Bitcoin Worth $1.2B Leaves Coinbase in a Sign of Persistent Institutional Adoption

While bitcoin’s (BTC) four-month bearish price action appears to have scared away retail leverage traders, institutions focused on longer-term horizons seem unperturbed.

That’s evident from the recent large outflow of coins from the U.S.-based crypto exchange Coinbase (COIN), according to blockchain analytics firm Glassnode.

-

A total of 31,130 bitcoin left Coinbase last week, the highest single-week outflow since 2017, data tracked by Glassnode shows.

-

“Large outflows like this one are actually part of a consistent trend in the Coinbase balance, which has been stair-stepping downwards over the last two years,” Glassnode said in a weekly newsletter published Monday. “As the largest exchange by BTC balance, and a preferred venue for U.S. based institutions, this further supports the adoption of bitcoin as a macro asset by larger institutions.”

-

The past week’s outflow has pushed the number of coins held on the Nasdaq-listed exchange to a four-year low of 649,500 BTC. The balance held across all centralized exchanges has dropped to 2,519,403 BTC, the lowest number since November 2018.

-

The declining exchange balance means fewer coins are available for liquidations on the exchange. In other words, the sell-side liquidity is drying up, suggesting scope for a sharp move on the higher side, especially as the coins withdrawn from Coinbase were moved to a largely inactive wallet.

-

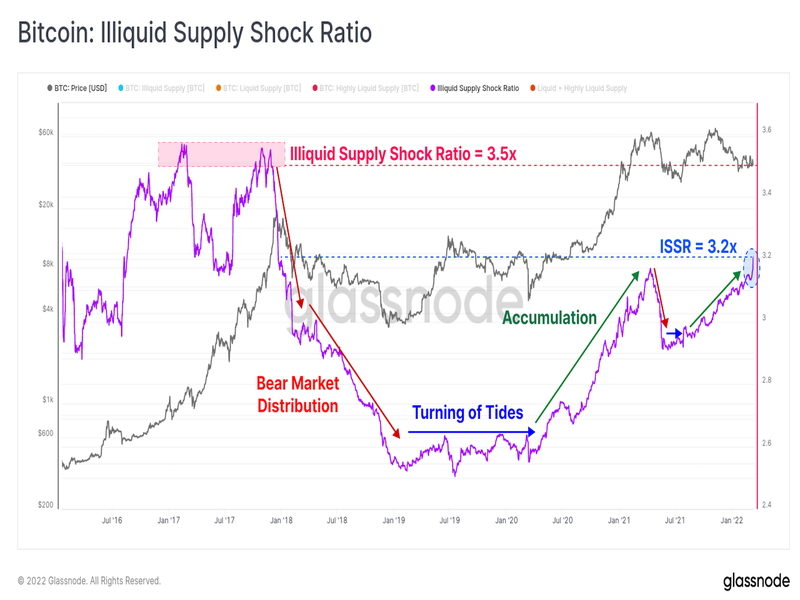

“If we look at the Illiquid Supply Shock Ratio (ISSR), we can see a significant uptick this week, suggesting that these withdrawn coins have been moved into a wallet with little-to-no history of spending,” Glassnode said.

-

Bitcoin was last seen trading near $38,600, representing a 2% drop on the day.