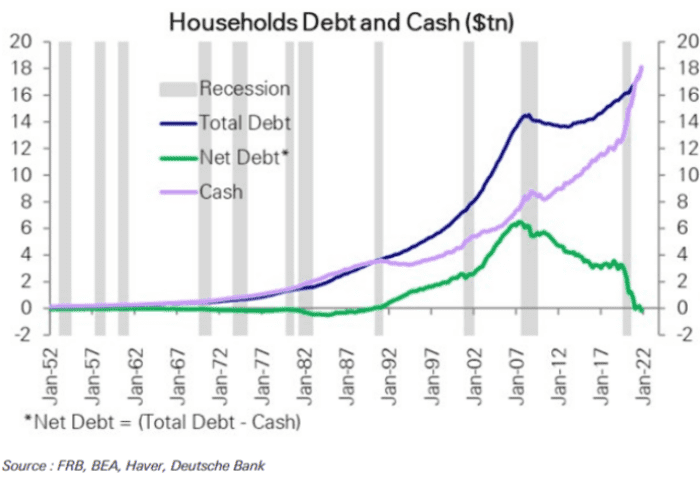

Fed may need to be even more aggressive fighting inflation as U.S. household cash exceeds debt for first time in three decades, warns Deutsche Bank

With U.S. households looking in good financial shape, the Federal Reserve may need to be even more aggressive raising interest rates to cool the economy and bring down high inflation, according to a research note from Deutsche Bank.

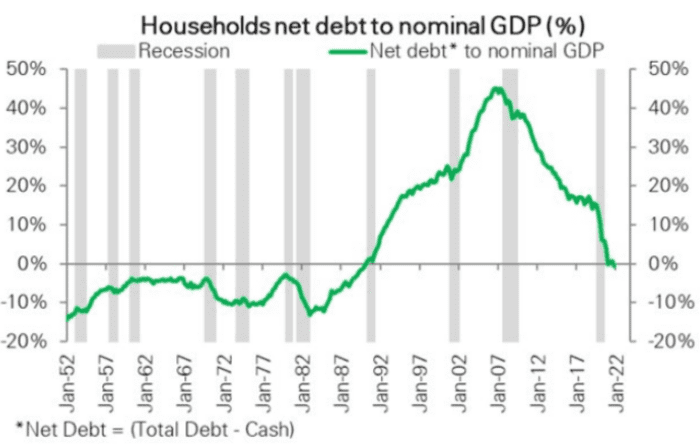

U.S. household cash “now exceeds debt for the first time in three decades with net debt collapsing to zero,” Jim Reid, head of thematic research at Deutsche Bank, said in an emailed note Wednesday. “The Fed may have to hike even more aggressively to slow consumer demand and curb price rises given their healthy balance sheets.”

Investors have been anticipating that the Federal Reserve will become more aggressive hiking its benchmark rate as it seeks to combat the hottest U.S. inflation in about four decades. James Bullard, president of the Federal Reserve Bank of St. Louis, said April 18 that he wouldn’t rule out a large hike of 75 basis points, though that is not his base case, according to a report from The Wall Street Journal.

U.S. recessions may arrive even with household cash exceeding debt, says Deutsche.

“While negative net debt is a sign of comfort, we had seven recessions between the early 1950s and early 1980s when it was also negative,” Reid wrote in his emailed note. “We think a hard landing will ultimately be unavoidable by late ‘23 / early ‘24 after an aggressive series of Fed hikes over the next 18 months.”

High inflation and rising interest rates have weighed on markets this year.

“In 2023, we expect equity markets to hold up well through the summer, before the US falls into recession,” Deutsche Bank analysts including Reid wrote in a separate research report Wednesday. “This should see equities correct by a typical 20% as it begins, before bottoming half-way through and recovering prior levels.”

Read: What the rising probability of a ‘growth scare’ means for the stock market, according to Citigroup

The Deutsche Bank research analysts are maintaining their year-end 2022 target for the S&P 500 at 5,250, according to the report. The S&P 500 index SPX,