Ukraine updates: Canada to revoke ‘most favoured nation’ status to Russia, Belarus

Check here for the latest news

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under stress as central banks tighten policy.

There is a lot going on out there, so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

3:40 p.m.

Russia’s economy will decline 35 per cent in the second quarter and 7 per cent in 2022 overall, — a shock comparable to the 1998 crisis, forecasts JPMorgan.

“A peak-to trough decline in Russian GDP is now expected at around 12%, comparable to 1998 (~10%) and 2008 (~11%) crises and COVID-19 shock (~9%),” Anatoliy Shal at JPMorgan said in a note to clients.

— Reuters

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

2:43 p.m.

That 70’s Show

Bank of Canada Governor Tiff Macklem is in the middle of a busy day. He gave a speech this morning, talked to reporters after, and will appear at the House of Commons finance committee later this afternoon.

You can read about the speech here. The press conference turned into a version of That 70’s Show.

“So, what happens if inflation expectations do become unmoored? We lived this in the 1970s, and what you see in an economy when inflation expectations become unmoored, is that nothing in the economy works well,” Macklem said. “What did we see in the ’70s? Everybody felt like they were getting ripped off because they’d get their paycheque, but prices would go up. There was a lot of strikes, there was a lot of labour strife because workers always felt like their wages weren’t getting keeping up with inflation.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Are we about to relive those years?

“In the current context, we have these big supply disruptions that are boosting inflation and as the pandemic eases, those supply disruptions should gradually work their way out,” Macklem said. “Provided we keep inflation expectations well-anchored as those things work out, inflation should come down. But if we let inflation expectations become unmoored, then when those supply constraints ease, inflation won’t come back down, and it’ll be much more costly to get it back down.”

Macklem said that war in Europe has “injected new uncertainty,” into Canada’s outlook, but not enough to veer off a path to higher interest rates to keep that inflation in check.

— Stephanie Hughes

2:15 p.m

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

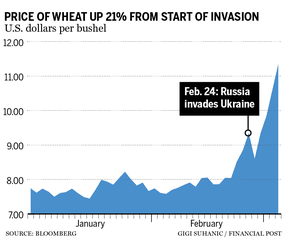

Wheat prices hit 14-year high

Grain prices continued to surge today, driven by growing fears that Russia’s invasion of Ukraine will disrupt the planting season and continue to choke off exports from one of the most important bread baskets in the world.

An agriculture expert warned the European Parliament this week that the conflict has shut down Black Sea ports that are crucial in moving commodities out of the region. Russia and Ukraine account for about a third of global wheat exports and 19 per cent of corn exports.

May contracts for soft red winter wheat jumped seven per cent on Thursday to US$11.34 per bushel at the Chicago Board of Trade — an exchange that heavily influences the price paid to Canadian grain farmers. May corn contracts were up almost five per cent to US$7.60 per bushel.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Wheat futures are at the highest level in 14 years and major growing regions like North America will need to produce a good harvest this summer to boost global supplies and prevent further price inflation, Bloomberg reported.

But to do that, Canada needs rain. Western Canadian farmers are coming off a devastating drought last summer that reduced crop output by as much as 40 per cent, said Tom Steve, the general manager of the Alberta Wheat and Barley Commissions.

“Farmers are concerned about the moisture situation,” he said. “We don’t have a lot of snow cover in Western Canada and we didn’t get much moisture in the fall. We really need a wet spring to recharge the soil moisture.”

After last year’s drought, some farmers have less grain left in their storage bins than they normally would — which means they aren’t able to take full advantage of the recent spike in wheat prices. At the end of 2021, Canada’s total stocks of wheat were down 38 per cent year over year to 15.6 million tonnes, according to a Statistics Canada report last month.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Food prices are expected to keep rising as the Russian invasion squeezes an already tight supply of grains. The Food and Agriculture Organization of the United Nations has warned of implications on food security for Ukraine as well as countries that depend on exports from the region. Egypt, for one, relied on Ukraine and Russia for 86 per cent of its wheat imports in 2020, Bloomberg reported.

The Baking Association of Canada (BAC) said the conflict isn’t likely to impact grain supplies for domestic baking operations, but it does risk driving up production costs — which are already high due to last year’s drought.

“These forces are expected to increase global market prices which will in turn translate into higher costs for Canadian flour – cost which may need to be passed onto consumers,” BAC executive director Martin Barnett said in a statement. “The baking industry is already grappling, along with other food manufacturing sectors, with almost 7 per cent inflation.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Jake Edmiston

12:47 p.m.

As Russia’s war against Ukraine enters its second week, a new poll suggests that a majority of Canadians believe it has the potential to escalate into a world war.

In the Leger poll, conducted between Feb. 25 and 27 just after Russia invaded, 89 per cent of Canadians said they were worried about the invasion and 66 per cent said they believed it had the potential to develop into a world war.

When asked: “How confident are you in the leadership of Justin Trudeau leading Canada in a conflict that involves Russia,” 37 per cent said they were very confident or somewhat confident in the prime minister’s abilities.

The poll showed widespread support for Ukraine.

Eighty-three per cent of Canadians said they supported Ukraine, 15 per cent said they didn’t know and two per cent said they supported Russia.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Canadians in the poll gave the strongest support to sanctions to end the conflict. Forty-five per cent saw stronger economic sanctions as the best route, 21 per cent favoured negotiations and just 14 per cent military action.

Many of those polled said they thought Russian President Vladimir Putin was lying about his motives for invading Ukraine. When asked about Putin’s statement, “I have decided to conduct a special military operation… to protect people who have been subjected to bullying and genocide… for the last eight years,” 74 per cent said he was lying, 22 per cent did not know and four per cent thought he was telling the truth.

When broken down by political party affiliation, 81 per cent of those who said Putin was lying identified as Liberal, 74 per cent as Conservative, 82 per cent as NDP and 54 per cent as People’s Party of Canada.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Gigi Suhanic

12:15 p.m.

Canada pulls back from Arctic Council, led by Russia

Seven countries that ring the Arctic have pulled out of the international body that oversees its use and development in protest of Russia’s invasion of Ukraine.

Canada, the United States, Norway, Iceland, Sweden, Denmark and Finland have announced they won’t participate in the work of the Arctic Council or attend any of its meetings until further notice.

The Arctic Council is currently led by Russia.

The council is the main international body that brings together all northern nations to discuss environment and development issues.

It also includes Indigenous groups as permanent participants.

The organization was founded in Ottawa in 1996.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— The Canadian Press

12:00 p.m.

Prime Minister Justin Trudeau said Canada and its allies are “calling to suspend” Russia from Interpol.

“We’re supporting this because we believe that international law enforcement cooperation depends on a collective commitment to the Universal Declaration of Human Rights and mutual respect between Interpol members,” Trudeau said.

— Bianca Bharti

11:45 a.m.

Bank of Canada Governor Tiff Macklem used a speech today to add some texture to the Bank of Canada’s decision on March 2 to raise interest rates for the first time in more than three years.

Macklem called the war in Europe “deeply troubling,” and acknowledged that it has “injected new uncertainty.” But it’s not enough uncertainty to knock the central bank off its path to higher interest rates. With inflation advancing at its fastest pace in in more than three decades, Macklem promised a “careful” and “deliberate” march back to higher borrowing costs.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Read Kevin Carmichael’s analysis of the latest from the Bank of Canada here.

11:26 a.m.

The Russian ruble is falling so far, so fast, the Bank of England today said it would cease publishing the currency’s exchange rate against sterling and the U.S. dollar.

“In current market conditions it is not possible to publish rates that are representative of the prevailing interbank market,” the BoE said in a statement. “Publication of these exchange rates is suspended until further notice.”

The ruble slumped to new record lows against the dollar and euro today after Fitch and Moody’s downgraded Russia’s sovereign debt to “junk” status.

At 1305 GMT, the rouble was more than 9 per cent weaker against the dollar at 117.4 and down over 7 per cent against the euro at 125.1 on the Moscow Exchange, marking the first time the rouble has traded weaker than 110 to the dollar in Moscow and the first time it has breached 123 to the euro.

— Reuters

10:56 a.m.

Increasingly shut out of Western financial institutions by sanctions, Russian companies are turning to China.

The Moscow branch of a Chinese state bank has seen a surge in enquiries from Russian firms wanting to open new accounts, a person familiar with the matter told Reuters.

“Over the past few days, 200-300 companies have approached us, wanting to open new accounts,” said the source.

10:32 a.m.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Now read what Eric Nuttall thinks Canadian policymakers can learn from Europe’s energy woes

9:16 a.m.

BREAKING Deputy Prime Minister Chrystia Freeland just announced that Canada will revoke “most favoured nation” status to Russia and Belarus, meaning it will no longer receive WTO benefits such as low tariffs.

The only other country without this status is North Korea, Freeland said. Russia and Belarus will now be subject to 35 per cent tariffs on their exports to Canada.

“We will not let Russians and Russian institutions that are central to President Putin’s fallen kleptocracy enjoy this prosperity.”

Freeland said the impact of Russian sanctions to Canadians will be minimal, noting that after the Crimea annexation, Canada had begun discouraging trade and business with Russia.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“It was a decisive move,” Freeland said. “With regards to G7 countries, Canada has the loosest ties with Russia.”

That paved the way to enforce the strong measures implemented this year, she said.

The minister of immigration, Sean Fraser, said Canada will welcome Ukrainians fleeing the Russian invasion.

“The reason we are committed to offering refuge to Ukrainians who seek it is that by opposing Putin’s tyranny and oppression, they are advancing the democratic values in Ukraine that define us as Canadians.”

Canada will enforce a measure called the Canada-Ukraine Authorization for Emergency Travel and there will be no limit on the number of applications so that Ukrainians fleeing can enter Canada and find work with an open work permit.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

An expedited pass will be created so that Ukrainians who have family in Canada can arrive here sooner. The pass will apply to a broader scope of family members rather than the usual scope of immediate family members.

“Those Ukrainians who are ready to give their lives to defend the values we hold dear, we stand with you, not only in our work, but also interactions,” Fraser said.

“We will provide equipment to help defend your homeland. We will provide financial support to help stabilize your economy. We will impose economic sanctions on your oppressor. Today, we will offer a safe haven to your families while you fight on the frontlines of a war to defend your freedom from tyranny to the benefit of the entire world.”

— Bianca Bharti

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

8:52 a.m.

Canada has imposed new sanctions against Russia’s energy sector in response to “Russia’s unprovoked and unjustifiable invasion of Ukraine.”

Mélanie Joly, Minister of Foreign Affairs, said in a release that new restrictions are being imposed on 10 key individuals in Russian energy giants Rosneft and Gazprom in an effort to pressure the country to cease hostilities. The government did not name the individuals.

Ottawa said it would continue to consult with its allies on further sanctions if Russia persists with its aggression against Ukraine.

“Canada’s support for Ukraine and its people is unwavering. We will continue to meet every act of aggression by Russia’s leadership with measures designed to weaken its ability to wage war,” Joly said in the release. “As the horrific events in Ukraine continue to unfold before our eyes, it is clear more must be done. Those who aid and abet Russian aggression will be held accountable. Canada stands with Ukraine.”

Additional reporting by Reuters and Bloomberg

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.