Sanctions put Russia in an economic vise and West still has more options, experts say

‘It’s kind of like a massive aerial bombing (in financial terms)’

Article content

Russia’s currency plunged and its stock market seized Monday after Canada and other G7 nations intensified financial sanctions aimed at pressuring Moscow to pull back from its invasion of Ukraine.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Measures targeting Russia’s central bank froze a significant portion of the country’s US$650-billion of reserves, preventing the government from using those emergency funds to shore up its economy against the Western assault, analysts said.

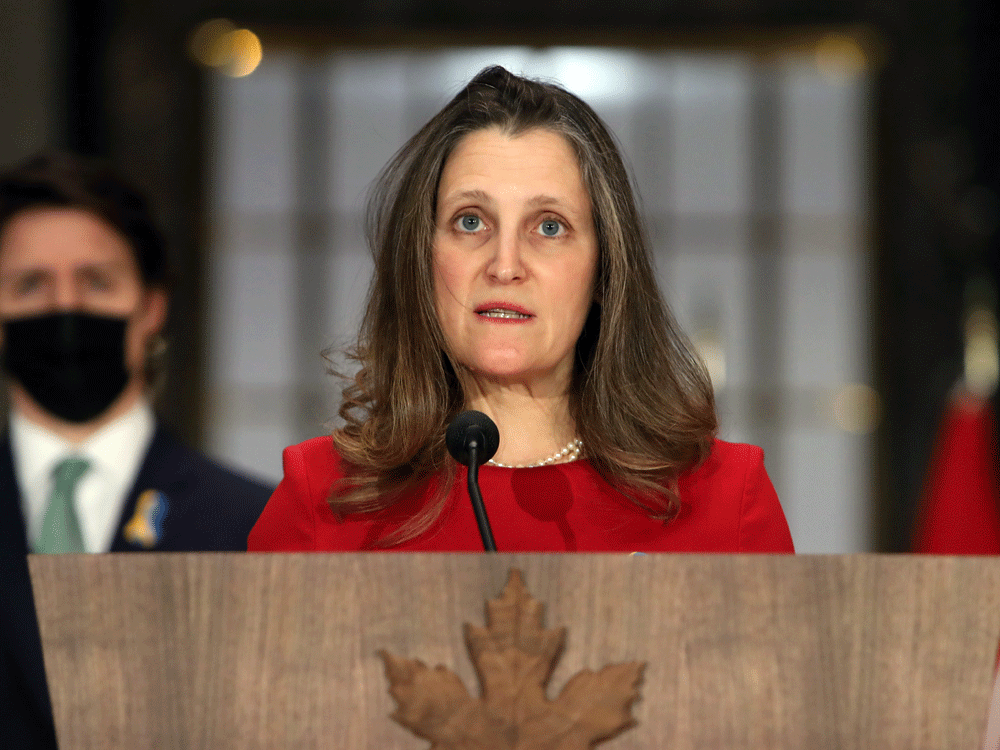

On Monday, deputy prime minister Chrystia Freeland said all Canadian financial institutions are prohibited from engaging in any transaction with the Russian Central Bank, and Canada is also imposing an asset freeze and prohibition on dealing with Russian sovereign wealth funds.

In addition, Prime Minister Justin Trudeau said Canada would ban imports of crude oil from Russia. Canada imported energy products from Russia worth about $290 million from Russia in 2021, according to Statistics Canada, with Quebec and Newfoundland and Labrador accounting for almost all of it.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

While this isn’t a large amount compared to other countries, the bans and prohibitions are on top of international sanctions unleashed in recent days, including a declaration over the weekend that some Russian banks would cut off from SWIFT, the global inter-bank messaging platform that facilitates the bulk of international transactions.

-

Canada banning crude oil imports from Russia, sending anti-tank weapons to Ukraine

-

How the Russia-Ukraine crisis is impacting markets and the economy

And observers say the West has even more economic firepower to deploy if needed.

“It’s kind of like a massive aerial bombing (in financial terms),” said Mark Warner, international competition, trade and investment lawyer at MAAW Law.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The risk that Russia could be further isolated from the global economy accelerated Monday’s run on the country’s currency.

The ruble, which has been under pressure since before Russia made good on a threat to invade Ukraine last week, fell to its lowest level on record. It sunk more than 30 per cent after leaders in Canada, the European Commission, France, Germany, Italy, the United Kingdom, and the United States issued a joint statement condemning Putin’s “war of choice” and committing to ensuring the removal of “selected Russian banks” from the SWIFT system.

“Those holding ruble deposits in Russia, including corporates, sensing that the Russian banking system might get cut off from the rest of the world, rushed to try to convert them into dollars or other western currencies held abroad,” said Avery Shenfeld, chief economist at CIBC Capital Markets.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“All that selling, without an offsetting need to buy, creates a huge imbalance that causes the ruble to tumble.”

Clifford Sosnow, a partner at law firm Fasken Martineau DuMoulin LLP in Toronto, said the combined sanctions will make it “exceedingly” difficult to move dollars into and out of the Russian market and cause “general disruptions of supply chains involving Russia.”

He added that the latest sanctions are layered upon existing sanctions related to Russian investments in some oil production operations.

“Removing Canadian and other country banks from SWIFT access to Russian banks and preventing the Russia Central Bank from accessing foreign reserves… makes any international trade with Russia difficult, including oil and gas purchases from Russia,” said Sosnow, who is chair of the international trade group at Faskens.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

However, some observers noted that there is still some firepower left in the financial arsenal, though using it could hurt some G7 nations that still rely heavily on Russian oil and gas exports.

One example of restraint can be seen in the decision not to cut all Russian banks from the global SWIFT inter-bank network, which will allow some payments to continue to be made.

“While public opinion may demand more, for now the SWIFT-related sanctions are probably cumbersome but not too negative,” Citi analysts led by Dirk Willer said in a note to clients Monday.

Europe, and particularly Germany’s, heavily reliance on natural gas from Russia is causing the G7 countries including Canada to apply as much pressure as possible to banks, oligarchs, and ordinary citizens without making the moves so widespread and all-encompassing that they jeopardize those energy imports, said Warner.

“It’s obviously a very fluid situation, but that’s the architecture … to keep those countries out of it,” he said. “If it changes, we’ll know right away because … that actually would be the (financial equivalent of) nuclear attack.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.