A bear-market rally could be lurking, but investors should ‘sell any rips,’ says Bank of America

Despite the extensive losses seen for stock markets so far this year, it’s not over until it’s over — and investors should keep selling into any big rebounds higher.

That’s the advice from a team of strategists at Bank of America, led by Michael Hartnett, in their Friday “Flow Show” note. In focus for the bank is increasing debate about whether the market has capitulated, which refers to investors basically giving up on trying to recapture lost gains.

Some strategists view capitulation as a sign the market has bottomed and a good time to buy stocks. However, even a near 1,200-point drop for the Dow industrials DJIA,

Stocks were rising on Friday morning, but major indexes were still set to add to a string of weekly losses.

Read: The technician who called the 2020 market bottom says a ‘shocking rally’ is in store

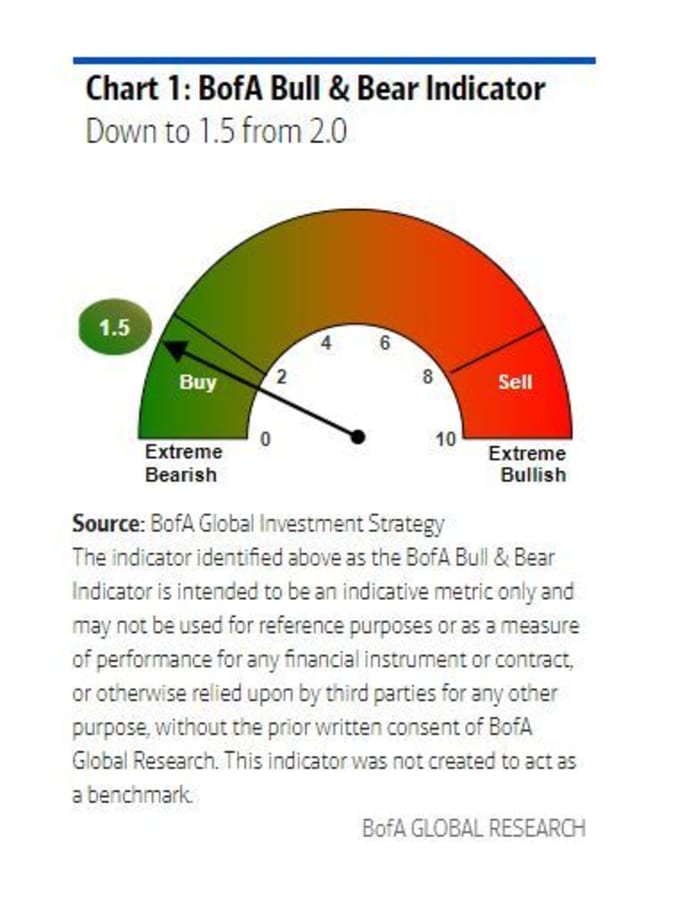

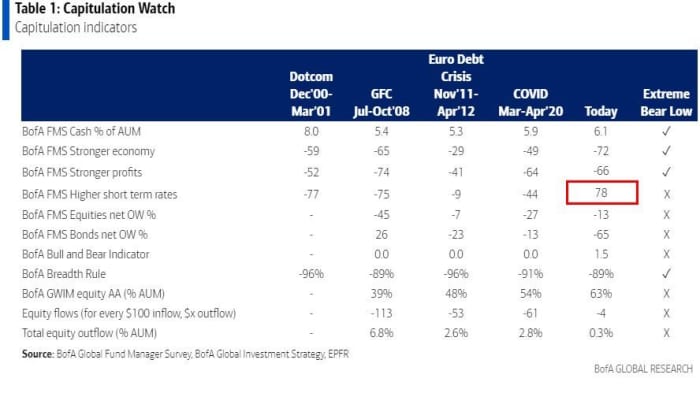

Bank of America pointed out that high cash levels for investors —- it reported earlier this week that global fund managers’ cash allocations were the highest since 2001 —- and its own contrarian bull/bear indicator are both pointing to capitulation.

But other pieces of the puzzle are missing, they said. For example, both the bank’s institutional and private client flows aren’t at capitulation lows. Among its private clients with $2.9 trillion in assets under management, 62.8% is allocated to stocks (lowest since February 2021), 18% to bonds (highest since July 2021) and 12.1% cash (highest since Jan. 2021).

Of course, they note, there is no “true capitulation” involving the Federal Reserve in sight. That tends to mean a massive market pullback that gets the central bank to ease up on tightening monetary policy. A systemic event and rise in the unemployment rate would be required first, said Hartnett.

The bottom line is that the stock market is “very vulnerable to [a] bear rally, but we would still argue ‘sell any rips,’ said Hartnett and the team.

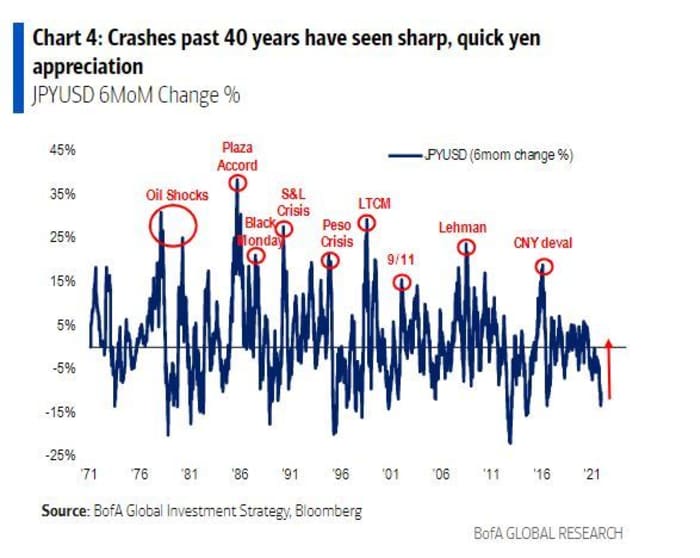

One more thing for investors to look out for, crashes over the past 40 years have involved a rapid acceleration of the Japanese yen USDJPY,

Read: How long does the average bear market last? Selloff leaves Dow, S&P 500 near threshold.