Want to beat the stock market over the next decade? Add bonds to your portfolio

The death of the 60/40 portfolio has been widely accepted as growth and technology stocks overwhelmed gains in fixed-income securities since the end of the financial meltdown over 10 years ago.

However, it is highly likely that such an allocation — 60% stocks and 40% bonds — will outperform an all-equity index over the next decade.

While that may sound like a bold statement, there are important reasons why that could be the case.

Let’s start with the premise of why many are proclaiming death to the allocation: Faster inflation and higher interest rates will make bonds less attractive.

That’s a logical assumption.

Unfortunately, such is likely not to be the case due to the expanding debts and deficits as explained in detail here.

The path to zero

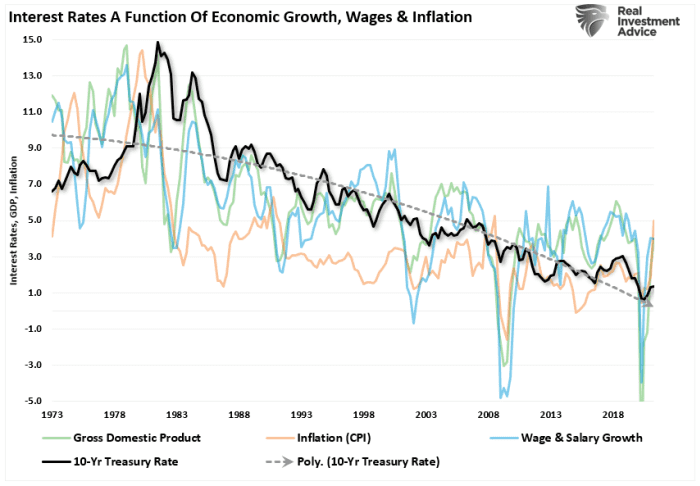

Interest rates reflect three primary economic factors: economic growth, wage growth and inflation. Those are the determinants in setting the “rate” for lending money.

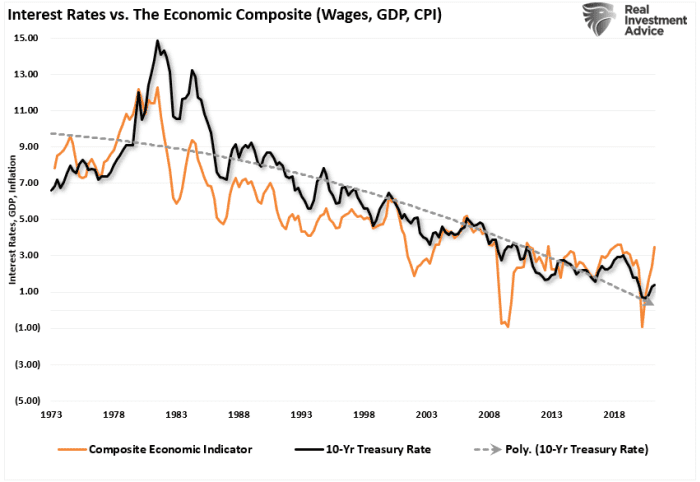

That chart is a bit cluttered. I created a composite of the three underlying measures to get a clearer relationship. The chart below combines inflation, wages and economic growth into a single composite and compares it to the 10-year Treasury rate TMUBMUSD10Y,

Again, the correlation should not be surprising given rates must adjust for future impacts on capital.

- Equity investors expect that as economic growth and inflationary pressures increase, the value of their invested capital will increase to compensate for higher costs.

- Bond investors have a fixed rate of return. Therefore, the fixed return rate is tied to forward expectations. Otherwise, capital is damaged due to inflation and lost opportunity costs.

The correlation between rates and the economic composite suggests that current expectations of sustained economic expansion and rising inflation are overly optimistic. At current rates, economic growth will likely very quickly return to sub-2% growth by 2022, particularly as the Federal Reserve tightens monetary policy.

If yields are correct, then investors should be heeding its warning as lower yields will translate into slower rates of earnings growth. Of course, such is problematic for valuations.

Valuations

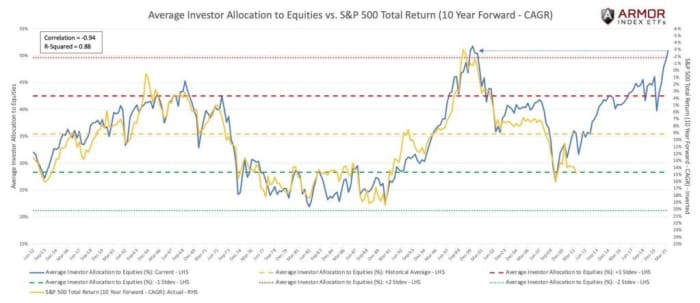

Wall Street veteran Bob Farrell once quipped that investors tend to buy the most at the top and the least at the bottom. Such is simply the embodiment of investor behavior. Our colleague, Jim Colquitt of Armor ETFs, recently made an important observation.

“The graph below compares the average investor allocation to equities to S&P 500 SPX,

More importantly, current allocations to equities are more than two standard deviations above the norm. Per Jim:

“Since 1952, we’ve only had four quarterly observations above the two standard deviation line. Each of which resulted in negative returns (compound annual growth rate, or CAGR) for the subsequent 10 years. We now have a fifth.”

If you think his analysis is overly bearish, it isn’t.

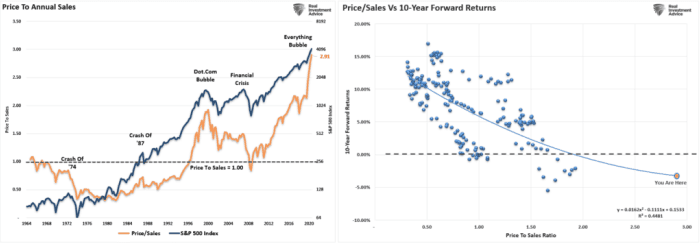

As discussed in undefined virtually every measure of fundamental analysis suggests the markets are expensive.

“Ten-year forward returns are below zero historically when the price-to-sales ratio is at 2x. There has never been a previous period with the ratio climbing to near 3x.”

If valuations are correct, and 150 years of historic evidence hold true, there is a significant probability equity returns will fall towards zero on a “buy and hold” basis over the next decade.

Conclusion

For investors, the value of having bonds in your portfolio is a reduction in volatility. When volatility spikes, investors react emotionally, which leads to a litany of investment mistakes.

As value investor and Warren Buffett mentor Benjamin Graham said: “The investor’s chief problem — and even his worst enemy — is likely to be himself.”

By reducing volatility, and the emotional battle, investors are able to take a more logical approach in managing their portfolio over time.

As fund manager John Hussman once said: “That ability to respond to changing market conditions in a disciplined way is the one thing that passive buy-and-hold investors don’t have. I strongly believe that it’s the primary factor that will determine investment success over the coming decade. Lacking a flexible discipline, my view is that passive investors are doomed to go nowhere in an interesting way over the coming 10- to 12-year horizon.”

In a market, economy and global economy supported almost entirely by debt, expectations for economic growth, inflation and interest rates can only remain low, or go lower.

As economist Carmen Reinhart said: “If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.”

Whether you think the bear market will occur sooner or later, bigger or smaller, is mostly irrelevant. The point of the exercise is that if “valuations matter,” and bonds provide lower volatility and protection of principal, the 60/40 allocation is not dead.

It is likely the allocation you will want over the next decade.

Lance Roberts is chief strategist at RIA Advisors, editor of Real Investment Advice and host of “The Real Investment Hour.”