The ‘all-out economic and financial war’ against Russia

Check here to find out how the crisis is impacting markets, Canadian businesses and the financial world

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic retaliation as western nations pile on sanctions in what France has called “all-out economic and financial war.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

To get the latest news on the conflict and how it is affecting markets, businesses and the economy, watch here.

5:29 p.m.

The International Monetary Fund (IMF) and World Bank Group said the war in Ukraine is “creating significant spillovers to other countries.”

“Disruptions in financial markets will continue to worsen should the conflict persist,” they said in a joint statement.

4:25 p.m.

Bank of Canada rate hike on track for tomorrow

The Canadian economy’s proven resilience through Omicron and trade disruptions will keep the Bank of Canada on course to hike the key policy rate tomorrow, and the war in Ukraine won’t cause Governor Tiff Macklem to falter.

“In fact, the war translates into a net inflationary impulse into Canada through the terms of trade lift granted by higher oil prices,” Derek Holt, head of Capital Markets Economics at Bank of Nova Scotia, wrote in a note to clients.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

In January, Macklem said the economy has reached its limit of non-inflationary growth and data put out today by Statistics Canada showed gross domestic product recovered to pre-pandemic levels when the economy grew by 6.7 per cent, annually, in the fourth quarter of 2021. Canada has zero net trade exposure to Ukraine and Russia, Holt noted, and the sanctions imposed so far won’t cripple Canadian businesses, at least not yet.

With inflation running hot right now, the central bank will stay focused on its mandate to bring it within its target of one to three per cent at tomorrow’s announcement, he said. “Macklem will choose his words carefully in his speech on Thursday and flag geopolitical uncertainties, but the info we have thus far isn’t enough to blow them off course.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Bianca Bharti

4:15 p.m.

Wall Street ended sharply lower on Tuesday, with financial stocks bearing much of the damage for a second straight day as the Russia-Ukraine crisis deepened and stirred anxiety among investors.

According to preliminary data, the S&P 500 lost 68.04 points, or 1.51 per cent, to end at 4,305.90 points, while the Nasdaq Composite lost 220.47 points, or 1.60 per cent, to 13,530.93. The Dow Jones Industrial Average fell 601.80 points, or 1.78 per cent, to 33,290.80.

In Toronto, the S&P/TSX Composite Index closed down 121.85 points, or 0.58 per cent, to 21,004.51.

4:00 p.m.

Apple Inc. has halted all sales of its products in Russia, saying the company stands “with all of the people who were suffering as a result of the violence.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The iPhone maker said Tuesday that it’s taken a number of actions in response to the invasion, including pausing product sales in Russia. “Last week, we stopped all exports into our sales channel in the country. Apple Pay and other services have been limited,” Apple said.

Last week, Ukrainian government officials asked Apple Chief Executive Officer Tim Cook to halt sales in the region.

“We are supporting humanitarian efforts, providing aid for the unfolding refugee crisis, and doing all we can to support our teams in the region,” the company said Tuesday.

— Bloomberg

3:30 p.m.

Crypto exchanges are pushing back at calls to ban all Russian users.

Mykhailo Fedorov, Ukraine’s vice-prime minister, has called on “all major crypto exchanges to block addresses of Russian users,” not just the politicians but to “sabotage ordinary users.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“To unilaterally decide to ban people’s access to their crypto would fly in the face of the reason why crypto exists,” said Cayman Islands-registered Binance, one of the world’s biggest crypto exchanges. Rival Okx, based in the Seychelles, also said it had no plans to bar Russian accounts in bulk.

But Western countries, trying to end Russia’s hostilities on Ukraine with sanctions, are worried that cryptocurrencies will provide a back door to move money around the world while they seek to shut Russia out of the global financial system.

Trading between the Russian rouble and crypto assets such as bitcoin and tether has doubled since the assault on Ukraine began, reaching US$60 million a day on Monday, suggesting Russian accounts — barred from the established dollar-based financial system through sanctions — are stashing funds in crypto or moving wealth overseas.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

3:14 p.m.

Canada to shut ports to Russian ships

Canada has decided to shut its ports to Russian-owned ships later this week in response to Moscow’s invasion of Ukraine, Transport Minister Omar Alghabra said today.

“Russia must be held accountable for its invasion of Ukraine,” Alghabra said. “Today, we are taking steps to close Canadian waters and ports to Russian-owned or registered ships. We will continue to take action to stand with Ukraine,” he added.

So far Canada has banned imports of Russian crude oil, imposed sanctions on Russian President Vladimir Putin, closed Canadian airspace to Russian planes, and forbid Canadian financial institutions from dealing with the Russian central bank.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Reuters

3 p.m.

For now, Magna International Inc., one of the biggest car systems makers in the world, is holding tight in Russia while Western companies are beginning to trickle out of the country amid the fighting in Ukraine.

The Aurora-based company runs six manufacturing facilities and employs 2,500 people in the vast Eurasian country. “Our operations are currently running and we continue to monitor the very dynamic situation. We are liaising with our customers and suppliers on a daily basis in order to review individual programs – our focus is to maintain business continuity,” a spokesperson said by email.

Firms like BP Plc and Shell Plc have already announced their exit. So too has Norway’s biggest energy company Equinor ASA, France’s TotalEnergies SE and Exxon Mobil Corp.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Magna reported on Feb. 11 a 14-per-cent drop in sales to US$9.1 billion for its fourth quarter ended Dec. 31, 2021. It attributed COVID-19 disruptions and semiconductor shortages to the year-over-year decline.

— Bianca Bharti

2:48 p.m.

Alberta’s pension giant AIMCo has committed to divesting its Russian holdings, which amounted to less than $99 million in direct and indirect exposure to Russian securities at the end of February.

“As Alberta’s investment manager, this decision is both values- and value-driven,” AIMCo said in a statement, citing the invasion of Ukraine and the ensuing humanitarian crisis.

“It reflects a change in the price of geopolitical risk and sustained impairment to the underlying value of the respective companies.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The investments accounted for 0.06 percent of AIMCo’s more than $160 billion in assets under management.

“Our exposures fluctuate with market values and trading decisions,” AIMCo said, adding that it had no direct exposure to Russia beyond public equities.

“AIMCo also commits that it will not purchase Russian assets during the conflict or while financial sanctions are being applied to Russia or its leaders.”

— Barbara Shecter

2:22 p.m.

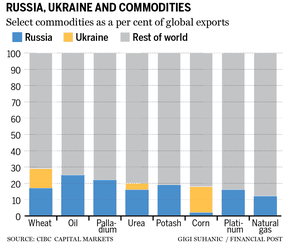

Grain prices climb as conflict chokes off one of the world’s most important bread baskets

Grain prices continued to climb today amid fears that Russia’s invasion of Ukraine will destabilize the region’s food production.

Shutdowns at Black Sea ports cut off a main gateway to one of the world’s most important bread baskets — Ukraine and Russia — which make up a third of global wheat trade, and 19 per cent of global corn trade. That has a “huge impact” on the global market for commodities, said Michael Scannell, deputy director-general at the European Commission’s agriculture division.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“When that trade effectively stops, that clearly is going to have a huge impact as traders rush to try and find alternative markets,” he told the European Parliament at a committee hearing on Monday.

Shipping firms are “extremely reluctant” to try to access Ukraine’s ports, especially since the county’s navy has heavily mined adjacent waterways, Scannell said. But the ports themselves haven’t been damaged, so trade could theoretically resume as soon as the conflict ends.

“But frankly nobody expects that to happen in the short term,” he said.

The war has also complicated agricultural logistics inside Ukraine, with authorities forced to stop crucial functions such as the certification of cereal crops, Scannell said.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Food and Agriculture Organization of the United Nations said Ukraine and Russia’s available grain exports are “relatively low” at this time of year, with the largest volumes coming after the fall harvest.

That harvest could be bleak, with the coming sowing season for corn already at risk, Scannell told the European Parliament.

“Clearly, with a war going on, it’s very, very difficult to focus on these types of plantings,” he said. “This raises the possibility that this crisis will continue into the medium term.”

May contracts for soft red winter wheat increased 5.35 per cent to US$9.84 per bushel, at the Chicago Board of Trade as of mid-day today. That follows an 8.64 per cent increase, to US$9.34 per bushel, on Monday.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Corn futures were also up as of mid-day today, with May contracts trading for US$7.26, up 35 cents or 5.1 per cent over previous day.

The sharp increase in the grain market today confirmed that the market’s view of the conflict, narrative around the conflict and global food supplies are shifting, Patricia Uhrich, a commodity broker with CHS Hedging wrote in a note to investors. The question, she said, is no longer “if” the war will disrupt supplies from the Black Sea region, but “how much and for how long?”

But as crop futures rise, agriculture leaders have warned that the conflict is also likely to drive price inflation in key farm inputs, including fuel and fertilizer.

— Jake Edmiston

1:41 p.m.

How the return of great power politics is reshaping Canada’s trade policy

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Trade Minister Mary Ng kept some appointments in Washington this week, despite the war in Eastern Europe. Her office issued a press release on March 1 that said the minister met with Katherine Tai, her counterpart in President Joe Biden’s administration, and Charles Grassley, an important Republican senator from Iowa. Naturally, Ng “reiterated Canada’s steadfast support for Ukraine along with allies, including the United States.”

Ng also set out for some American audiences Prime Minister Justin Trudeau’s new approach to international trade.

Current events amplify the extent to which the world has changed since Trudeau was elected in 2015. Back then, the government talked of signing free-trade agreements with China and India, massive markets, but notoriously difficult places to do business. Trudeau’s attempt to make Canada the first G7 country to do a free-trade deal with China flopped, and after the imprisonment of Michael Kovrig and Michael Spavor, relations between the two countries have never been worse.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

If trade talks with India have a pulse, it’s a faint one. Canada and India technically are friends, but they have a lot of issues with each other. That relationship likely will become more fraught, given India’s longstanding reliance on Russia for military equipment. Prime Minster Narendra Modi’s government isn’t among the U.S. allies that have signed on for what French Finance Minister Bruno Le Maire called an “all-out economic and financial war on Russia.”

Remarks Ng gave at an event hosted by the Wilson Centre on Feb. 28 showed how the return of great power politics is reshaping Canada’s trade policy.

Canada remains focused on Asia, but there was no mention of China or India; instead, Ng highlighted her efforts to secure a trade agreement with the Association of Southeast Asian Nations, a 10-member group that includes Singapore, Thailand and Vietnam.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Trudeau’s government remains a fan of working through international organizations, but it will seek out ad hoc assemblies that aren’t dominated by the United States, China, and the other “great powers” that have bigger agendas than pursuing trade. Ng mentioned the Ottawa Group of 13 countries and the European Union that was formed at a meeting in Ottawa in 2018 to come up with ways to make the World Trade Organization work better.

Perhaps most significantly, Canada now is seeking trading partners that “share its values,” and it only wants deals that are “comprehensive and progressive.” That’s new. Trudeau was agnostic about values when he decided to make China his top trade target, and a values-led approach could complicate future talks with India. It could leave Canada even more reliant on the U.S., a dependence that Trudeau has stated he’d like to weaken.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But there might not be another way forward for Canada in the world. Because it’s 2022.

— Kevin Carmichael

1:35 p.m.

‘Putin is living in his own head’

“Putin is living in his own head and it’s not a nice place to be,” says Roman Waschuk, former Canadian Ambassador to Ukraine. Waschuk talks with Financial Post’s Larysa Harapyn about which sanctions are working against Russia. Recent ‘killer’ banking sanctions such as freezing central bank reserves are proving to have a significant impact.

12:31 p.m.

Bank of Canada seen hiking but maybe not so much

Nearly all economists and analysts expect the Bank of Canada to kick off its rate hiking cycle tomorrow after it, controversially, decided to hold off in January. At the first rate announcement for 2022, many assumed the central bank would raise interest rates because the economy had closed its output gap, a measure for non-inflationary growth.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Governor Tiff Macklem even said as much during the January announcement, but with its credibility at stake and the country in the midst of the Omicron wave, the Governing Council decided to stay put.

Now, with Russia’s invasion of Ukraine, it seems Macklem could face a challenging environment again as he begins rate lift-off.

“Keeping policy too loose risks sending inflation surging, while tightening too much could tip the economy into a deep slowdown — or worse,” Doug Porter, chief economist at Bank of Montreal, said by email. Inflation hit a 30-year-high in January, climbing 5.1 per cent even as the labour market lost 200,000 jobs and some businesses temporarily closed.

The Governing Council, however, cannot afford to deliver anymore surprises and does not want to add to the drama of geopolitical events, Porter said. “Amid profound uncertainty elsewhere, the Bank wants to be a source of stability and predictability.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

And ultimately, the Bank of Canada needs to stay focused on its mandate: inflation targeting, said Porter. The central bank said it expects inflation to remain around five per cent for the first quarter of 2022 and with oil and other commodities prices climbing, because of the European conflict, inflation could climb even higher.

“Taking these factors together, we expect the Bank to hike by 25 bps tomorrow, and to continue grinding rates higher in the months ahead. However, these events likely remove the risks of the Bank being even more aggressive (e.g., hiking by 50 bps at some point), and may somewhat dim the upside for total rate hikes this year,” Porter said.

— Bianca Bharti

12:15 p.m.

North American markets continued to drop in mid-day trading.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

In Toronto, the S&P/TSX Composite fell 146.71 points, or 0.69 per cent, to 20,979.65.

In New York, the S&P 500 was down 73.51 points, or 1.68 per cent, to 4,300.43. The Nasdaq fell 203.60 points, or 1.48 per cent, to 13,547.80. The Dow Jones Industrial Average fell 689.53 points, or 2.03 per cent, to 33,203.07.

12:07 p.m.

Canada’s big banks offer financial aid, messages of support for Ukraine

The heads of Canada’s biggest banks are standing in solidarity with Ukraine, offering messages of support and financial aid during earnings week.

Darryl White, the chief executive officer of the Bank of Montreal, acknowledged the humanitarian crisis in Ukraine and the impact to Ukrainians everywhere, including those in Canada.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“At BMO, we stand with our Ukrainian and Russian employees, customers and members of our community in this time of need,” White said during the Tuesday morning conference call. “To help support global aid efforts, BMO has committed $200,000 to the Canadian Red Cross (for) Ukrainian’s humanitarian crisis… and we are accepting donations on behalf of the Red Cross at BMO branches across Canada.”

Brian Porter, president and chief executive officer at the Bank of Nova Scotia, also began his remarks with words of solidarity with Ukraine on Tuesday.

“We stand unequivocally with the people of Ukraine and with our large and vibrant Ukrainian community here in Canada,” Porter said.

While geopolitical tensions have rocked the markets, banks such as BMO and the Royal Bank of Canada (which reported results on Thursday), said they held no direct exposure to markets in the Ukraine and Russia.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Stephanie Hughes

11:22 a.m.

Companies leaving Russia grow by the hour

International companies are exiting Russia en masse in wake of its invasion of Ukraine, reversing three decades of investment following the collapse of the Soviet Union in 1991, Bloomberg reports.

As sanctions from Western countries pile up, many companies have concluded that it’s become too risky on both a reputational and financial level to do business there. The number of companies leaving is growing by the hour.

BP Plc started the exodus on Sunday, announcing it would exit its 20 per cent stake in state-controlled oil company Rosneft. Next came Shell Plc. on Monday, followed by Norway’s biggest energy company Equinor ASA, France’s TotalEnergies SE and Exxon Mobil Corp.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Still other companies are pausing business interests in the country. Daimler Truck Holding AG said it’s stopping business activities there until further notice. Volvo Car AB and Volvo AB are also halting sales and production in Russia. General Motors Co. said it would halt shipments to the country as well.

Meanwhile, MasterCard Inc. and Visa Inc. said they are blocking some Russian activity from payment networks to comply with sanctions.

Foreign companies who can’t easily exit the country, such as consumer goods companies, could face retaliation from Russia for the moves, experts say. They could be subject to boycotts and, in extreme situations, some firms could even have their assets seized.

— Bloomberg

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

11:02 a.m.

IEA members open their oil reserves

Ministers from the International Energy Agency (IEA) member states have agreed to the release of 60 million barrels of oil from their emergency stockpiles, following a special meeting on the impact of Russia’s invasion of Ukraine on oil supply.

Sixty million barrels is roughly equivalent to 12 days of Russian crude oil exports, commodities analyst Rory Johnston said on Twitter Tuesday.

The move is intended to provide stability to global oil markets where prices have been spiking over fears of disruptions to exports of crude and refined products from Russia.

But some analysts speculated Tuesday that the move would not be sufficient to ease soaring prices.

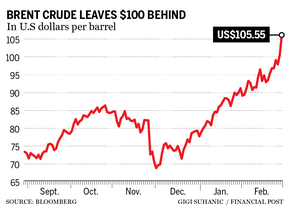

Brent futures prices for May delivery climbed to more than US$105 a barrel and West Texas Intermediate (WTI) crude for April rose to above US$103 a barrel during the session Tuesday.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Tuesday’s announcement represents the fourth drawdown of emergency oil stockpiles in the history of the IEA. Previous releases occurred in 2011, 2005 and 1991.

In a press release, the IEA said energy supply should not be used as a means of political coercion or as a threat to national and international security.

“The IEA Secretariat will continue to closely monitor global oil and gas markets and to provide recommendations to the Governing Board, including possible additional emergency oil stock draws, as needed,” the organization said.

“Ministers also discussed Europe’s significant reliance on Russian natural gas and the need to reduce this by looking to other suppliers, including via LNG, and to continue to pursue a well-managed acceleration of clean energy transition.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The IEA said on Thursday it will release a 10-point plan for how European countries can reduce their reliance on Russian gas supplies.

— Meghan Potkins

10:57 a.m.

Not everybody is pleased with the pace of Canada’s actions against Russia. This from the former foreign affairs and trade adviser to Stephen Harper.

10:44 a.m.

Canada has just announced another $100 million in humanitarian aid to Ukraine.

“The lives of the children of Ukraine have been thrown into chaos. Their classrooms have been replaced by bomb shelters. Their playgrounds have become battlefields. Their beds have become the hard ground,” Minister of international development Harjit S. Sajjan said in a press release today. “We will continue to be there for our Ukrainian friends and partners during this difficult time.”

The money will help provide emergency health services (including trauma care), protection, support to displaced populations and life-saving services such as shelter, water and sanitation, and food.

10:05 a.m.

No quick fix to Europe’s energy crisis — not even from Canada

There appears to be no easy solution to Europe’s skyrocketing energy costs.

Right now, there’s geopolitical risk to the oil market but it’s not yet reached a point where production has slowed and barrels have come offline, said an energy director at RBC Capital Markets. Still, tensions in Ukraine have caused oil prices to surge, recently pushing past US$100 a barrel.

“Let me be clear here: I think the oil market fundamental backdrop is perhaps the most bullish that I have seen in my career,” Michael Tran, managing director of global energy strategy at RBC Capital Markets, said in an interview with Larysa Harapyn.

Tran also noted that Europe, which is one of Russia’s biggest customers for oil, could struggle in trying to find alternative supplies of energy and natural gas. Getting help from Canada could prove difficult because “we just don’t have large-scale export capacity pointed in the right direction.

Europe has been bolstering its green supply of energy, but the recent conflict on the heels of supply-chain strain from late last year show that there’s still too much friction to be fully self-reliant on green energy.

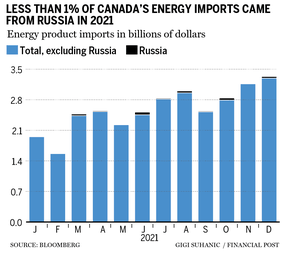

As the chart below shows the Russian conflict is not likely to impact Canada’s energy supply as less than one per cent of our energy imports come from the country.

— Bianca Bharti

9:41 a.m.

‘We will cause the collapse of the Russian economy’

France declared an “all-out economic and financial war” against Russia today as punishment for its invasion of Ukraine.

Canada, the United States and allies have imposed sanctions on Russia’s central bank, oligarchs and officials, including President Vladimir Putin himself, and barred some Russian banks from the SWIFT international payments system.

French Finance Minister Bruno Le Maire described the sanctions packages as proving “extremely effective.”

“We’re waging an all-out economic and financial war on Russia,” Le Maire told France Info radio. “We will cause the collapse of the Russian economy.”

In a matter of weeks, Russia has turned from a lucrative bet on surging oil prices to an uninvestable market with a central bank hamstrung by sanctions, major banks shut out of the international payments system and capital controls choking off money flows.

Today Russia said it was placing temporary curbs on foreigners seeking to exit Russian assets, putting the brakes on an accelerating investor exodus driven by the sanctions.

Le Maire’s remarks drew an angry riposte from Russia’s former president and prime minister, Dmitry Medvedev, who is now the deputy Chair of the Security Council of the Russian Federation.

9:38 a.m.

North American stocks opened lower today with bank stocks declining further as the Russia-Ukraine crisis deepened, while a surge in oil prices boosted shares of energy companies.

The Dow Jones Industrial Average fell 79.12 points, or 0.23 per cent, at the open to 33,813.48.

The S&P 500 opened lower by 10.80 points, or 0.25 per cent, at 4,363.14, while the Nasdaq Composite dropped 34.70 points, or 0.25 per cent, to 13,716.70 at the opening bell.

The TSX was up 64.60 points or 0.31 per cent to 21,190.96

Additional reporting by Reuters and Bloomberg

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.