been told to encourage passengers to use masks on flights to or from destinations where wearing a mask on public transport is still required.

10:15 AM

Lavrov: Russia has enough energy buyers outside West

Russia’s foreign minister has insisted his country has enough buyers for its energy outside the West.

Sergei Lavrov said: “Let the West pay more than it used to pay to the Russian Federation, and let it explain to its population why they should become poorer.”

It comes as the EU pushes to reach an agreement on cutting out imports of oil and gas from Russia.

10:08 AM

Brookfield closes in on $5bn HomeServe takeover

Brookfield Asset Management is said to be closing in on a takeover of emergency household repairs firm HomeServe in what would be the UK’s largest take-private deal this year.

The takeover is set to value HomeServe at about $5bn (£4bn), with Brookfield hammering out final terms of the transaction, Bloomberg reports.

Shares in HomeServe jumped 12.8pc, taking its market value to around £3.7bn.

Canadian investment firm Brookfield said in March it was exploring a deal for HomeServe and received an extension under UK takeover rules to make a firm offer by May 19.

09:47 AM

National Grid to make early £200m payment to UK households

National Grid has said it will pay £200m in excess revenues to UK households over the next two years instead of waiting for a five-year review period to end.

The power network operator returns profits from its power links when they exceed a predetermined cap.

National Grid said the early payback, which has been approved by Ofgem, will contribute to lowering energy bills for consumers.

The regulator hasn’t yet decided how the money will be paid back to households.

John Pettigrew, chief executive of National Grid, said:

While National Grid’s impact on customer bills is relatively small, we strive every day to keep our costs as low as possible. Given how challenging the current rise in overall energy costs is for people across the country, we want to play our part in helping reduce consumer bills.

That’s why we have requested this change to our standard regulatory process and are working with Ofgem to accelerate payments over the next two years to make a difference now.

09:16 AM

Rishi Sunak’s failures will trigger a recession, economists warn

Rishi Sunak is driving Britain into a recession through his failure to tackle the cost-of-living crisis, top economists have warned.

Tim Wallace and Louis Ashworth report:

The economy will shrink in the second half of the year, according to the National Institute of Economic and Social Research (Niesr), in part because of the Chancellor’s reluctance to prop up consumer spending with tax cuts or support for households.

Niesr predicts that inflation will soar above 8pc and unemployment will increase to above 5pc as the country is hammered as part of an international slowdown.

Its forecasters also expect Russia’s war in Ukraine to slam the brakes on global growth, costing the world economy $1.5 trillion of output.

Britain’s GDP will fall by 0.2pc in the three months to September and another 0.4pc in the final quarter of 2022 as “stagflation” threatens, before returning to years of mediocre growth.

Mr Sunak had the room to spend more or hold back tax hikes in his Spring Statement, Niesr said, which would have helped to “reduce the likelihood” of the economy going into reverse.

08:58 AM

ITV warns over summer advertising slump

ITV has posted a surge in advertising revenues, but warned of a tougher summer ahead amid wider uncertainty and tough comparisons to last year’s Euros boost.

The Love Island and Britain’s Got Talent broadcaster reported a 16pc rise in total ad revenues in the first three months of the year, helping lift overall revenues to £834m.

It said April was also strong, but warned of a slowdown in the rest of the second quarter, with ad sales dropping 8pc in May and 15pc in June.

ITV is facing a struggle to live up to last year, when the Euro 2020 football drove an 89pc jump in ad revenues in the second quarter. It also cited a hit to ad budgets from the cost-of-living crisis and Ukraine war.

Dame Carolyn McCall, chief executive of ITV, said the group was on track to launch its new on-demand platform ITVX in the final three months of the year, which is set to help it deliver a target for at least £750m in digital revenues by 2026.

The group unveiled ITVX alongside annual results in March, when it also spooked investors with plans to increase digital content investment.

08:44 AM

Lagarde signals interest rate rise in July

ECB President Christine Lagarde has said a first interest rate increase in more than a decade may come “weeks” after the end of the central bank’s bond buying programme, suggesting a move as soon as July.

Ms Lagarde said: “This first rate hike, informed by the ECB’s forward guidance on the interest rates, will take place some time after the end of net asset purchases.

“We have not yet precisely defined the notion of ‘some time’, but I have been very clear that this could mean a period of only a few weeks.”

With inflation currently four times the ECB’s 2pc target, ECB officials are increasingly pushing for an interest rate rise in July.

While the Federal Reserve and Bank of England are well under way with tightening monetary policy, the ECB hasn’t raised borrowing costs since 2011.

08:30 AM

Rusagro shareholders consider delisting London shares

Shareholders in Russian agriculture giant Rusagro are considering delisting the company from the London Stock Exchange.

In a statement, the company said it would consider cancelling its listing and obtaining admission to “any other” stock exchange. Shares are currently traded in London as well as Moscow.

Rusagro, which is a major producer of pork, fats and sugar, is 10pc owned by Russian tycoon Maxim Vorobyov.

In March, the London Stock Exchange halted trading in 27 companies with links to Russia in response to Putin’s invasion of Ukraine.

08:25 AM

Hungary says EU’s Russian oil ban still unacceptable

The EU’s proposed oil sanctions against Russia would destroy the Hungarian economy and does not offer a solution to the huge problems it would create for the country, according to Foreign Minister Peter Szijjarto.

In a video posted on his Facebook page, Mr Szijjarto said that after talks conducted so far, the EU does not have a solution.

He added that the only way to an agreement on an oil ban would be if it applied to maritime oil shipments, and all shipments of Russian oil via pipelines would be fully exempted.

08:10 AM

Philip Morris to buy Swedish Match in $16bn tobacco deal

Philip Morris International has agreed to buy smokeless tobacco company Swedish Match for $16bn (£13bn) as it accelerates its push beyond cigarettes.

The Marlboro maker offered 106 Swedish krona per share for its smaller rival – a premium of nearly 40pc on Swedish Match’s closing price yesterday.

The board of directors at the Stockholm-based company said investors should accept the offer. Its London-listed shares jumped more than 9pc.

The takeover, which is one of the largest transatlantic deals this year, pushes Philip Morris into the market for oral nicotine products and opens up the growing US smoking alternatives market.

It comes as PMI looks at ways to pull out of Russia following the invasion of Ukraine.

07:56 AM

Germany insists gas supply still secure

Germany has issued reassurances that its gas supply is currently still secure after flows of Russian gas to Europe through a key transit point in Ukraine dried up.

Germany’s economy ministry said:

We are monitoring the situation closely. The gas crisis team and the pipeline network operators are also monitoring the situation. Supply in Germany is currently still secure.

07:50 AM

Compass raises forecasts on outsourcing boost

Catering giant Compass has raised its annual sales outlook, saying it expected more companies to outsource staff to cut costs amid surging inflation.

The FTSE 100 firm lifted its target for full-year revenue growth to around 30pc, from between 20pc and 25pc previously. Shares jumped 9.6pc after the update.

Compass said it was facing soaring costs as a result of the war, as well as staff shortages and supply chain troubles. It said it was reviewing the prices it charges, but that efforts to offset these costs had so far paid off.

The company added that rising inflation was helping drive a push towards outsourcing as schools and companies look to make savings.

Pre-tax profits jumped to £632m in the six months to March 31, up from £133m a year earlier. Revenues rose 36pc to £11.5bn.

07:36 AM

Gove rules out emergency Budget

Michael Gove has insisted there won’t be an emergency Budget to address the cost-of-living crisis and said claims of a split between Boris Johnson and Rishi Sunak over the issue were “overinflated”.

The Levelling Up Secretary told the BBC:

It is an example of some commentators chasing their own tails and trying to take a statement that is common-sensical, turning it into a ‘major’ capital letters ‘big news story’.

When the Treasury quite rightly say ‘calm down’, people instead of recognising that they have overinflated the story in the first place then say ‘Oh, this is clearly a split’.

The truth is the Prime Minister says ‘Government is working hard’ and the Treasury say ‘Yes we are and I’m afraid the Budget is going to be when we said it would be’. That becomes a story? No.

It comes after Boris Johnson said he and the Chancellor would be saying more about the cost-of-living crisis in the coming days. Mr Gove said these comments were “over interpreted”.

07:31 AM

FTSE rises and fallers

The FTSE 100 has pushed higher in early trading, boosted by strong earnings and as investors turned their attention to US inflation data due later today.

The blue-chip index gained 0.4pc, driven by a jump in commodity stocks.

Miners including Rio Tinto and Anglo American rose, tracking metal prices higher amid signs of lower Covid cases in China.

Energy giant Shell was up 0.4pc as the ongoing threat of an EU ban on Russian oil drove prices higher.

Catering giant Compass was the biggest riser, jumping 9pc after it raised its revenue forecast and announced a £500m share buyback.

The domestically-focused FTSE 250 rose 0.5pc.

07:25 AM

EU drafts €195bn plan to wean itself off Russian energy

The EU is said to ramp up its commitments to renewables and energy savings as part of a €195bn (£167bn) plan to wean itself off Russian supplies by 2027.

The European Commission will propose raising its clean energy target for 2030 to 45pc from the current 40pc, Bloomberg reports.

It will also boost its energy efficiency goal, requiring member states to reduce energy consumption by at least 13pc, up from current targets of 9pc.

The measures form part of efforts by the bloc to end dependence on the Kremlin’s energy sector.

But the move is proving divisive, with Hungary blocking plans to ban Russian oil by the end of the year, forcing the EU to water down its proposals.

07:13 AM

Tui hails strong summer demand as it cuts losses in half

Holiday group Tui more than halved its losses over the last six months as it hailed a strong recovery in customer demand for the summer.

The company reported a loss of €614.5m (£525m) for the half-year to March 31, down from a €1.3bn (£1.1bn) loss for the same period a year earlier.

It told shareholders it could return to profit by the end of the year as a result.

Tui said it expects a “strong” summer and has already achieved 85pc of the booking levels seen in summer 2019, before the outbreak of the pandemic sent the travel sector into crisis.

It said the latest quarter was “significantly improved” as the easing of pandemic restrictions helped boost bookings.

07:07 AM

French economy to grow just 0.2pc this quarter

France’s economy will grow only 0.2pc in the second quarter after stagnating at the start of the year as companies face increasing difficulties getting supplies amid the war in Ukraine.

The proportion of industrial firms reporting supply issues affecting their output rose to 65pc in the Bank of France’s latest survey.

While the proportion fell slightly in construction, more than half of companies in that sector were still having problems.

The Bank of France said the “moderate” growth it expects will be driven largely to a recovery in the services sector following a lockdown-induced slump at the start of the year.

07:02 AM

FTSE 100 opens higher

The FTSE 100 has pushed higher at the open as investors turn their attention to US inflation data later today.

The blue-chip index rose 0.6pc to 7,283 points.

06:58 AM

Centrica boss: Windfall tax ‘like burning furniture to stay warm’

Slapping a windfall tax on the profits of energy giants is similar to “burning furniture to stay warm” as it would hit investment and push up costs in the long term.

That’s according to Chris O’Shea, chief executive of British Gas parent company Centrica, who was speaking after his company said its profits were set to more than double to £600m this year.

Energy giants including Centrica, BP and Shell have cashed in on the recent surge in oil and gas prices, fuelling calls for a windfall tax as households struggle with soaring household bills.

But Mr O’Shea told the Times he was “genuinely worried that ill-informed conversation is going to lead to something that will actually reduce investment”.

He added: “You’ve got to look and say: ‘What will it do longer term? What if it does impact investment?’ Prices are going to go up long-term.

“You have got to be careful you don’t burn the furniture to stay warm. My point is you’ve got to think strategically.”

06:51 AM

Gas supplies halted for first time

While fears over the war have been hammering gas markets for weeks, this is the first time physical supplies have actually been disrupted.

Ukraine has said it will stop receiving the fuel into the Sokhranivka gas metering station from 7am local time after declaring a force majeure, meaning it can’t control the infrastructure in occupied territory.

It’s proposed to move the shipments to the other entry point, Sudzha. But Russia’s Gazprom has said this is “physically impossible”.

Prime Minister Boris Johnson will travel to Helsinki where he’ll give a press conference this evening, after visiting Sweden earlier in the day.

06:40 AM

Gas prices rise amid clash over Russian supplies

Good morning.

Gas prices have pushed higher amid a clash between Ukraine and Russia that threatens to disrupt a third of the fuel supplies delivered to Europe.

Ukraine said flows via one of two key entry points will stop from today as occupying Russian troops interfere with operations. It’s declared a force majeure, meaning it’s unable to provide deliveries for reasons beyond its control.

The country’s network operator said these supplies – roughly a third of all Russia’s flows to Europe – could be rerouted. However, Gazprom insisted such a switch was “technically impossible”.

Benchmark European gas prices rose as much as 6.8pc at the open, while the UK equivalent was up 9pc.

5 things to start your day

1) Russia responsible for satellite hack causing chaos across Europe Cyber attack shut down 5,800 German wind turbines ahead of Ukraine invasion

2) EA Sports blows full-time whistle on its Fifa football video game Electronic Arts to launch new EA Sports FC title

3) Rise of EVs risks wave of ‘catastrophic’ shipping fires Thousands of vehicles, including Bentleys and Porsches, sank in the Atlantic in March

4) Britain joins the space race with first satellite launch from Cornwall Shoebox-sized satellites to be sent into orbit this summer

5) Top City lawyers to take classes on menopause Linklaters hopes this new training will ‘facilitate open discussions’ about menopause

What happened overnight

Hong Kong equities opened slightly down on Wednesday, steadying after losses from Wall Street’s rout on fears of economic risks from surging inflation.

The Hang Seng Index dropped 0.6pc at open. The Shanghai Composite Index climbed 0.3pc, while the Shenzhen Composite Index on China’s second exchange rose 0.6pc.

Tokyo stocks also opened lower on Wednesday. The benchmark Nikkei 225 index was down 0.6pc, while the broader Topix index was off 0.5pc.

Coming up today

-

Corporate: Brewin Dolphin, Compass Group, Tui (interims); Airtel Africa, ITV, Marshalls, Spirax-Sarco (trading statement)

-

Economics: Consumer price index (US, China), economic growth forecasts (EU), RICS house price balance (UK)