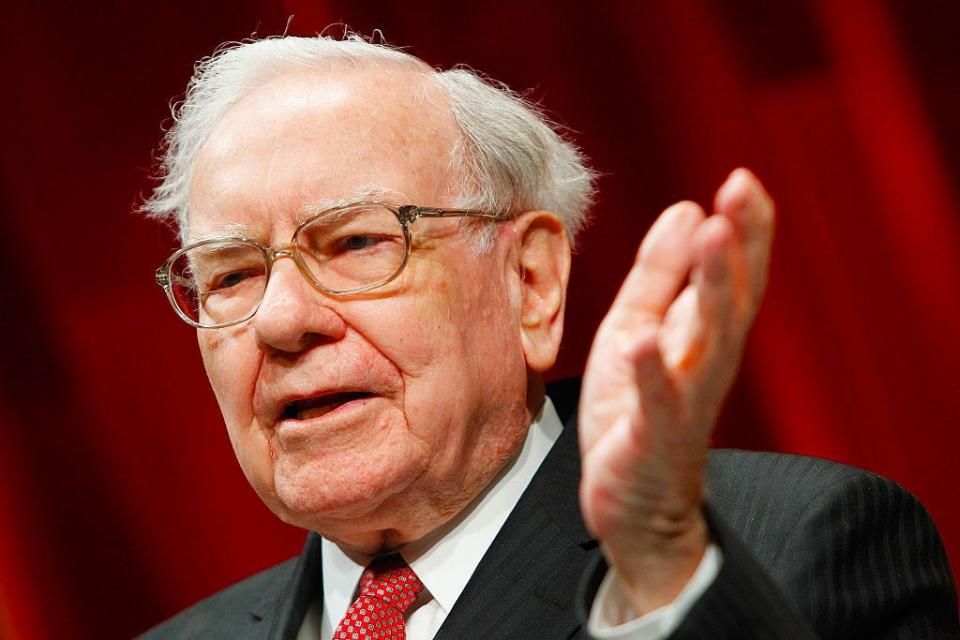

Warren Buffett’s ‘fourth law of motion’

A version of this post was originally published on TKer.co.

Warren Buffett published his annual letter to Berkshire Hathaway shareholders on Saturday. You can read it here.

Arguably the greatest investor of all time, Buffett is known for timeless insights about investing using very approachable language.

Lately, I’ve been thinking about something he said in his 2005 letter:

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

Newton was a pretty smart guy. Much of what we’re taught in high school physics and calculus can be tracked back to him. And apparently, he had a pretty good track record as a diversified, buy-and-hold an investor. That was before he got crushed speculating on shorter term swings in the stock market.

When markets make sharp moves up or down for whatever reason, it can be very tempting to stray from your long-term investment plan and ramp up your short-term trading activity in an attempt to maximize gains and minimize losses.

While there may be some opportunities you are able to correctly exploit, there’s also the very high risk that you mistime the market and do significant irreversible damage to your long-term returns. (Read more here and here.)

With every trade comes not one, but two decisions. If you decide to buy, then you also have to know under what conditions you would decide to sell.

Similarly, if you’re thinking about trimming your exposure to stocks because you think the market will go lower in the short-term, then you also have to consider under what conditions you would buy to get back to your target long-term asset allocation. As I wrote in my Thursday newsletter this is “particularly important, because you have to consider scenarios under which prices only rise from“ the moment you sell.

These are all good questions to ask upfront as you formulate your investment plan. Perhaps the most important element of prudent investing is having a good plan.

By the way, Newton’s folly was not that he got involved in the South Sea Bubble. Rather, it’s the fact that he was trading in and out of it. From WSJ columnist Jason Zweig:

Prof. Odlyzko estimates that if Newton had bought and held his South Sea shares continuously from early 1712 through 1723, when the stock stabilized after the bursting of the bubble, he would have earned a cumulative total return of approximately 116%. That’s about 6.5% annually, not counting dividends — a generous return at a time when long-term government bonds carried interest rates of 4% to 5%. However, Newton didn’t buy and hold continuously.

If only Newton had given it time.

For more Warren Buffett posts from yours truly:

Some recent features from TKer:

Rearview ?

? ? Stock market tumbles and rallies: From Monday to mid-day Thursday, the S&P 500 fell 5.4% to a low of 4,114.65. From there, the S&P surged 6.6% to close Friday at 4,384.65. For the week, the S&P gained a modest 0.8%. The volatility has been attributed to Russia’s invasion of Ukraine. For more on this, read this.

? By the way, the stock market has gotten cheaper! The forward P/E on the S&P 500 dipped below its five-year average for the first time since April 2020. For more on this, read this.

? Consumer spending is up: The pace of personal consumption expenditures jumped by 2.1% in January from the previous month, according to the BEA. This was much stronger than the 1.6% expected by economists.

? This spending data comes despite survey data published this week from both the University of Michigan and the Conference Board, which showed consumer sentiment fell amid concerns about inflation. Indeed, on Friday we learned that the Federal Reserve’s favorite measure of inflation — the core PCE price index — jumped by 5.2% in January from a year ago, the largest increase since 1983. For more on this counterintuitive behavior, read this.

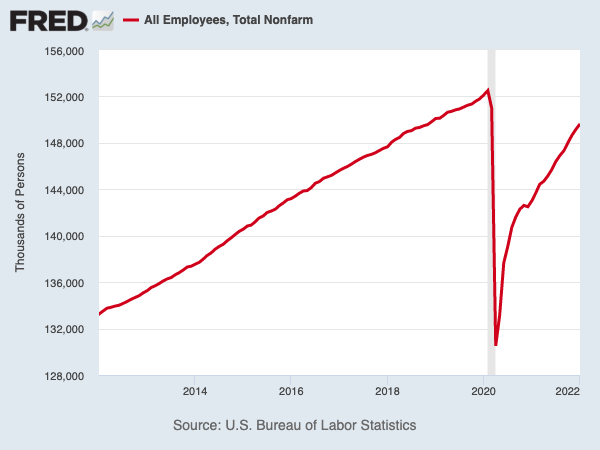

? Employment improvement: Continued claims for unemployment insurance benefits fell to 1,476,000 during the week ending February 12, a decrease of 112,000 from the prior week. This is the lowest level since March 1970.

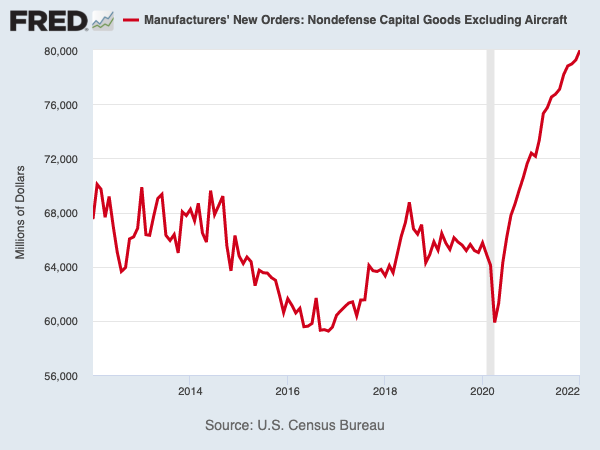

? Business investment is strong: Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — climbed by 0.9% in January to a record $79.98 billion. This is a bullish leading indicator. For more on this, read this.

? Home prices are up: U.S. home prices in December were up 18.8% from a year ago, according to the S&P CoreLogic Case-Shiller Index. From S&P DJI’s Craig Lazzara: “We have previously suggested that the strength in the U.S. housing market is being driven in part by a change in locational preferences as households react to the COVID pandemic. More data will be required to understand whether this demand surge simply represents an acceleration of purchases that would have occurred over the next several years rather than a more permanent secular change. In the short term, meanwhile, we should soon begin to see the impact of increasing mortgage rates on home prices.“

Up the road ?

Friday comes with the February U.S. jobs report. Economists estimate that U.S. employers added 400,000 jobs during the month as the unemployment rate declined to 3.9%.

A version of this post was originally published on TKer.co.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube