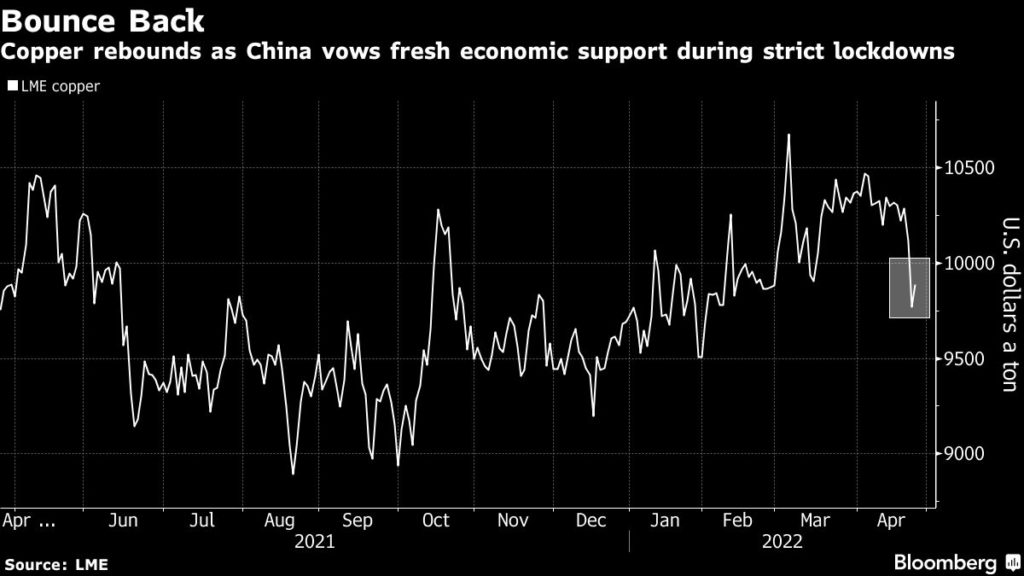

Copper price rebounds as China steps up support for economy

On Tuesday, copper rose as much as 2.3% in China as the country’s central bank vowed to increase monetary support to the real economy, especially for industries and small businesses hit hard by the pandemic.

That follows the People’s Bank of China’s decision Monday to cut the amount of money that banks need to have in reserve for their foreign currency holdings, an attempt to help limit the drop in the yuan.

Copper for delivery in July rose 1.6% from Monday’s settlement price, touching $4.54 per pound ($9,997 per tonne) on the Comex market in New York.

Click here for an interactive chart of copper prices

Fund managers have been increasing bearish bets on the CME copper contract over the last couple of weeks, Reuters columnist Andy Home reported.

“With declines in aluminum and nickel as well, the overall picture that emerges is that China’s weakened demand outlook is outweighing supply concerns, which were elevated after Russia’s invasion of neighboring Ukraine on Feb. 24,” wrote Reuters columnist Clyde Russell.

“Policy may be the salvation for China’s iron ore and base metal demand this year,” Vivek Dhar, commodities analyst at Commonwealth Bank of Australia, wrote in a note.

“Policymakers are hoping for a soft landing, helping stabilize commodity demand in the property construction sector,” while infrastructure investment in the country is also expected to rise significantly this year, he added.

(With files from Reuters and Bloomberg)