Moscow airport furloughs 7,000 staff as Russia sanctions bite

Moscow’s biggest airport has put around 7,000 employees on furlough and slashed their pay in a sign that Russia is preparing for a prolonged period of international isolation.

Sheremetyevo Airport, previously the country’s busiest international transport hub, furloughed 40pc of its staff last week and cut their pay by a third, according to local media reports.

Bosses told staff the decision was “out of the control of the employer” and connected to the “critical decrease in passenger traffic” triggered by Western sanctions.

It comes after Western countries imposed a slew of harsh sanctions against the Kremlin following its invasion of Ukraine, including closing their airspace to Russian-owned and Russian-registered aircraft.

This has resulted in Russia only having permission to operate direct flights to a handful of countries, such as Belarus, Serbia and the United Arab Emirates.

11:23 AM

Ukraine gas network operator “still in control”

Ukraine’s state-run gas transmission system operator said on Monday that it had full control of the network.

“The company retains operational and technological control,” it said in a statement.

Gas flows from Russia through Ukraine remain near the full booked capacity, transparency data shows.

11:19 AM

Antofagasta to exit controversial Pakistan project

Mining giant Antofagasta is to exit its contentious project in Pakistan in a $900m (£684 million) deal.

The FTSE 100 firm said it has agreed a deal with Canadian partner Barrick Gold Corp and authorities in Pakistan to end its involvement in the Reko Diq copper and gold mine project.

It comes after work at the site was suspended in 2011 due to a dispute over the legality of the licensing process.

Shares in the company rose by more than 5pc on Monday.

11:13 AM

UK, US embargo of Russian oil largely symbolic – but an EU ban would bite

A ban on buying Russian oil in Britain and the US will have little impact on Moscow because they only buy small amounts anyway, Russian state media has claimed.

Interfax quoted Russian deputy prime minister Alexander Novak Novak as saying his country is in the process of resolving logistical issues linked to its oil shipments abroad and that the country’s oil and gas production was continuing as usual despite sanctions.

But his comments come as EU countries – which buy more than half of Russia’s oil exports – are looking again at a possible oil embargo.

The foreign ministers of Lithuania and Ireland are among those pushing such a move, at the start of a week of intense diplomacy.

11:06 AM

Poland planning ramp up of defence spending

The Polish government wants to amend the constitution so that it can raise defence spending, a government spokesman said on Monday.

The Defence of the Fatherland Act adopted this month says that Poland’s defence spending will increase to 3pc of GDP, which could result in exceeding budgetary thresholds enshrined in the constitution.

“The Polish army must be immediately equipped to the highest standards, therefore one of the proposed changes to the constitution will be the exclusion of expenditure on the army and armaments from the public debt threshold,” a government spokesman said.

Changes to the constitution require a two-thirds majority in the lower house of parliament and an absolute majority in the opposition-dominated Senate, so the government’s proposals need to be supported by other political parties.

10:41 AM

Germans urge oil-rich Gulf states not to “profiteer” from Ukraine war

A top German minister has urged Gulf states not to “profiteer” from Western sanctions on Russia following the invasion of Ukraine.

Speaking on a visit to the United Arab Emirates, economy minister Robert Habeck said: “I’m not asking that they join the sanctions….but I ask not to be a profiteer of European and US sanctions.”

He is visiting the region to discuss long-term energy supplies as Berlin scrambles to wean itself off Russian gas.

Earlier, on Sunday, Habeck announced a new partnership with Qatar on supplies of liquefied natural gas.

In Abu Dhabi, he said German firms would sign five memoranda of understanding concerning hydrogen research and development.

10:32 AM

Swiss told: Confiscate assets of Russian oligarchs

Switzerland must freeze the accounts of Russian oligarchs in the country and confiscate their assets, the Polish prime minister said on Monday.

Mateusz Morawiecki was speaking as he welcomed Swiss president Ignazio Cassis to Warsaw.

“They must be frozen, the assets of Russian oligarchs in Switzerland must be confiscated and I called on the president to see to it that Switzerland approaches this topic decisively,” Morawiecki told a news conference.

Cassis said Switzerland had already adopted European Union sanctions against hundreds of people, including many oligarchs.

“They cannot dispose of their assets,” he said.

In a bid to force a Russian military withdrawal from Ukraine, Western countries have imposed numerous sanctions, including freezing the Russian central bank’s assets.

10:23 AM

Fuel duty cut will still leave Sunak with tens of billions to ease cost of living crisis

Rishi Sunak’s plans to ease pain at petrol pumps by cutting fuel duty is set to cost £2.5bn – but would only represent a fraction of the possible £75bn war chest available to the Chancellor as tax revenues soar.

The Treasury is said to be mulling a 5p per litre reduction in fuel duty after prices at the pump soared to their highest level on record last week.

Fuel duty has been frozen for over a decade at 57.95p per litre but the proposed cut would cost the Chancellor around £2.5bn, my colleague Tom Rees reports.

Mr Sunak is facing mounting pressure to splash out on measures to help shield households from the fastest rise in living costs for 30 years.

10:14 AM

Zara owner hit by Spanish truck driver strikes

A Spanish truck-driver strike going on for the last week is now delaying deliveries by Inditex, the world’s largest clothing retailer.

Inditex is warning clients that buy products on its Zara website that shipments could suffer delays due to the strike.

The strike over fuel prices has been disrupting supply chains in the country.

Last week, a dairy industry trade group said that the protests had interrupted the supply of raw materials and distribution to retail chains.

German carmaker Volkswagen will also halt production Monday at its plant in the northern Spanish region of Navarra as it lacks some of the components needed due to the strike, Europa Press reported Friday.

10:11 AM

Putin warns Europe: Oil embargo will hurt you more than Americans

The Kremlin on Monday said Europe would be hit hard in the event of an embargo on Russian oil but would not affect the United States.

Some European Union foreign ministers are pushing for an oil embargo as part of further sanctions against Russia, in an effort to punish Moscow over events in Ukraine.

But Dmitry Peskov, Vladimir Putin’s spokesman, pictured above, told reporters the question of any oil embargo was a very complex topic.

Meanwhile, as European leaders prepared for a summit with US President Joe Biden on Thursday, Dutch premier Mark Rutte stressed the EU could not cut itself off overnight.

“Too many refineries in the eastern and western part of Europe still completely depend on Russian oil and with gas it’s even worse”, he said after a meeting with Lithuanian President Gitanas Nauseda in Vilnius.

10:03 AM

Michael Gove attacks “cartel” of house builders

Our lead story in today’s paper, by reporter Ben Gartside, reports how Michael Gove has been further distancing himself from the “cartel” of British housing developers.

In comments likely to add to the Levelling Up Secretary’s feud with builders, he told Tory activists:

I’m not a poster boy [for developers]…I’m not particularly popular with developers at the moment because of some of the steps we’ve taken in respect of building safety and some of the other changes we want to make as well.

There are 101 changes we want to make, that we’ve essentially got a cartel of volume housebuilders who operate in a particular way, and there are all sorts of unhappy consequences.

As I mentioned, all of their incentives are essentially to swallow up virgin greenfields, rather than to think hard about regeneration.

09:59 AM

Energy giants buoy Footsie as oil price rises

The FTSE 100 rose on Monday as surging oil prices boosted shares of energy majors, although concerns about inflation and a handful of brokerage downgrades checked overall market gains.

The commodity-heavy index advanced 0.5pc, hitting its highest level in more than two weeks.

Both Shell and BP gained about 2.5pc, tracking a jump of more than $3 in Brent crude prices after news that European Union governments will consider whether to impose an oil embargo on Russia over its invasion of Ukraine.

Miners such as Glencore and Anglo American also edged higher as London aluminium prices leaped nearly 5pc after Australia banned exports of alumina and aluminium ores to Russia.

Higher commodity prices this year have driven up mining and energy stocks, which have a big weight on the FTSE 100, helping the index outperform its peers.

“This resilient performance has helped to put the UK back on the map for overseas investors looking to diversify their holdings,” said Russ Mould, investment director at AJ Bell.

09:56 AM

Are days of boozing and laddish banter over for City traders?

For decades, male City traders thought boozing and banter would win them a badge of honour.

But the finance sector is now changing, my colleague Lucy Burton argues in a comment piece today:

It is not just women who suffer from loutish behaviour which normalises sexism and turns overt abuse into a joke. Men who want to work in sectors, such as finance and insurance, should not have to feel that toxic masculinity and mindless nights’ out is their fast-track ticket to getting ahead.

There is more than one way to be a man. The hard-drinking version typically associated with lad culture isn’t the majority. Even the rugby captain who once poured vomit over his own head at university may now be ready to move on.

09:50 AM

House prices jump by nearly £6,000 in a month

House prices have hit a fresh record high, jumping by nearly £6,000 in a single month amid a rush to buy ahead of rising mortgage costs, my colleague Melissa Lawford writes for Telegraph Money.

The average British home now costs £354,564, according to property website Rightmove, marking the first time asking prices have risen above £350,000.

It came as homeowners increased their price tags by 1.7pc to an average of £5,760 in March, the largest monthly rise during spring since 2004.

Sellers are taking advantage of an extreme shortage of homes up for sale, as well as buyers rushing to purchase before rising interest rates bring an end to the era of cheap debt.

The Bank of England last week made its third consecutive increase to the Bank Rate since December, to 0.75pc.

09:46 AM

Italy’s biggest utility firm to quit Russia

Enel, Italy’s largest utility, will exit from its Russia operations in a matter of months, chief executive Francesco Starace said on Monday.

“We are on the process of selling thermal generation, this is a process we had time ago,” Starace told Bloomberg. “With regret, I think we have to fold.”

Established in 2004, Enel Russia PJSC contributes just over 1pc of the company’s overall gross operating profit.

On Friday, Starace said that Enel would reduce its exposure to Russia but wasn’t planning a full exit.

Other major energy companies, including BP, Shell and Italy’s Eni, have already announced plans to exit their investments in Russia following the invasion of Ukraine.

09:43 AM

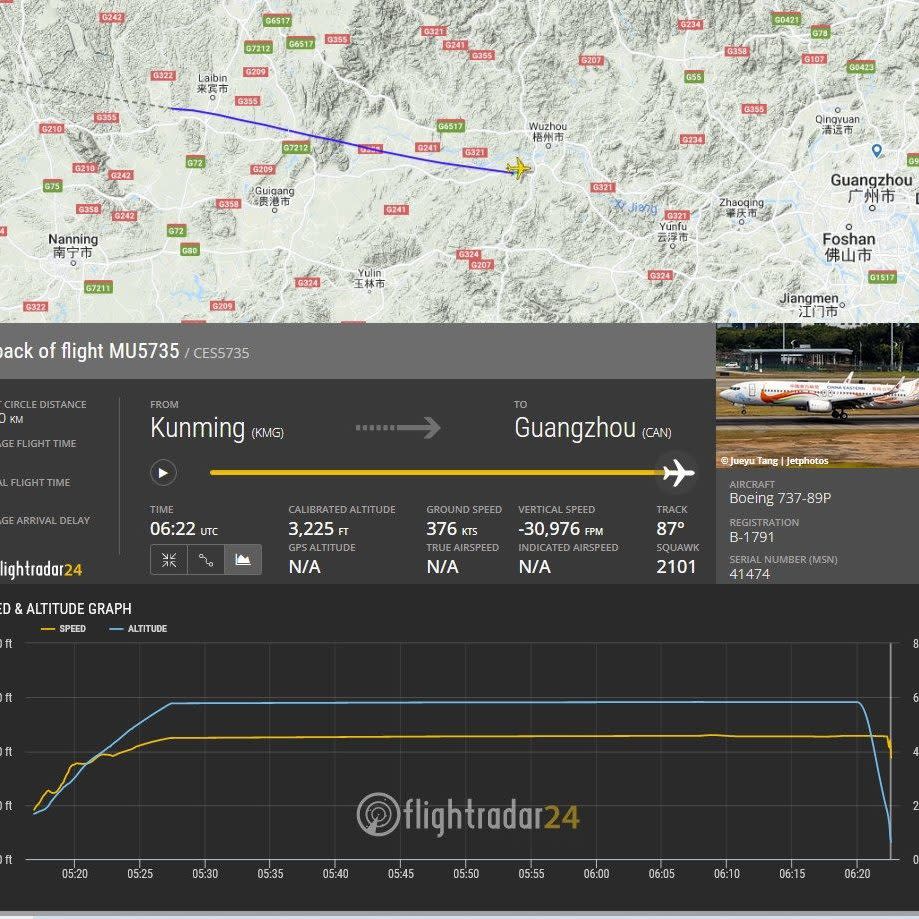

Chinese jet crashes with 132 on board

A China Eastern Airlines plane carrying 132 people has crashed in China’s southwestern province of Guangxi, Bloomberg report.

According to FlightRadar24, flight MU5735 – a Boeing 737 plane – was traveling from Kunming to Guangzhou when radar tracking showed a sudden steep descent.

Eyewitness videos posted to social media showed a mountainous crash that sparked a fire, with flames and smoke billowing from the scene.

China Eastern’s website, mobile app and some of its social media platforms were turned to black and white in a sign of mourning.

The crash was confirmed by the Civil Aviation Administration of China, which said there were 123 passengers and nine crew members on board.

China Eastern lost contact with the aircraft over Wuzhou, CAAC said. China’s aviation regulator said it has initiated its emergency response and dispatched a working group to the scene.

Representatives for China Eastern and Boeing weren’t immediately available for comment.

Shares of Boeing fell 6.8pc to $179.97 in pre-market U.S. trading.

09:29 AM

Russia facing more debt default tests

Russia’s ability to stave off default will be tested again today as it faces the first of several deadlines for debt payments worth more than $2.6bn (£1.97bn).

Moscow narrowly avoided its first external bond default – when a country cannot or will not pay back national debts – in more than a century as it began making payments of $117m on two dollar bonds last week.

But the pressure will ramp up further from Monday – the deadline for a fresh $66m debt interest payment.

It is the first of multiple due this month which are worth a total $615m, before Russia then faces a $2bn bond payment on April 4.

09:17 AM

Moscow airport furloughs 7,000 staff as Russia sanctions bite

Moscow’s biggest airport has put around 7,000 employees on furlough and slashed their pay in a sign that Russia is preparing for a prolonged period of international isolation, my colleague Simon Foy writes.

Sheremetyevo Airport, which was the country’s busiest international transport hub prior to the invasion of Ukraine, furloughed 40pc of its staff last week and cut their pay by a third, according to local media reports.

Mikhail Vasilenko, the airport’s general director, wrote to staff saying the decision was “out of the control of the employer and employees” and connected to the “critical decrease in passenger traffic” triggered by Western sanctions, the reports said.

Mr Vasilenko did not specify when the furlough period would end, heightening speculation that the airport was preparing for months of disruption.

It comes after Western countries, including the UK, US and EU, imposed a slew of harsh sanctions against the Kremlin following its invasion of Ukraine, including closing their airspace to Russian-owned and Russian-registered aircraft.

This has resulted in Russia only having permission to operate direct flights to a handful of countries, such as Belarus, Serbia and the United Arab Emirates.

Before furloughing staff, Sheremetyevo had already mothballed two terminals at the airport since the outbreak of the war.

09:06 AM

“Gung ho” Boris to hold meeting with nuclear bosses

Boris Johnson is expected to meet nuclear industry bosses today as he seeks to rally investment in new UK projects.

The Prime Minister, who according to the Financial Times is “gung ho” for nuclear power, is set to host a roundtable event to discuss how to build a new generation of plants more quickly and cheaply.

Nuclear power forms a key pillar of the Government’s strategy to reach “net zero” carbon emissions by 2050, as it provides a stable baseload of energy to complement intermittent renewable sources such as wind and solar.

However, in recent decades the proportion of energy generated by nuclear power has fallen in Britain.

Kwasi Kwarteng, the Business Secretary, has said that has to change for the country to hit green targets.

How?

Firstly, new nuclear. Needed when the the wind doesn’t blow and the sun doesn’t shine.

We are reversing 30 years of drift with the first new power station in a generation, more cash for future large projects, and our Nuclear Bill to unblock financial obstacles.

(6/9)

— Kwasi Kwarteng (@KwasiKwarteng) February 28, 2022

08:54 AM

Elsewhere, Hong Kong to ease draconian travel restrictions next month

Hong Kong has said it will relax anti-Covid-19 measures in April, lifting a ban on flights from nine countries including Britain, reducing quarantine for international arrivals and reopening schools.

The moves, announced on Monday by chief executive Carrie Lam, come after a backlash from businesses and residents who see the rest of the world shifting to “living with the virus”.

Residents in the Chinese ruled territory have become increasingly frustrated with the stringent measures, many of which have been in place for over two years.

A ban on flights from Australia, Britain, Canada, France, India, Nepal, Pakistan, Philippines and the United States will be lifted from April 1.

Meanwhile, hotel quarantine for arrivals could be cut to seven days from 14 if residents tested negative, and schools are set to resume face-to-face classes from April 19.

Hong Kong’s border has effectively been shut since 2020, with businesses and the city’s economy left reeling from widespread closures.

08:46 AM

North Sea oil and gas regulator tees up new licensing round

The UK is preparing to issue the first new North Sea drilling licences since 2020 as ministers scramble to firm up energy supplies that have been disrupted by Russia’s invasion of Ukraine.

According to the Financial Times, the Oil and Gas authority is teeing up a new licensing round, having previously put them on hold to devise a new framework that would incorporate climate targets.

Andy Samuel, the regulator’s boss, said drilling licences for existing discoveries were now “pretty much ready to go”.

Boris Johnson has backed increasing domestic production of oil and gas as a way of reducing dependence on foreign imports.

But it is likely to spark a fresh row with green campaigners, who have called for no new fossil fuel extraction to be commenced.

08:34 AM

Saudi Aramco reports $110bn profit, pledges to boost

Saudi Arabia’s state oil company Aramco pledged on Sunday to hike investments by around 50pc this year as it reported a $110bn annual profit, Reuters reports.

Under pressure from the West to boost output amid soaring prices, Aramco said it would boost capital spending from $31.9bn to $40-50bn this year.

Asked if the company would pump more oil to fill gaps in the market left by the war in Ukraine, chief executive Amin Nasser said:

We recognise energy security is paramount for billions of people around the world, which is why we continue to make progress on increasing our crude oil production capacity, executing our gas expansion programme and increasing our liquids to chemicals capacity.

The company has said it plans to raise its crude oil “maximum sustainable capacity” to 13 million barrels a day by 2027, and wants to increase gas production by more than 50pc by 2030.

It produced about 12.3 million barrels of oil per day last year.

08:27 AM

As oil price rises, Chancellor eyes cut to fuel duty

As the rising oil price puts upwards pressure on petrol forecourt prices – already at record highs – Rishi Sunak is eyeing a cut in fuel duty, our correspondents Charles Hymas and Tony Diver write today.

Expectations that the levy could be reduced by 5p a litre have been raised ahead of the forthcoming Spring Statement after the Chancellor pledged to “stand by” hard-pressed householders facing “prohibitively expensive” petrol prices.

Such a move is also said to have the backing of Boris Johnson, who “pushing” for a cut for motorists.

Mr Sunak told the BBC’s Sunday Morning programme: “We recognise the importance of people being able to fill their cars up, and that not being prohibitively expensive.”

08:20 AM

How would the West cope without Russian oil?

Global markets could be denied 2.5 million barrels a day of Russian oil starting in April as sanctions take hold and buyers shun Russian supplies, the International Energy Agency (IEA) recently warned.

Another 500,000 barrels a day may be “shut in”, or kept back despite supplies being available.

The agency said a move by its member countries to release 63m million barrels from emergency stocks would initially provide a buffer for markets but these could not address long-term supply issues.

Only Saudi Arabia and the United Arab Emirates, two members of the Opec cartel, have the spare capacity to offset the potential supply shortfall markets are facing.

But for now they are sticking to only modest production increases agreed by Opec.

Boris Johnson recently visited the region to try and persuade the Saudis to turn on the taps, but came away empty-handed.

08:12 AM

Frances pushes for “no taboos” on Russia sanctions

France is among EU countries pushing for “no taboos” when it comes to Russian sanctions, as the bloc continues to weigh up an embargo on the country’s oil.

President Emmanuel Macron has said that if the situation worsens in Ukraine – where thousands have been killed, over 5 million have been displaced and cities devastated by shelling – then no measures should be ruled out, according to Reuters.

For example, a Russian chemical weapons attack in Ukraine or heavy bombardment of the capital Kyiv, could be a trigger for an oil embargo, adding to a panopoly of already-punishing financial sanctions.

Reuters quotes a French presidency official saying:

These sanctions are meant to force President Putin into a new calculation. Among our partners and among the countries trading with Russia, there are some who are more sensitive on the issue of oil and gas. Nevertheless, the president (has) said, there is no taboo.

Moscow has warned that EU sanctions on Russian oil could prompt it to close a major gas pipeline to Europe. The EU relies on Russia for 40pc of its gas, with Germany among the most dependent of the EU’s large economies.

Germany is also the largest EU buyer of Russian crude and has spoken against imposing an embargo.

All EU sanctions decisions require consensus but France, which heads the EU’s six-month presidency, will likely prove crucial.

08:05 AM

Ukraine war sends oil rising for third day as Chancellor mulls cut to fuel duty

Good morning.

Oil prices are climbing for the third session in a row as EU countries continue to weigh an embargo on Russian supplies ahead of a meeting with US President Joe Biden.

With the Ukraine conflict showing little sign of easing, brent crude rose by more than 3pc to about $111 per barrel on Monday as traders bet that the market would continue to stay tight.

It comes as a cut in fuel duty has been signalled by Boris Johnson and Rishi Sunak, as they seek to ease the cost of living crisis facing families in the Spring Statement.

It comes as EU governments are considering an oil embargo on Russia its invasion of Ukraine, on top of a punishing collection of sanctions already imposed.

They had previously backed away from such a move but Baltic countries including Lithuania are still pushing for it, according to Reuters. Biden is due to arrive in Brussels for a Nato summit on Thursday.

5 things to start your day

1) Gove attacks ‘cartel’ of big property developers The Levelling Up Secretary opened a new front in his war with housebuilders amid a row over building safety.

2) M&S chairman warns of price rises Retailer’s chairman says clothes and food will become more expensive after the war in Ukraine pushed up energy costs.

3) Chancellor breaks with Cabinet colleagues in P&O freeports row Rishi Sunak says involvement of ferry company’s Dubai-based parent is separate to furore over sackings.

4) Go-Ahead expected to retain Govia Thameslink rail line Joint venture likely to continue running Britain’s biggest rail franchise despite being booted off Southeastern and £26m fine

5) Russia facing fresh debt default test Despite making payments last week, Moscow still has $40bn of bonds outstanding and key payments are approaching.

What happened overnight

Asian share markets started the week in a sober mood on Monday as fighting in Ukraine raged on with no sign of stopping, leaving investors clutching at hopes for an eventual peace deal.

Investors were also anxiously waiting to see if Russia would meet more interest repayments this week. It must pay $615 million in coupons this month while on April 4, a $2 billion bond is due.

Trade was sluggish with Japan on holiday, leaving S&P 500 stock futures down 0.3pc and Nasdaq futures 0.4pc. EUROSTOXX 50 futures dipped 0.1pc and FTSE futures edged up 0.1pc.

MSCI’s broadest index of Asia-Pacific shares outside Japan was flat. Japan’s Nikkei was shut, but futures traded around 200 points above the cash close.

Chinese blue chips firmed 0.1pc, with investors waiting on further details of possible stimulus from Beijing.

Coming up today

-

Corporate: Photo-Me International, Raven Property Group (full-year results); SThree (trading statement)

-

Economics: Producer price inflation (Germany)