2 Beaten-Down Stocks Insiders Are Buying Heavily

The last few months, with the exception of some short bullish trading runs, have been brutal for the markets. Stocks are down, pretty much across the board. The tech-heavy NASDAQ index has fallen 25% year-to-date, while the broader S&P 500 is down 16%.

As for causes to the market turndown, you can take your pick. Supply chains remain snarled, and the Chinese government’s anti-COVID lockdown policies and the Russian war against Ukraine aren’t helping that matter any. Inflation, which started taking off a year ago, remains stubbornly high, at levels not seen in 40 years or more. And while the job market continues to show gains, the economy is still short more than a million jobs from pre-pandemic levels.

So it’s a tough macro-economic picture, one that makes it ever more difficult for investors to know just what moves to make. It’s time to find a signal, some sign that will show just what stocks are likely to bring returns going forward.

This is where the Insiders’ Hot Stocks tool at TipRanks can clarify matters. By tracking the trading activity of corporate officers, the insiders, investors can see what stocks getting snapped up by ‘those in the know,’ and can follow their lead. We’ve gotten that process started, pulling up the details on two beaten-down stocks that have both shown some major insider buying. Let’s take a closer look.

iMedia Brands (IMBI)

First up is iMedia Brands, a leader in the interactive media world with a portfolio of assets including a strong presence in the niche of TV-shopping universe. iMedia’s channels include ShopHQ and ShopHQ Health, ShopBulldogTV, and ShopLaventa, along with such digital assets as the end-to-end OTT streaming service Float left, and the digital logistics service i3PL. Last fall, iMedia closed its latest acquisition, of 123tv, the German television retail marketplace, in a deal worth $93 million, including a $72 million cash payment.

iMedia will be presenting its 1Q22 numbers later this month, but in a preliminary release management said it expects a top line between $154 million and $157 million. This would represent year-over-year revenue growth in the range of 35% to 38%, and would be in line with the previously published guidance of $156 million. The company expects its net loss to deepen, from $3.3 million in the year-ago quarter to the range $11.9 million to $12.3 million in the coming report. Looking ahead to the full year 2022, the company is guiding toward total revenues of $675 million to $725 million, or y/y top line growth of 23% to 32%. Meeting this preliminary report will give iMedia four consecutive quarters with sequential revenue gains.

iMedia announced on May 12 the pricing of a new sale of stock, to raise about $24 million. The stock dilution pushed the shares down to 52-week low.

The insiders, however, are not so worried. Four members of the company’s board made ‘informative buys’ at that time. Two of those buys were for $100K or less; the third was for $600,000. The fourth buy, however, made by director Eyal Lalo, was far more substantial. Lalo picked up 390,880 shares, putting down $1.2 million for the stock.

Covering iMedia for Craig-Hallum, analyst Alex Fuhrman reminds investors that there are strong gains in store for IMBI. Fuhrman rates the stock a Buy, and his $20 price target implies an upside of a huge 813% on the one-year time horizon. (To watch Furhman’s track record, click here)

“We are encouraged that the company is able to reiterate its outlook despite volatility stemming from Russia’s invasion of Ukraine, especially considering that IMBI generates more than 20% of its revenues in Germany, Poland, and Austria via its 2021 acquisition of German TV retailer 123tv. The strong holiday season results are even more impressive when you consider that most big e-commerce companies not named Amazon (e.g. 1-800 Flowers, QVC, HSN) reported lower-than-expected results for Q4 as rising freight and labor costs have eroded margins,” Fuhrman wrote.

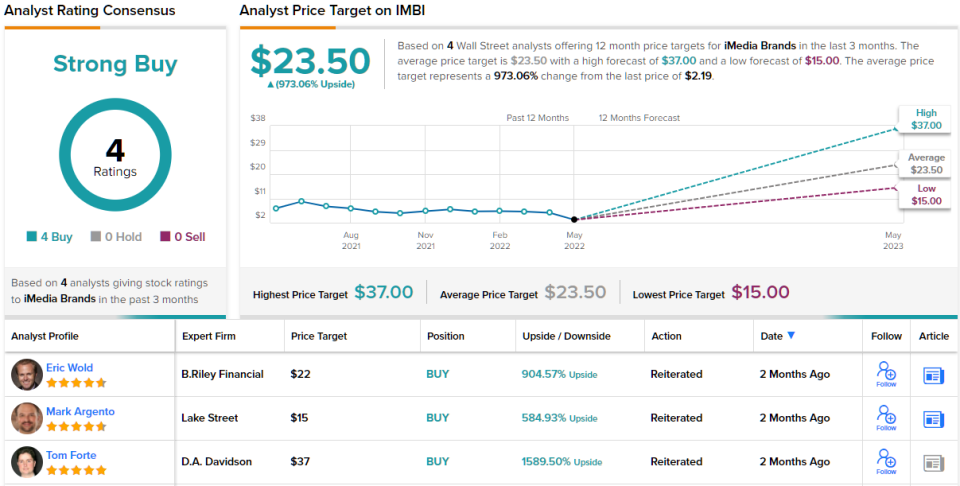

Overall, all four of the recent analyst reviews on this stock are in agreement with the bullish outlook, giving the stock its unanimous Strong Buy consensus rating. The shares are priced at just $2.19 and their $23.50 average price target suggests a highly robust upside of 973% in the next 12 months. (See IMBI stock forecast on TipRanks)

Corsair Gaming (CRSR)

Let’s switch gears a bit, and take a look at Corsair Gaming. This is another tech company, but one that works on the hardware side. Corsair develops, manufactures, and markets the high-end gear that PC gamers love to have. Among Corsair’s product line are streaming equipment, headsets, smart ambient lighting, audio systems, and monitors – the peripherals that enhance the gaming experience are loved by gamers from creators to hobbyists to serious players. Corsair also supplies power supply units, solid state drives, memory chips, and case coolers.

Corsair has had a hard time in recent months, as the PC gaming sector hasn’t seen as big a rebound as the more traditional brick-and-mortar economy. The reasons are manifold, and complex. While consumer spending is up, spending on games has dropped back after the initial post-lockdown bounce. The hardware and peripherals are subject to both production and supply line delays, factors which were exacerbated by the lockdowns in China and the war in Ukraine. So it may be no wonder that CRSR shares have lost 50% in the last 12 months.

At the same time, the financial results Corsair reported earlier this month, for 1Q22, were in-line with the previously published guidance. Corsair reported a top line of $380.7 million, down 28% from 1Q21, and reflects the year-ago quarter’s pent-up demand and the boost from government COVID stimulus checks. It is important to note that the 1Q22 revenue was up 23% from the pre-pandemic 1Q20.

On the insider front, Board member Samuel Szteinbaum last week made a hefty purchase of company stock. His buy totaled 80,000 shares and cost more than $1.14 million. That stock buy bumped his holding in the company to a value of $3.63 million.

Corsair stock is covered by D.A. Davidson analyst Franco Granda, who notes the headwinds that are pushing the gaming industry around these days, but still comes down on an optimistic note.

“Although CRSR has done a good job at sourcing products to meet demand, industry headwinds are proving difficult to overcome for everybody. If a broken supply chain and inflation weren’t enough, COVID lockdowns in China and the Ukraine war are exacerbating the NT business. 70% of the Y/Y declines in 1Q22 originated from Europe, highlighting the impact of diminished consumer confidence, particularly following the start of the war… Despite these pressures, the company continues to gain share (innovation and product availability) in the areas it is a leader in. In fact, CRSR already exceeded its target to gain 1% share every year, in 1Q alon,” Granda opined.

In line with this outlook, Granda rates CRSR shares a Buy, with a $28 price target to imply a 77% upside for the year ahead. (To watch Granda’s track record, click here)

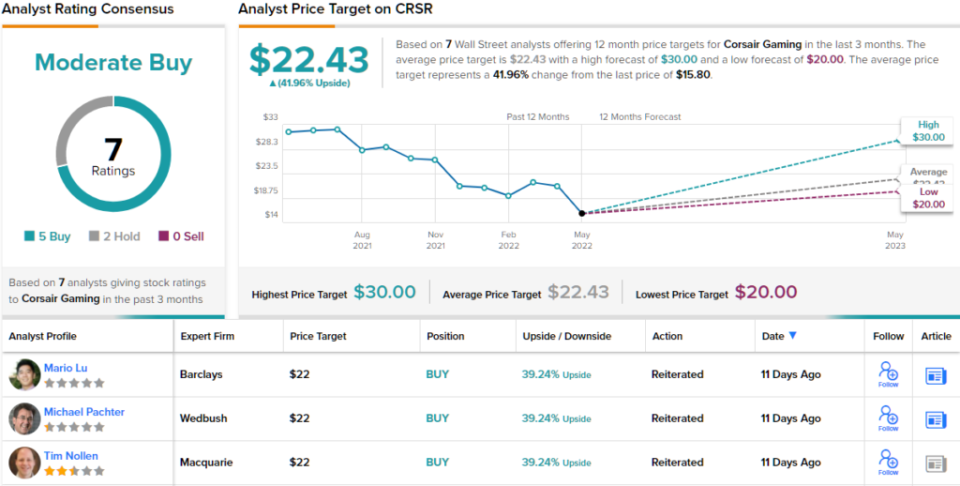

Overall, the sentiment on the Street would agree with the bulls on this gaming company. Corsair has 7 recent reviews, which break down 5 to 2 in favor of Buys over Holds and support the Moderate Buy consensus rating. Shares have an average price target of $22.43, suggesting ~42% upside from the trading price of $15.80. (See CRSR stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.