Live: What Bay Street and beyond are saying about the federal budget

Expert analysis and opinion on what effects business, the economy and you

Article content

Justin Trudeau’s Liberal government tabled a budget yesterday that included $452.3 billion in new spending, as well as tax hikes for Canada’s big financial institutions.

Advertisement 2

Story continues below

Article content

There’s a lot to cover here and to get you started, have a look at Stephanie Hughes’ quick summary of the main points. It will literally take just a minute.

12:15 p.m.

Alberta weighs in on federal budget

The early reviews are in from Alberta on the federal government’s 2022 budget plan.

Jason Kenney’s United Conservative government hailed Ottawa for its delivery on a promise to provide tax credits for carbon capture, utilization and storage (CCUS) technology, calling the move “critical” to meeting Canada’s energy needs and climate goals.

The new fiscal plan includes $2.6 billion over the next five years for companies to invest in CCUS projects. The credit will cover half the cost of new carbon capture technology to reduce greenhouse gas emissions. After 2030, the value of the credit will be cut in half in order to prompt businesses to begin building projects sooner.

Advertisement 3

Story continues below

Article content

The measure falls short of the 75 per cent Canada’s oil and gas industry had been asking for, though some business groups and governments, including Alberta, had said that a 50 per cent credit would be enough incentive to get projects moving forward.

There was some grumbling from the province and parts of the oil and gas sector, however, about the federal government’s decision not to extend the tax credit to projects that capture CO2 for enhanced oil recovery (EOR) — a process which can lower per barrel emissions while enabling increased output.

And the reaction from Alberta’s government wasn’t just limited to the new tax measures.

Alberta Finance Minister Travis Toews complained that large federal deficits will continue to drive inflation, which is increasing the cost of living. Toews also said a more prudent budget would have focused on increasing private sector investment.

Advertisement 4

Story continues below

Article content

“In particular, this budget lacks a plan to boost business investment and long-term competitiveness in Canada,” Toews said in a statement late Thursday.

“Alberta is poised to lead the country in growth this year, however this budget does little to promote business investment attraction, increase productivity and provide increased market access opportunities for Alberta.”

— Meghan Potkins

11:45 a.m.

Budget pledges not-for-profit ombudsman to settle complaints between banks, customers

The federal government pledged in Thursday’s budget to create a single, not-for-profit ombudsman that banks will be required to use to settle complaints from customers that can’t be resolved internally, a decision that won praise from the national Ombudsman for Banking Services and Investments.

Advertisement 5

Story continues below

Article content

Under the current system, banks do not have to use OBSI, opting instead to resolve customer complaints through for-profit resolution services.

“We applaud the government’s decision to correct our current system that allows banks to choose the ombudsman who will investigate and decide on their customers’ complaints,” said Maureen Jensen, chair of OBSI. “An ombudsman needs to be a fair arbiter between banks and their customers and if an ombudsman needs to compete for the banks’ business, it puts banks in the position of choosing their own referee.”

Toronto-Dominion Bank pulled out of OBSI more than 10 years ago amid disputes over the methodology the ombudsman was using to calculate compensation to bank customers. Royal Bank of Canada had already pulled out a few years earlier and both banks took their customer complaints to ADR Chambers. However, regulatory stipulations require them to settle brokerage disputes through OBSI.

Advertisement 6

Story continues below

Article content

OBSI investigates at no cost to the bank customer and can recommend compensation of up to $350,000. However, it does not have the power to compel a bank or brokerage to pay, something that has been heavily criticized by investor advocates over the years.

“OBSI has long argued that a competitive dispute resolution model leads consumers to reasonably question the impartiality and independence of the system,” the ombudsman said in a statement. “This perception of conflict of interest can undermine public confidence in the financial sector. The only way to improve consumer confidence is to remove ombudsman competition and establish a single, independent, not-for-profit ombudsman dedicated to the public interest.”

Advertisement 7

Story continues below

Article content

Jensen, who was chair of the Ontario Securities Commission until April 2020, said a single impartial “ombudservice” is recognized internationally as the best practice.

— Barbara Shecter

11:10 a.m.

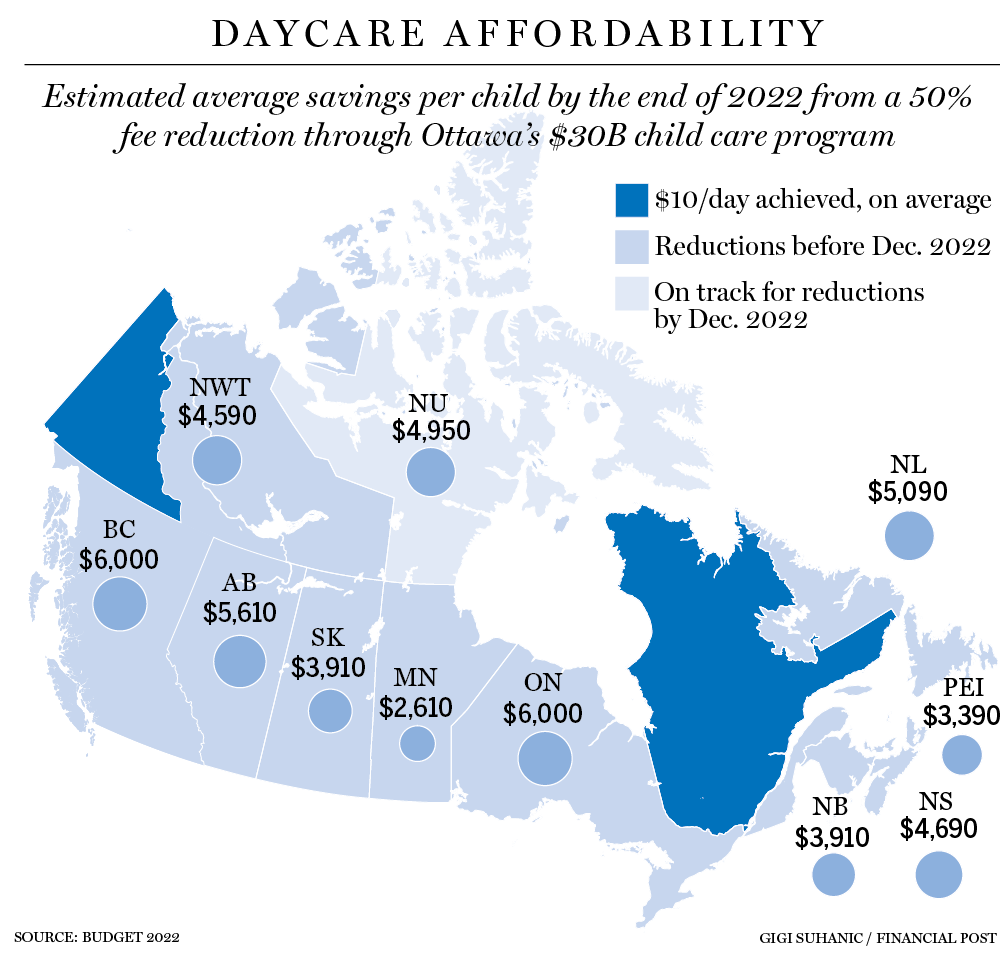

Here’s what the average family can expect to save on child care, according to the budget

The federal Liberals have devoted a lot of political energy and funding to affordable child-care policy.

Ottawa first earmarked $30 billion over five years in its 2021 budget with a target of $10-a-day child care by 2025-26 across the country.

Now that the federal government has inked deals with all the provinces and territories, the latest budget details the potential savings for families, estimated to amount to many thousands of dollars per year, per child.

Advertisement 8

Story continues below

Article content

The map, below, shows average savings per child at the end of this year from a 50 per cent reduction in child-care fees.

Though 2025-26 is the target year for the $10 fee, many provinces have accelerated the timetable.

Alberta, Saskatchewan, and the Northwest Territories have reduced the cost of child care by half, the budget said. In Ontario, fees will be reduced retroactively to April 1 by 25 per cent. Quebec and Yukon already have $10-a-day child care, on average.

The gross annual savings per child for families once the program is fully implemented is estimated as follows:

British Columbia: $9,390

Alberta: $8,610

Saskatchewan: $5,220

Manitoba: $2,610, by the end of 2022-23

Ontario: $9,000-plus

Newfoundland and Labrador: $7,560, as early as January 2023

Prince Edward Island: $4,170, by the end of 2024

Nova Scotia: $6,780

New Brunswick: $5,220

Northwest Territories: $7,300

Nunavut: $7,300, by the end of March 2024

Advertisement 9

Story continues below

Article content

— Gigi Suhanic

10:53 p.m.

Chrystia Freeland’s budget day power suit was Ukrainian blue

Google around, and it is hard not to notice a common thread running through Finance Minister Chrystia Freeland’s outfit choices, at least as they relate to photos that come up in an internet image search. There’s Freeland on the cover of a Toronto magazine wearing a Liberal red dress. There she is dressed in Liberal red again, with her arm thrown around the shoulder of former United States secretary of state Madeleine Albright (rest in peace). And she’s in red on a stage with Ivanka Trump, in a Liberal cabinet minister team picture and alongside former Donald Trump cabinet minister Rex Tillerson.

Thursday was budget day in Ottawa. The cameras were sure to be out. But Freeland’s outfit — a Ukrainian-blue suit with yellow buttons on the cuffs — ditched any whiffs of domestic political partisanship, while deftly conveying a message of solidarity with the people of Ukraine. It also seemed to say that whatever rhetorical skirmishes were bound to erupt with her political opponents after she delivered a budget promising $31.2 billion in new spending over the next five years, Vladimir Putin is an enemy all parties can agree upon.

Advertisement 10

Story continues below

Article content

Freeland described the Russian president and his “henchmen” as “war criminals.” She referenced the atrocities in Bucha and the bravery of the Ukrainians, who are “fighting our fight,” by which she meant the fight for democracy and an international rules-based order. Among the key articles of faith: you don’t invade your neighbour in a naked assault on their sovereignty.

The parts of Freeland’s budget speech that hit upon Ukraine got plenty of claps and, at one point, a brief standing ovation from her peers on both sides of the aisle in the House of Commons. That is a far cry from the April 2021 budget, with its $100-plus billion in spending pledges and dire Liberal warnings that the sky would fall unless it passed, which it did, most cynically, eight weeks before the prime minister called a snap fall election Canadians clearly didn’t want.

Advertisement 11

Story continues below

Article content

But Thursday’s budget performance will perhaps be remembered as the moment an incumbent government finally grew up. All it took was a war, runaway inflation and a housing crisis to get there. As an author and journalist before becoming a politician, Freeland took aim at Putin. Since being elected, she has championed the passage of the Magnitsky Act in 2017, giving Canada the tools to punish human rights offenders. After Russian tanks crossed the Ukrainian frontier on Feb. 24, she reportedly sent a letter to senior U.S. officials outlining a plan to freeze the assets of the Russian central bank.

“Chrystia has been a hero in my eyes in standing up to Vladimir Putin,” author, activist and businessman Bill Browder, told Financial Post’s Larysa Harapyn earlier this week. “She has been clear-eyed since the very beginning of who Vladimir Putin is, and what he is capable of, and it is really important that somebody with her knowledge and her backbone has been at the centre of this discussion.”

Advertisement 12

Story continues below

Article content

As for the dollars and cents, the new budget calls for $500 million in weapons to be sent to Ukraine and billions more to be spent on beefing up the Canadian military. “We know that peace is guaranteed only by our willingness to fight for it,” Freeland said.

There can be a surreal quality to federal budget days. What, exactly, does $31.2 billion in new spending, a promise to build more affordable housing ASAP, and charging stations to power an electric vehicle revolution look like to you, anyway?

Freeland, mind you, looked dressed for the occasion, not in red, but in the colours many Canadians are bleeding today, as the drumbeat of war rolls on.

— Joe O’Connor

10:17 a.m.

Canada’s national accounting association praised the federal government’s pledge this week to create a financial crimes agency to lead enforcement in the area of money-laundering and other financial crimes that “inflict serious costs” on Canada’s economy.

Advertisement 13

Story continues below

Article content

“We have called for reforms to Canada’s anti-money laundering regime to assist investigations and improve the level of prosecutions of money laundering in Canada and look forward to a consultation on the agency’s intended purpose,” Chartered Professional Accountants of Canada (CPA Canada), said in a statement Friday.

Thursday’s budget promised measures that would help “maintain the integrity of the financial system, promote fair competition, and protect both the finances of Canadians and our national security,” including the creation of the Canada Financial Crimes Agency.

— Barbara Shecter

10:07 a.m.

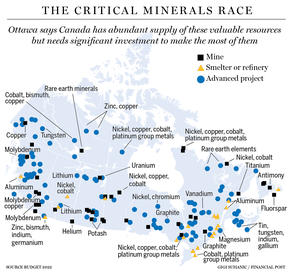

Critical minerals are a key pillar of the budget. The government is proposing billions of dollars in new spending to encourage more mining of the minerals that will be crucial as the world transitions to a low-carbon economy.

Advertisement 14

Story continues below

Article content

These include not only the lithium, nickel and cobalt used in batteries, but a far wider array of elements, from copper to manganese, writes the Financial Post’s Gabriel Friedman.

Canada has a lot of these minerals, but not so much of the infrastructure needed to first of all get them out of ground, and then turn them into something useful.

Take Ontario’s Ring of Fire in the James Bay Lowlands, the site of deposits of nickel, copper, and other metals, but isolated from the rest of the province because road access is limited.

The map below shows the critical mineral hot spots in Canada.

9:52 a.m.

Chrystia Freeland’s second budget is being billed as fiscally responsible with the deficit falling to $52.8 billion this year from $113 billion last and debt to GDP ratio tracking lower to 45.1 per cent this year to 41.5 per cent by 2026/2027.

But BMO economists Robert Kavcic and Douglas Porter say the real reason Ottawa has been able to hold the line is a huge swell in revenues from the commodity boom now going on.

“Essentially, revenues have been boosted by a short-term rush of higher inflation — but that’s not a healthy development, as eventually costs will also face upward pressure, including borrowing costs,” said the economists.

Advertisement

Story continues below