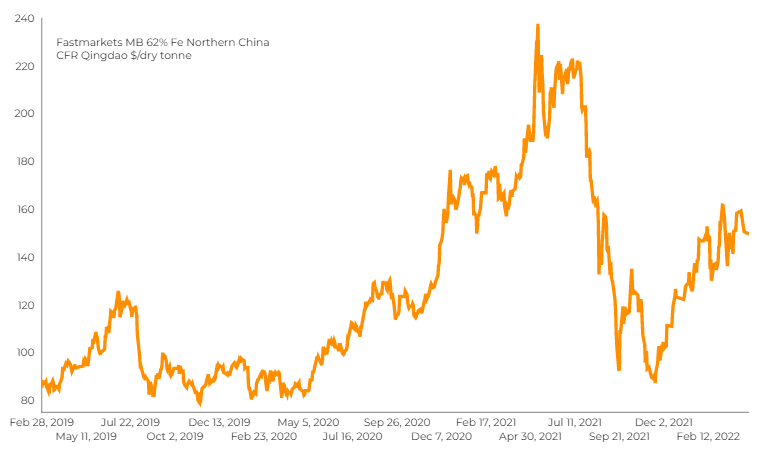

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $149.55 a tonne during morning trading, down 2.27% compared to Monday’s closing.

The most-traded September iron ore contract on China’s the Dalian Commodity Exchange ended daytime trade 3.3% lower at 887 yuan ($139.18) a tonne, after touching a two-week high of 942 yuan earlier in the session.

On the Singapore Exchange, the most-active May contract was down 2.3% at $151.35 a tonne.

China will reduce crude steel output this year, after slashing production in 2021 in line with its goal to control carbon emissions, said a spokeswoman for China’s state planner, the National Development and Reform Commission.

Expectations for additional policy support for the world’s second-largest economy, which faces risks of a sharp slowdown due to the lockdowns and headwinds brought on by the Ukraine war, have pushed Dalian iron ore prices up by more than 30% this year.

However, the timing and extent of the anticipated additional stimulus measures remain uncertain. Chinese authorities are walking a tight rope as they try to stimulate growth without endangering price stability.

“It remains to be seen how extensive the Chinese policy response will be,” J.P. Morgan economists wrote in a note.

“Slower Chinese growth is expected to linger into 3Q before rebounding, raising the risk of near-term spillovers to regional trading partners and commodity exporters,” they said.

(With files from Reuters)