Keep on Buying Tesla Stock, Says Analyst Ahead of ‘Master Plan Part 3’

That Tesla (TSLA) is a law unto itself is already well-established. And assessing the current state of the auto industry, Jefferies analyst Philippe Houchois thinks the EV leader is once again operating on another level.

“We have been trimming estimates across our OEM coverage, but we are raising them at Tesla on price increases more than compensating risk from volume and battery cost inflation. With cash accumulating at a faster pace than Tesla’s ability to grow physically, we look forward to Elon Musk revealing Master Plan Part 3,” Houchois noted.

That last part is a reference to Musk’s recent tweet. Based on how “transparent and prescient” previous versions were, Houchois anticipates the plan will “extend well beyond financing, storage and FSD, as these would barely dent a fast-growing cash pile.”

Houchois’ comments and boost for revenue/EPS targets between 2022 and 2024 come off the back of Jefferies’ recent auto conference, where the positive message put forward by Tesla has resulted in his confident take.

That said, there are still risks to take into account; supply chain woes, of course, and mostly to do with the global chip shortage. However, these are mitigated by the price hikes noted above and other bullish developments. Production is already ongoing at the Austin plant, the Berlin factory is set to open tomorrow (March 22), the Shanghai facility is on course to expand capacity toward 1 million units while a new plant should also be announced during the course of 2022.

Rather than focusing on affordability, Tesla has also made “maximising profitability” a priority this year, which given current constraints makes sense but also appears to Houchois to be “more tactical than strategic.”

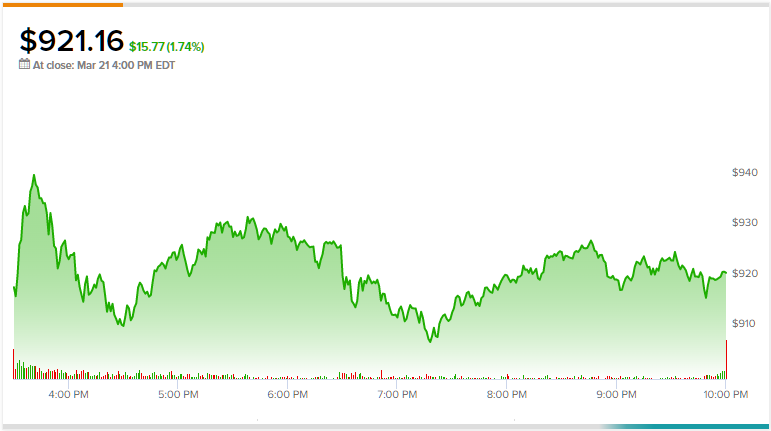

While Houchois’ rating on TSLA remains a Buy, considering the “riskier macro and geopolitical environment for valuation,” the analyst has lowered the price target from $1,400 to $1,250. Still, there’s upside of ~36% from current levels. (To watch Houchois’s track record, click here)

Overall, most analysts are in Tesla’s corner, though certainly not all are on board; the stock’s Moderate Buy consensus rating is based on 15 Buys, 6 Holds and 6 Sells. Going by the $46.22 average price target, the forecast calls for share appreciation of ~15% over the 12-month timeframe. (See Tesla stock analysis on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.