New tech will free cheaper, cleaner lithium supply – report

“I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business. Lithium margins right now are practically software margins.”

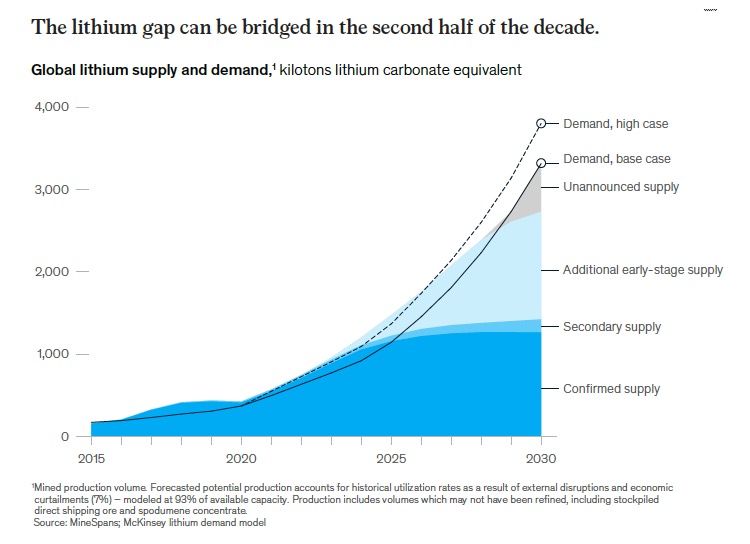

Musk is not alone in fretting about the market as lithium prices surge and demand from the electric vehicle market shows no sign of moderating, but a new report by consulting firm McKinsey argues worries about a shortfall may be overblown.

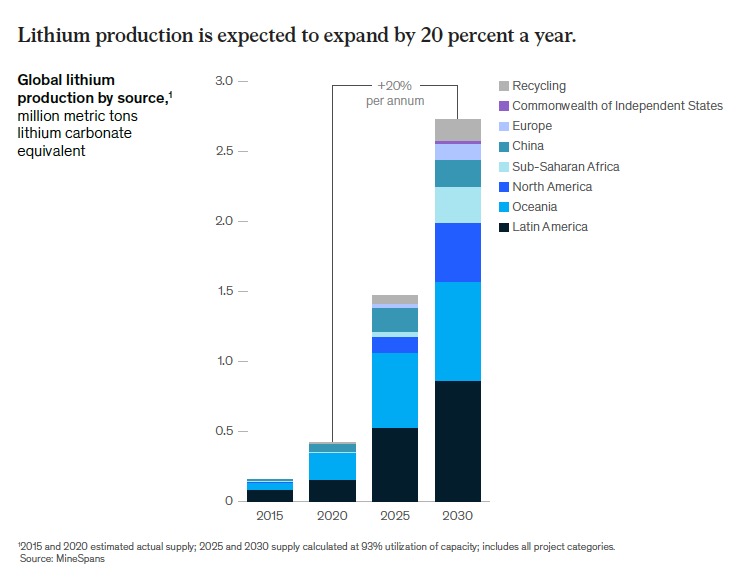

While lithium demand is skyrocketing – from an estimated 500,000 tonnes in 2021 to as much as 3.8 million tonnes by the end of the decade – new sources and new technologies will be enough to supply the market, McKinsey says.

RELATED: Mexico nationalizes lithium mining

The consulting firm says alongside conventional lithium supply, which is expected to grow by over 300% through 2030, direct lithium extraction (DLE) and direct lithium to product (DLP) “can be the driving forces behind the industry’s ability to respond more swiftly to soaring demand.”

In addition to filling supply gaps DLE and DLP could also reduce the industry’s environmental, social, and governance footprint, and lower costs by boosting recovery and capacity, McKinsey says.

Mckinsey acknowledges DLE is still in its infancy and of the five types of technologies only adsorption processes are already in commercial use, but DLE has several benefits including eliminating or reducing the size of evaporation ponds, less fresh water use, decreased production times, and increased recoveries from 40% for traditional brine operations to over 80%.

DLE, DLP and DSO

While geothermal and oil waste-water brines with grades of 100 to 200 parts per million will play a role in future supply with carmakers Renault, Stellantis and General Motors are already invested in early stage geothermal projects, any short term supply shocks could also be mitigated by direct shipping ore (DSO) which happened in 2018, when lithium prices previously spiked.

As for secondary supply, McKinsey says with expected battery lifetimes of around 10 to 15 years for passenger vehicles coupled with the possibility of extending EV battery life through use in the energy-storage sector, battery recycling is expected to only represent some 6% of total supply in 2030.

According to the report, in 2020, more than 90% of all lithium production occurred in just three countries: Australia, Chile and China, but new supply could come from places like Mexico, Canada, USA, Ukraine and Bolivia, with recently mapped reserves and also regions not usually associated with the battery raw material including Thailand, UK, Peru and Siberia.

Lithium prices cool

Lithium prices took a breather during the first half of April as lockdowns in China made trading difficult, but Benchmark Mineral Intelligence says that for chemical processors and battery manufacturers, the lull is unlikely to last.

The mid-April assessment by Benchmark shows battery grade lithium carbonate (EXW China, ≥99.5% Li2CO3) averaging $78,350 a tonne. That’s down just under 1% over two weeks. In April last year it was trading around $15,000 a tonne.

Prices for lithium hydroxide, used in batteries with high-nickel cathodes, continue to rise. Hydroxide historically trades at a premium to carbonate and has been playing catch up – the gap is now down to around $400 a tonne, from nearly $10,000 in February.

Benchmark says the slight downtrend in carbonate pricing “was not indicative of a wider market correction, but rather a temporary pause as a result of covid lockdowns in China, with expectations that prices will continue to increase in May if virus measures are eased.”