New Jersey Gov. Murphy floats property tax relief for nearly 1.8 million homeowners, renters

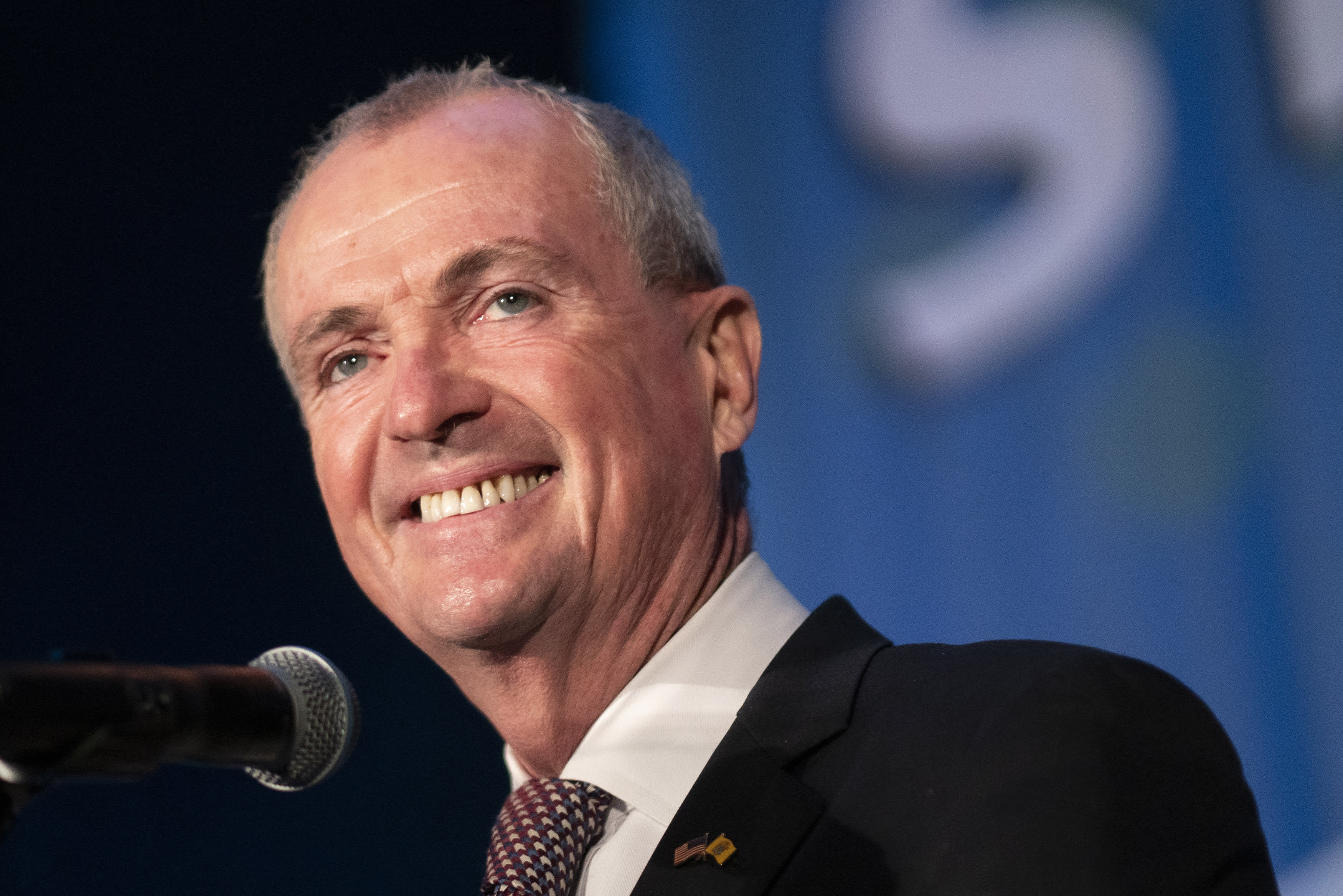

New Jersey Gov. Phil Murphy delivers a victory speech on Nov. 3, 2021, in Asbury Park, New Jersey.

Eduardo Munoz Alvarez | Getty Images

Property tax relief may soon be coming to New Jersey.

Gov. Phil Murphy has proposed the ANCHOR property tax relief program, extending savings to nearly 1.8 million households, as part of the state’s 2023 fiscal year budget.

Homeowners earning up to $250,000 per year may be eligible for rebates averaging $700, lowering the effective property tax rate to 2016 levels for many households, according to the plan.

More from Personal Finance:

IRS rule offers higher penalty-free withdrawals for early retirees

These 3 last-minute moves can still slash your 2021 tax bill

Sold your home? Here’s how to avoid a tax bomb this filing season

Renters making up to $100,000 may also qualify for a rebate up to $250, to help offset higher housing costs.

“This program will provide direct property tax relief to households regardless of whether they own or rent,” Gov. Murphy said. “While the state does not set property taxes, we believe that we must take action to offset costs and make life in New Jersey more affordable.”

The $10,000 cap on the federal deduction for state and local taxes for filers who itemize, known as SALT, has been a pain point as New Jersey faces the nation’s highest property taxes.

While some New Jersey and New York lawmakers have fought to include SALT reform in the Democrats’ spending package, the status of the plan is unclear.

Meanwhile, if New Jersey’s tax relief passes in the Democrat-controlled state legislature, it may distribute $900 million in property tax relief for fiscal year 2023.

The program aims to boost relief over a three-year period, increasing rebates to an average of $1,150 by 2025 for eligible families.

The proposal comes as many states are eying tax cuts, including income, sales, corporate, property and more, amid budget surpluses resulting from federal Covid-19 relief.