Qualcomm stock rallies more than 5% as handset sales drive record results, strong outlook

Qualcomm Inc. shares rallied in the extended session Wednesday after the chip maker’s record quarterly results and strong outlook blew past Wall Street estimates and the company assured analysts that demand continues to outstrip supply.

Qualcomm QCOM,

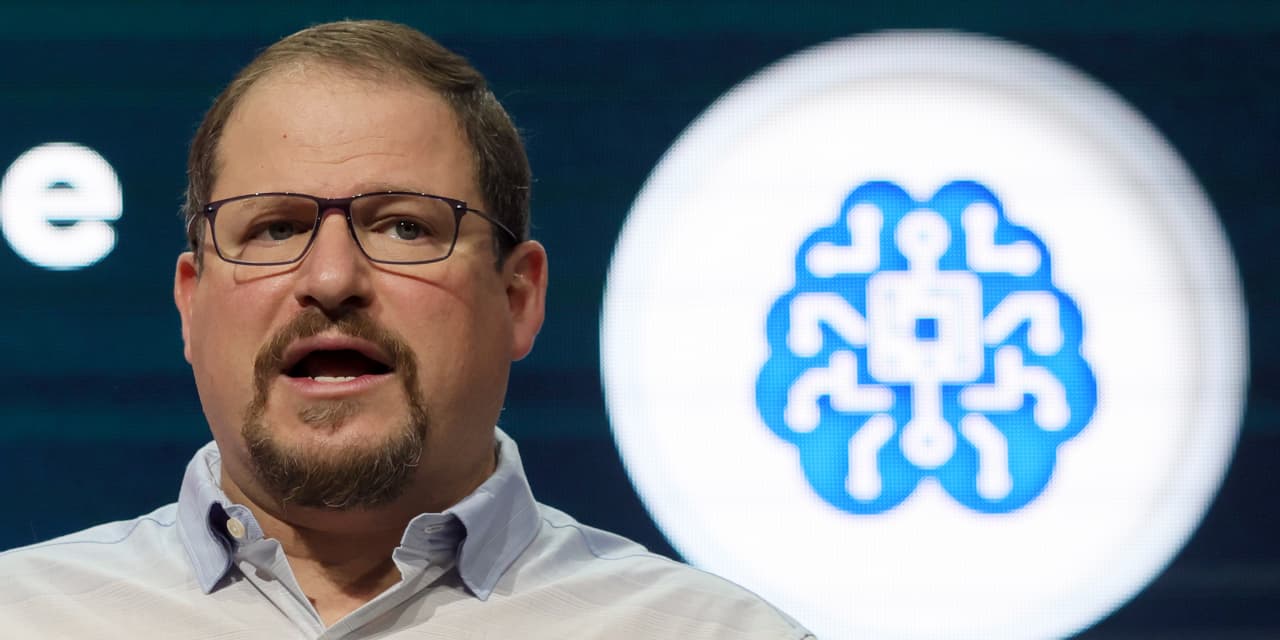

While some analysts are concerned that chip inventories are on the rise and that the supply shortage is beginning to come to a close, Qualcomm Chief Executive Cristiano Amon dismissed those worries on a conference call, and said continued strong demand is worked into the company’s guidance.

“We’ll still have more demand than supply across all business,” Amon told analysts.

A big driver of those sales come from the company’s core handset business, which saw strong gains in the second quarter and that Qualcomm Chief Financial Officer Akash Palkhiwala characterized to MarketWatch in an interview as the company’s so-called “mature” business.

For example, handset-chip sales soared 56% to $6.34 billion from a year ago, while the Street expected $5.91 billion. Handset sales are a part of Qualcomm’s CDMA technologies, or QCT, segment.

“We’re not just gaining share, which we did especially at Samsung where they decided to use our chip rather than their own internal chip for [their Galaxy S22 smartphone],” Palkhiwala told MarketWatch. “We’re also gaining share in terms of content … chips are becoming more complex and fewer people make those chips, and that plays to our advantage.”

The company forecast third-quarter QCT sales of $9.1 billion to $9.6 billion, and sales from Qualcomm’s technology licensing, or QTL, segment of $1.4 billion to $1.6 billion. Analysts had forecast $8.44 billion in QCT sales and QTL revenue of $1.51 billion.

In fact, CEO Amon expects Samsung 005930,

“In many of those markets that are now new markets to Qualcomm, Samsung is actively advertising Snapdragon as an ingredient brand for the Galaxy S22,” Amon told analysts. “I think that’s a very significant data point…I think we’re very confident that Samsung relationship is going to continue to be an extending relationship for us.”

By the end of the conference call, Qualcomm shares were up more than 5% after hours, following a 1.2% gain in the regular session to close at $135.10.

Read: Why semiconductor stocks are ‘almost uninvestable’ despite record earnings amid a global shortage

The company reported second-quarter net income of $2.93 billion, or $2.57 a share, compared with $1.76 billion, or $1.53 a share, in the year-ago period. The chip maker reported adjusted earnings, which exclude stock-based compensation expenses and other items, of $3.21 a share, compared with $1.90 a share in the year-ago period. Total revenue for the second quarter rose to a record $11.16 billion from $7.94 billion in the year-ago period.

Analysts estimated earnings of $2.95 a share, based on Qualcomm’s forecast of $2.80 to $3 a share, and revenue of $10.63 billion, based on Qualcomm’s revenue forecast of $10.2 billion to $11 billion.

RF front-end sales rose 28% to $1.16 billion compared with an expected $1.12 billion, auto-chip sales grew 41% to $339 million compared with the Street’s $282.4 million estimate, and Internet of Things, or IoT, sales surged 61% to $1.72 billion versus a $1.61 billion Street view.

Qualcomm reported QCT revenue of $9.55 billion, a 52% gain from a year ago. Analysts had estimated $8.9 billion, based on the company’s forecast of $8.7 billion to $9.3 billion. QCT includes handset and RF chips as well as chips for autos and IoT.

Revenue from the QTL segment slipped 2% to $1.58 billion for the first quarter, but were still above Wall Street estimates of $1.55 billion, based on a company forecast of $1.45 billion to $1.65 billion.

Over the past 12 months, Qualcomm shares are off 2.1%, compared with a 10.3% decline for the PHLX Semiconductor Index SOX,