Kevin Carmichael: Brace for more big hikes because Bank of Canada is far from finished

Canada’s economy is firing on all cylinders; unfortunately so is inflation

Article content

The Bank of Canada intentionally overdid it on the way into the COVID recession. So, perhaps it shouldn’t be a surprise that policymakers are scrambling to keep up with an economy that heated up faster than they anticipated.

Advertisement 2

Story continues below

Article content

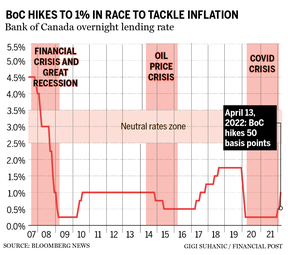

Governor Tiff Macklem and his deputies raised the benchmark interest rate by half a percentage point on April 13, an aggressive move, as central banks prefer to move in quarter-point increments.

Policymakers also said they would initiate “quantitative tightening,” which means the central bank will remove itself as an active participant in the bond market. The Bank of Canada purchased hundreds of billions of dollars of bonds during the recession to put additional downward pressure on interest rates and had been reinvesting what it earned when those assets matured. The reinvesting will now stop.

The outsized increase in borrowing costs, which took the benchmark interest rate to one per cent, was widely anticipated; the central bank had telegraphed that stronger-than-forecast inflation would force it to accelerate its march back to a more normal interest-rate setting.

Advertisement 3

Story continues below

Article content

Less anticipated, perhaps, was the extent to which the economy is straining on the central bank’s reins. The Bank of Canada’s new quarterly economic forecast sees gross domestic product increasing at an annual rate of six per cent in the second quarter, which is a rate of growth you would expect in the earliest days of a recovery, not at the point at which the recovery is over and the jobless rate is at a modern low.

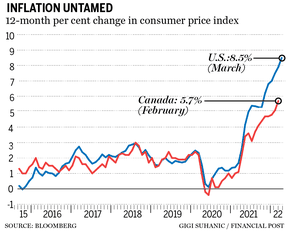

All that growth would be something to cheer if it wasn’t paired with equally strong inflation. The Bank of Canada acknowledged that it underestimated how much the consumer price index would increase in the first quarter, and now predicts an average monthly gain of 5.6 per cent, compared with a 5.1-per-cent forecast in January.

Advertisement 4

Story continues below

Article content

Policymakers see average headline inflation of 5.8 per cent in the second quarter, and forecast that price increases will remain well above the high end of their comfort zone — one per cent to three per cent — for the rest of the year.

The Bank of Canada said the war in Ukraine is the primary reason it underestimated inflation. Russia and Ukraine are big exporters of oil, natural gas, wheat and other commodities, and prices for those important inputs have soared since Russian President Vladimir Putin’s invasion of Ukraine on Feb. 24.

-

Bank of Canada raises interest rate: Read the official statement

-

Bank of Canada survey shows most businesses think it will take at least two years to get inflation under control

-

The Bank of Canada will almost certainly take the steeper path to higher rates next month

-

Inflation surges to 5.7%, adding pressure on Bank of Canada to accelerate rate hikes

Advertisement 5

Story continues below

Article content

It’s hard to criticize the Bank of Canada governor for failing to foresee a war in Europe. But that’s what happened, and now he must contend with an emergency stimulus program that worked so well that little of the scarring that typically occurs during a recession happened this time.

As a result, the economy came out of the downturn firing on all cylinders. That’s creating more demand than there is supply, putting extra pressure on prices amid a war, drought, COVID lockdowns, and sundry other disruptions that have already put upward pressure on prices.

The Bank of Canada emphasized that it is far from finished. Its new forecast discovered that the economy is probably now operating at a level that exceeds estimates of what it can produce without stoking inflation. And yet the benchmark rate is still below its pre-pandemic level.

A second half-point increase when the central bank next updates its policy rate on June 1 would surprise no one.

Policy makers said they are worried that households and businesses will absorb current inflation as the new normal. The Bank of Canada is relying on its credibility with the public to keep expectations anchored.

The thing about expectations is that every once in a while, you have to back up your words with actions. For Canada’s central bank, this is probably one of those times.

• Email: [email protected] | Twitter: CarmichaelKevin

Advertisement

Story continues below