The Canadian partners came back to the negotiating table over the weekend, presenting a non-binding offer to buy the company for A$8.25 a share, up from the initial offer of A$7.50. The new offer valued the company at A$5.43 billion.

AGL said the consortium’s latest proposal ignored “the momentum” the firm has recently seen in the business, including its “solid” half year result, progress on a demerger interest in its energy transition investment partnership and improved wholesale prices.

The Brookfield-Grok consortium looking to take private & transform AGL is putting our pens down – with great sadness.

This weekend, the board rejected our raised offer of $8.25. 46% more than the price of $5.55 about 90 days ago ? (1/3) pic.twitter.com/c5KYwGozDo

— Mike Cannon-Brookes ?????? (@mcannonbrookes) March 6, 2022

The Australian utility proposed in March to split into separate publicly traded companies: AGL Australia and Accel Energy, aiming to cut greenhouse gas emissions by as much as 60% by 2034. The demerger is expected to be completed by June this year.

Brookfield and Cannon-Brookes, Australia’s second-richest person and a co-founder of software business Atlassian Corp, planned to shift AGL to clean energy.

The company has launched since its own campaign to reach about A$1 billion ($725 million) from potential partners to transition its coal-fired power plants to low-carbon sites.

AGL owns three large coal plants, some gas and renewable assets, and one of Australia’s biggest energy retail businesses with more than four million customers, according to its 2021 annual report.

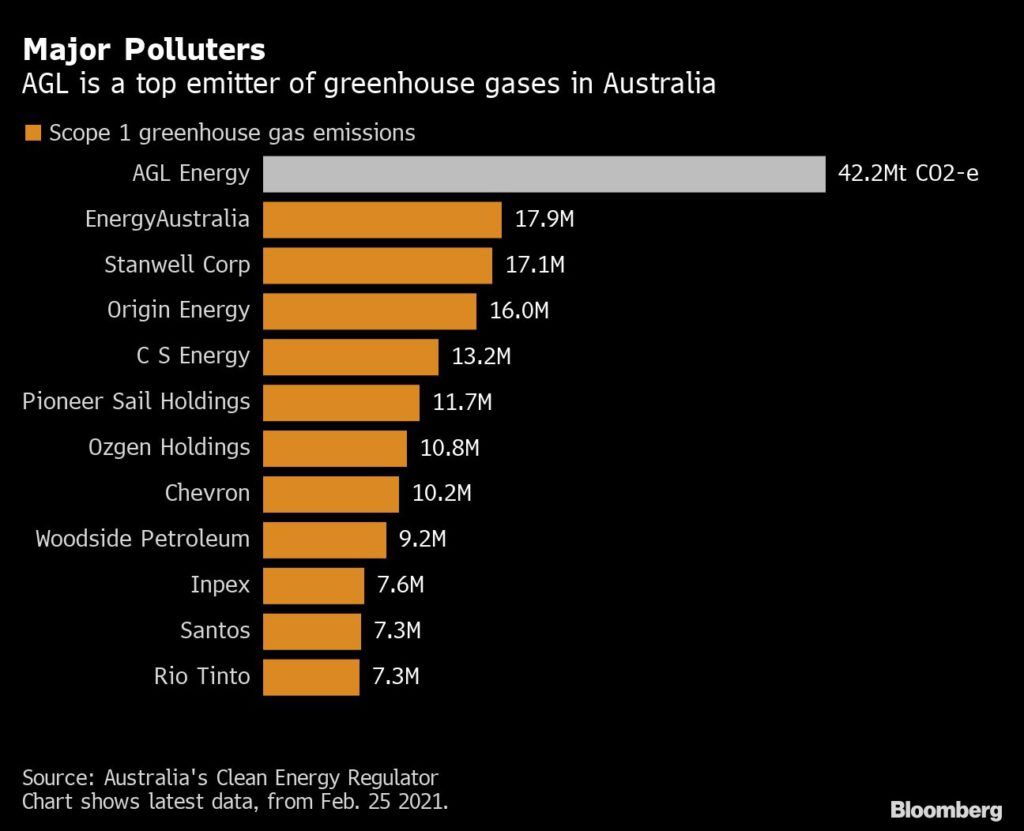

It is also Australia’s biggest carbon emitter, producing about 8% of the country’s total emissions, according to government figures.

Public debate on climate change in Australia and the role of coal, which still provides most of the country’s electricity, reached a new level following wildfires in late 2019 and early 2020.

Though Prime Minister Scott Morrison set a net-zero emissions target last year, his government has long favoured fossil fuels, and even touted a “gas-fired recovery” from the coronavirus pandemic.