Shipping Stocks Are Exploding Amid A Commodity Supercycle

Market experts consider rising inflation and the Ukraine crisis as the two biggest market risks this year. Runaway inflation has been corroding asset values, limiting buying power and eating away at corporate margins, while Russia’s invasion of Ukraine has disrupted key energy and commodity supply chains causing massive price spikes. Consequently, the Dow Jones Transportation Average has slumped 11% since late March on fears of waning domestic demand, with container shipping stocks being dragged down along with domestic transport.

But the commodities shipping sector is proving to be a different beast.

Leading commodity shipping stocks are firmly in the green this year and show no signs of slowing down after enjoying a banner year in 2021.

Tsakos Energy Navigation (NYSE: TNP) and Teekay Tankers (NYSE: TNK) recently hit fresh 52-week highs, as did dry bulk carrier owners Genco Shipping & Trading (NYSE: GNK), Golden Ocean (NASDAQ: GOGL), and liquefied natural gas (LNG) carrier owner Flex LNG (NYSE: FLNG).

TNP is now up 56.1% in the year-to-date; TNK has climbed 45.2%, GNK has gained 55.9%, while GOGL and FLNG have rallied 37.8% and 31.9%, respectively.

Numerous other commodity shipping stocks–but not container stocks–are on the cusp of new one-year highs.

Notably, tanker stocks have been soaring, too: Scorpio Tankers (NYSE: STNG) is up 58.0% YTD; Nordic American Tankers (NYSE: NAT) is up 29.9%, while Euronav (NYSE: EURN) and International Seaways (NYSE: INSW) have returned 30.8% and 39.8%, respectively.

According to Clarksons Platou Securities, rates for modern-built Suezmax (1-million-barrel capacity) crude tankers currently clock in at $45,300 per day, up 163% month on month. Modern-built product tankers in the MR class (25,000-54,999 deadweight tons) are pulling top-dollar at $52,400 per day.

Commodity Supercycle

In contrast, container-ship lessor stocks Zim (NYSE: ZIM) and Matson (NYSE: MATX) have cratered 33.5% and 25.5%, respectively, from their March peaks despite these companies boasting several years of contracted revenue booked at record rates that shield them from exposure to a drop in consumer demand.

There’s a method to the madness, though.

Enter the commodity supercycle.

Commodities handily outperformed other asset classes in 2021, and are widely expected to remain competitive in 2022. Indeed, Goldman Sachs global head of commodities research Jeffrey Currie has reiterated his earlier call saying we are merely at the first innings of a decade-long commodity supercycle.

Currie also says that there has been a complete redirection of capital over the past few years due in large part to poor returns in the oil and gas sector, with flows moving away from old-world economy investing style in things like oil, coal, mining, and towards renewables and ESG– and now there is a demand imbalance is being exposed.

The GS commodities expert adds that stretched equity valuations and still-low treasury yields make commodities even more attractive for investors wary of the high risks in these markets but still hunting for decent returns. In other words, commodities not only offer good prospects on a pure return basis but can also be a good hedge against growing market volatility.

But it’s Currie’s remarks about the metals sector that will probably catch the attention of ESG and clean energy investors more. According to the analyst, the biggest beneficiary of the ongoing commodity supercycle are metals, which he has compared to oil in the 2000s, thanks mainly to green capex. Currie says the ESG and clean energy transition is massive, with nearly all of the world’s nations pursuing clean energy goals at the same time, making copper one of the most important commodities of this cycle.

Related: Rival PM Says Libya Can Help UK Replace Russian Crude

Indeed, Currie has declared copper as the new oil, noting it’s absolutely indispensable in global decarbonization strategies with copper shortages already being felt.

Other notable clean energy experts share Currie’s views.

New energy research outfit Bloomberg New Energy Finance says the energy transition is responsible for driving the next commodity supercycle, with immense prospects for technology manufacturers, energy traders, and investors. Indeed, BNEF estimates that the global transition will require ~$173 trillion in energy supply and infrastructure investment over the next three decades, with renewable energy expected to provide 85% of our energy needs by 2050.

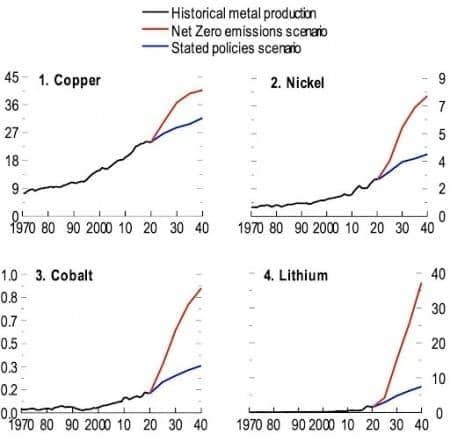

Clean energy technologies require more metals than their fossil fuel-based counterparts. According to a recent Eurasia Review analysis, prices for copper, nickel, cobalt, and lithium could reach historical peaks for an unprecedented, sustained period in a net-zero emissions scenario, with the total value of production rising more than four-fold for the period 2021-2040, and even rivaling the total value of crude oil production.

Source: Eurasia Review

In the net-zero emissions scenario, the metals demand boom could lead to a more than fourfold increase in the value of metals production–totaling $13 trillion accumulated over the next two decades for the four metals alone. This could rival the estimated value of oil production in a net-zero emissions scenario over that same period, making the four metals macro-relevant for inflation, trade, and output, and providing significant windfalls to commodity producers.

Estimated cumulative real revenue for the global production of selected energy transition metals, 2021-40 (billions of 2020 US dollars)

Source: Eurasia Review

Russia-Ukraine conflict disrupts PGM auto-led recovery

Not all commodities are benefitting from the current market setup, though.

Indeed, commodity experts at Standard Chartered have reported that PGM demand risks are likely to overshadow supply risks in the current year.

Russia produces around 40% of the world’s palladium and 9% of platinum and rhodium, the equivalent of 2.5Moz of palladium, 600koz of platinum, and 70koz of rhodium. The U.S. imports around 39% of its palladium from Russia, China imports 29%, and Hong Kong imported 70% in 2021. The loss of Russia’s supply would markedly tighten the PGM markets; but in the absence of market-specific sanctions or export bans driven by Russia’s invasion of Ukraine, supply-side losses have been driven by supply delays and rising costs given airspace closures. This is causing near-term disruption ahead of South Africa’s wage negotiations.

The market impact is not limited to the supply side; demand is also at risk from:

(1) China’s renewed COVID restrictions

(2) Tightening monetary policy

(3) Slower economic recovery

(4) Supply-chain challenges and

(5) Accelerated substitution in response to high and volatile prices.

Major auto production forecasters have lowered their 2022 estimates by up to 3.5mn units; this could reduce palladium demand by up to 375koz in 2022. Much of the supply tightness has materialized in H1, but demand losses are likely to accelerate in H2. These losses could be exacerbated by accelerated thrifting and switching of palladium in favor of platinum.

By Alex Kimani for Oilprice.com

More Top Reads from Oilprice.com: