Weekend reads: There’s a recession warning as the Federal Reserve fights inflation

The Federal Reserve this week increased the federal funds rate for the first time since 2018. Long-term market interest rates had risen significantly as investors anticipated that the central bank would begin winding down its bond portfolio, with a policy announcement coming as early as May, according to Federal Reserve Chairman Jerome Powell.

The big question is whether the Fed can bring down inflation from the highest level in 40 years to its target of 2% without causing a recession.

Jonathan Burton interviewed David Rosenberg, who warns investors to expect a recession as early as this summer, along with a reality check for home prices and a tumbling stock market.

Fed to shrink its $9 trillion balance sheet

As the Federal Reserve’s balance sheet ballooned during the coronavirus pandemic, long-term interest rates fell because the central bank’s massive purchasing power raised demand for U.S. government bonds and mortgage-backed securities. When bond prices rise, yields go down.

Much of the Fed’s bond purchases were funded by the creation of new money the central bank created at the touch of a button.

Joy Wiltermuth explains what happens to all that extra money — $9 trillion in total — as the Fed allows its bond portfolio to run off.

More coverage of the Federal Reserve and monetary policy:

How to read the ups and downs in oil prices

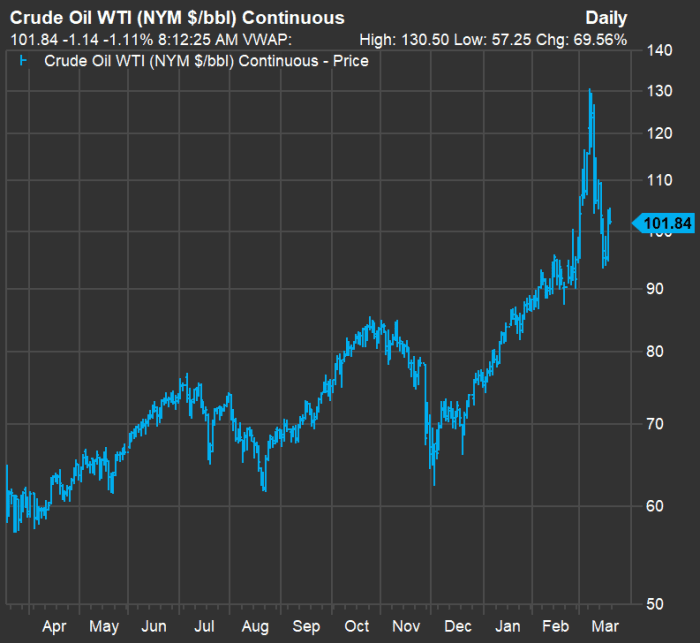

Above is a one-year chart showing the movement of forward-month contract prices for West Texas Intermediate crude oil CL00,

Here’s a roundup of coverage of the oil market and investment implications:

U.S. companies are fleeing Russia, but here’s an exception

Many U.S. companies have decided to stop doing business in Russia following that country’s invasion of Ukraine. But one glaring exception has been Koch Industries, as Ciara Linnane reports.

The big return to offices — but not for everyone

This is why suburban dwellers who commute into New York have traditionally been willing to pay premiums to live near train stations.

Bruce Bennett/Getty Images

As coronavirus case numbers continue to decline in the U.S., more workers expect, or are expected, to return to their offices. But some economic evidence counters those expectations.

For decades, workers who commuted into New York by rail would pay a premium to live within comfortable walking distance of a train station. That’s no longer the case, as Steve Goldstein reports.

Another factor that may temper the big return is workers’ increased expectations of flexibility. Andrew Keshner explains how one small-business owner who needs his employees on-site has addressed $5-a-gallon gasoline in California.

ETFs point to pockets of volatility

In this week’s ETF Wrap, Mark DeCambre highlights the way exchange traded funds have reacted to moves by the Federal Reserve and China’s government, and to gyrations in commodity and energy markets as the war in Ukraine continues.

A time for value stocks to shine

We have been in a tough environment for growth stocks — those of rapidly growing companies that tend to be highly valued to sales or earnings — because expensive stocks tend to get hit hardest as interest rates rise. The market turmoil springing from Russia’s invasion of Ukraine has also been a factor. The growth-oriented Nasdaq Composite Index COMP,

It might take a years-long cycle of rising interest rates for inflation to be tamped-down by the Federal Reserve. That uncertain period might be one during which value stocks will shine.

Michael Brush has advice for investors on how to select value stocks and names five examples.

More from Brush: It’s time to buy the best beaten-down stocks in tech and elsewhere, and this winning fund manger shows you how

A mix of retirement-planning remedies

Everyone loves to be given simple advice, but often a complex approach of attacking a problem from several angles can be best — especially when you have time to work with. Alessandra Malito writes the Help Me Retire column. This week she helps a couple that believes they haven’t saved enough for retirement with several ways they can take advantage of their strengths and balance their finances.

A closer look at insider stock sales

Some investors monitor stock sales by corporate insiders for signals of when to bail. Then again, the executives might be selling their shares for all sorts of reasons, some of which have nothing to do with a company’s performance.

It might be more useful to look at the stocks corporate officers and directors have decided not to sell, according to new research described by Mark Hulbert.

Are you tired of the stock-market rollercoaster?

When Jeremy Olshan became the top editor of MarketWatch in 2014, he banned photos of traders on the floor of the New York Stock Exchange for most articles, as the great majority of stock trading was no longer being done the old-fashioned way.

Now, as he prepares to leave MarketWatch to become the personal finance bureau chief at the Wall Street Journal, Olshan argues it’s time to stop using roller-coaster photos at the top of stories about market volatility and save them for actual reports about companies that operate amusement parks.

Mark DeCambre will become the new editor of MarketWatch after leading its financial markets coverage team since 2014.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.