Barrick hikes dividend amid ‘softer’ Q1 results

Announces 20-cent dividend, expects stronger second half

Article content

In the ongoing debate about how to draw investors to the gold mining sector, Toronto-based Barrick Gold Corp. is joining its rivals in a time-tested strategy: giving them money.

Advertisement 2

Story continues below

Article content

Barrick on Wednesday announced a 20-cent dividend, made up of a 10-cent base dividend along with a first-time 10-cent “performance” dividend tied to its net cash balance, which reached US$743 million amid soaring gold prices.

The dividend hike comes as chief executive Mark Bristow announced “softer” first quarter results in 2022, including US$438 million in net earnings and US$763 million in free cash flow. Both were were down 18.5 per cent and 48.3 per cent respectively from the same quarter one year earlier. Lower gold production and higher operating costs did not offset a higher gold price.

“We expect that the second half of the year should be stronger,” Bristow said on a call with analysts on Wednesday morning.

Advertisement 3

Story continues below

Article content

In a press release, Bristow said the quarterly results looked “softer … particularly when compared to Q4 of 2021, which included a record-breaking performance from” its mines in Nevada.

Indeed, net earnings were down 39.6 per cent from the US$726 million posted in the fourth quarter in 2021, while free cash flow was down 45 per cent.

Since last quarter, Barrick’s gold production declined 17.7 per cent to 990,000 thousand ounces and its all-in sustaining costs rose 19.9 per cent to US$1,164.

Analysts gave the company’s financial performance a mixed review. Fahad Tariq, an analyst at Credit Suisse, wrote that the company’s adjusted per share earnings of 26 cents missed his estimate of 29 cents, which he attributed to higher operating expenses.

Advertisement 4

Story continues below

Article content

“On cost inflation, Barrick noted it has built up a strategic inventory of key commodities,” which could help it in the future, Tariq said in a note.

Still, gold prices have been steadily rising throughout the quarter and the company realized an average gold price of US$1,876 per ounce — up 4.6 per cent from last quarter.

More broadly, rising gold prices, which are up 36 per cent from US$1,286 in May 2019, have boosted many gold miners’ cash balances, stoking a trend toward higher dividends.

In February, Barrick announced it would add performance dividends of between five to 15 cents on top of its 10-cent base dividend, depending on its cash balance.

Earlier this year, Toronto-based Agnico Eagle Mines Ltd, which has paid a divided for 38 consecutive years, announced a 14 per cent hike to a 40-cent quarterly dividend. In February, Denver-based Newmont Corp. declared a 55-cent quarterly dividend, with the possibility of increases tied to the gold price.

Advertisement 5

Story continues below

Article content

-

Copper’s contribution to Barrick’s bottom line is increasing as Pakistan project revived

-

Barrick CEO suggests miners overpaying for assets amid higher gold prices

-

How gold miners lost their mojo

-

Barrick Gold lost its ‘social licence’ in Papua New Guinea. This is the price it’s paying to earn it back

In his earnings call with analysts on Wednesday morning, Bristow cited the Ukraine-Russia conflict, rising inflation and the surge of COVID-19 cases in China as evidence of what he called the “greatest period of economic, social and geopolitical disruption … in more than a generation.”

“All in all, it’s a time of radical change, and nobody knows how it’s going to turn out,” Bristow said.

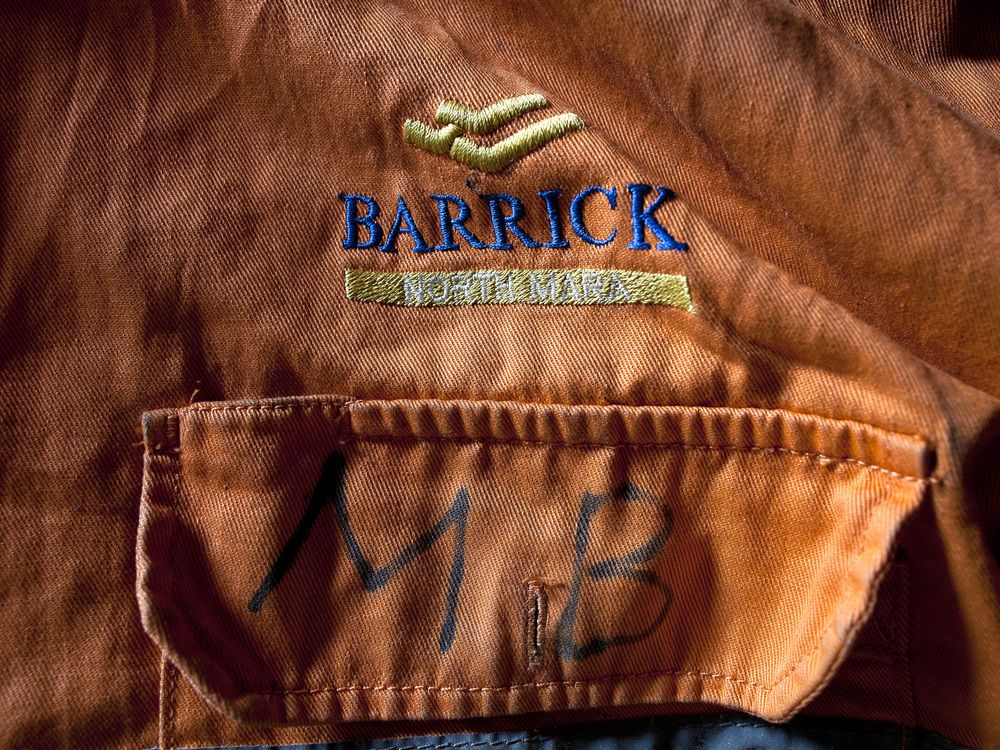

But he added that Barrick, the second-largest gold miner in the world with mines throughout the Americas, Africa and the Middle East, considers managing risk one of its core strengths. At the start of every year, its top executives meet and spend a week reviewing risks and opportunities.

“Fortunately for Barrick, managing risks in challenging geopolitical jurisdictions is one of our core competencies, largely gained in Africa, where our mines have continued to operate steadily and profitably through civil wars, coups d’état, complex logistics and delicate negotiations with host governments,” he said in a press release.

• Email: [email protected] | Twitter: GabeFriedz

Advertisement

Story continues below