How details on shrinking Fed’s almost $9 trillion balance sheet might shake up markets more than a rate hike on Wednesday

There’s the potential for a bigger market-moving development from the Federal Reserve than its widely expected quarter percentage point interest rate hike on Wednesday: fresh information about policy makers’ plans for reducing their almost $9 trillion balance sheet.

B. of A. strategists Mark Cabana and Katie Craig, along with portfolio manager Thomas Graff of Brown Advisory, are among those who see a likelihood that policy makers could produce new details on efforts to reduce the size of their portfolio. And that would come as a surprise to many in financial markets, who aren’t expecting the central bank to update its so-called “quantitative tightening” plans just yet.

The highest U.S. inflation rate in 40 years is putting pressure on the Fed to act, while the Russia-Ukraine conflict is adding downside risks to the economy and the outlook. A sooner-than-expected effort to jump start the process of shrinking the Fed’s portfolio would be seen as one way to deliver tighter financial conditions and a response to high inflation, while avoiding larger-than-normal rate hikes of more than a quarter point at a time.

Read: How the Federal Reserve could cut its near $9 trillion balance sheet as it fights inflation

“Any announcement on the balance sheet would certainly have a signaling effect,” Graff said via phone Tuesday. “If they were to give us a pretty definitive guide on the balance sheet Wednesday, that would tell us they are trying to be as aggressive as they can be. This would be the way they could send a message beyond the action of rate hikes.”

Such a message would be interpreted by financial markets as a “very hawkish sign” that leads to a ” `sell everything’ market,’ ” he said. “Short-term yields would have to rise a good bit and the whole curve would sell off pretty strongly,” and possibly spreading into other asset classes, like stocks.

To be sure, central bank policy makers aren’t expected to actually start shrinking their portfolio this week, but signaling how they might begin to go about the process has the potential to catch traders off guard in much the same way that minutes of the December meeting did when they were released on Jan. 5. That’s when policy makers revealed that they had a lengthy discussion about reducing their balance sheet. The minutes helped push the 10-year Treasury yield TMUBMUSD10Y,

In a note released Monday, BofA’s Cabana and Craig said that while Fed officials are unlikely to explicitly state when they’ll begin quantitative tightening, “we may get further clarity as to how much the current geopolitical tensions in Ukraine are weighing on that decision.”

“Our base case is that the Fed will both announce and implement QT in May,” though the risks are skewed to June or July, they wrote. They also said that policy makers are unlikely to actively sell assets and will instead “rely mostly on passive redemptions to manage their balance sheet lower.”

Traders of fed funds futures are currently pricing in a 98% chance of a 25 basis point hike on Wednesday. They also see a better than 50 percent chance the Fed delivers the equivalent of at least seven 25 basis point rate hikes this year, which would lift the Fed’s policy rate target to at least 1.75% to 2%, or higher, from a current level of 0% to 0.25%, based on the CME FedWatch Tool. Yet that’s still far behind where some say the target should already be for the Fed to demonstrate seriousness about fighting inflation.

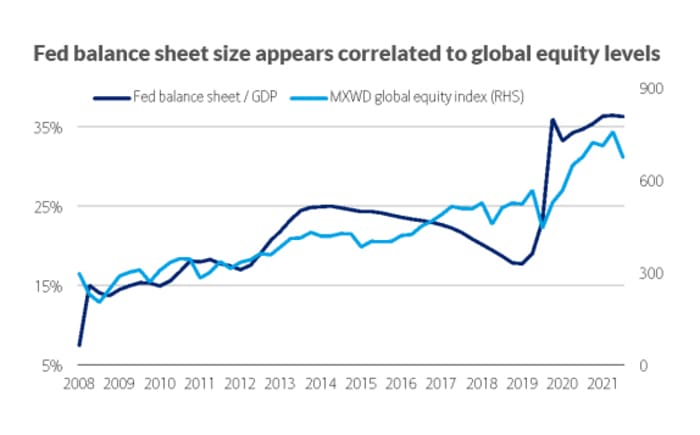

Neither the Fed nor many in the market are confident about what sort of impact a shrinking balance sheet might have on rates. However, an expanding balance sheet appears correlated to higher global equity levels, according to B. of A. rates strategist Ralph Axel.

JPMorgan Chase & Co.’s JPM,

“If they make progress in those discussions, we would expect them to convey that either in an addendum to the statement or in the opening remarks of Powell’s press conference,” Feroli wrote in a note last week. “Chair Powell’s post-meeting press conference would be the natural venue to provide any more details on plans for reducing the size of the balance sheet, such as the size of the monthly runoff caps, the duration of the phase-in period for those caps, and the conditions that will warrant the eventual start of the process.”

As of Tuesday afternoon, selling of Treasurys resumed, sending yields back up again ahead of Wednesday’s FOMC decision. The 10-year rate TMUBMUSD10Y,