This Is One of the Best Chip Stocks to Own in February

The new year is well underway, and in order to make the best of 2022 it’s important to consider the seasonality trends for February. Semiconductor stocks have attracted considerable attention thanks to the ongoing global chip shortage, as well as yesterday’s impressive earnings report from sector member Advanced Micro Devices (AMD). Today, we will focus on another name that could turn in big gains by the end of the month: Nvidia Corporation (NASDAQ:NVDA). The stock stands out as one of the 25 best performers in February going back 10 years, according to a list compiled by Schaeffer’s Senior Quantitative Analyst Rocky White.

Per White’s data, Nvidia stock has seen eight positive one-month returns in this time period, averaging an 6.3% pop, this is good for second biggest one-month return in the semiconductor space for February, with Applied Materials (AMAT) averaging a 6.9% monthly win. A similar move from its current perch of $243.30 would put the security back over the $257 mark.

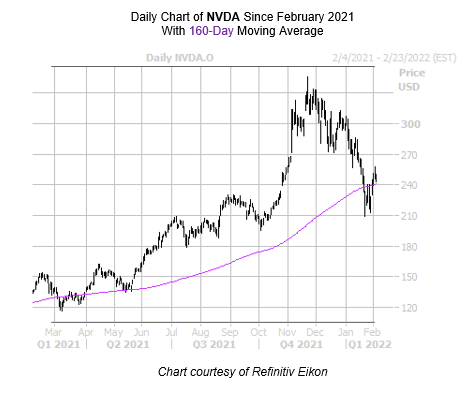

Nvidia stock started off the year by shedding 16.8% in January, which marks its worst monthly performance since May 2019. This certainly wasn’t helped by news that the company’s $40 billion takeover of British tech provider Arm was abandoned after the U.S. Federal Trade Commission (FTC) sued in order to to block the transition. Despite this, NVDA maintains a pretty solid 80.9% year-over-year lead, with reclaimed support from the 160-day moving average emerging this week.

NVDA could also benefit from a shift in the options pits. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), NVDA sports a 50-day put/call volume ratio that sits higher than 84% of readings from the past year. This means that while calls are still outnumbering puts on an overall basis, the latter are being picked up at a much quicker-than-usual clip.