These 2 numbers sum up why the housing market won’t get back to normal for a long time

Last week I got a letter in the mail.

Like you, I’m surprised this still exists as a practice but desperate times call for desperate measures:

Now I would like to think our house is just that beautiful, but I don’t think we’re the only ones who received a letter from this Realtor. I’m sure there were many houses in multiple neighborhoods that got the same thing.

I showed my wife this letter and joked we should ask for a 20% premium over the current value. It’s a big round number but it’s essentially useless.

Why?

We have to live somewhere!

Even if we were able to secure a much higher selling price, it wouldn’t really help us all that much.

We already have a 3% mortgage rate locked in. We have a decent chunk of equity in the home. And as our desperate Realtor alluded in their letter, it would be nearly impossible to find another house right now to buy.

The combination of rising home prices, low mortgage rates that are locked in by current homeowners and low supply makes it unappealing to sell your house and look for another one right now.

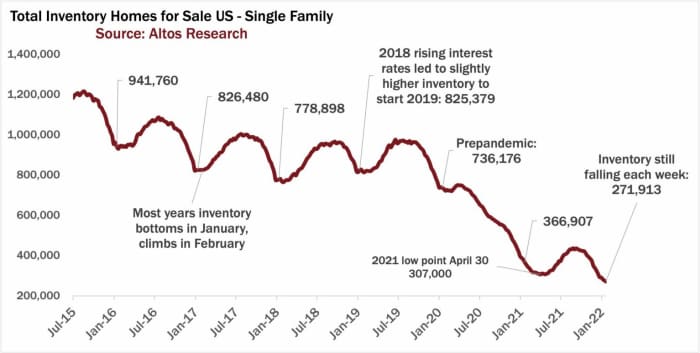

Mike Simonsen from Altos Research has a chart that shows just how dire the housing supply situation is right now:

That’s 271,913 homes for sale in the entire country right now!

We’re in a housing market where we have record high demand and record low supply. If you want to know why prices are 20% higher than they were a year ago this is the simplest explanation.

But there’s more going on here.

Simonsen was recently on the Odd Lots podcast with Tracy Alloway and Joe Weisenthal where he explained how many homeowners are doubling up on their real-estate investments:

It’s like a doubling up. The homeowner goes to buy the next home, move up or move down. And because mortgages are so cheap, it’s a really good time to keep the first one as a rental unit. And so each year I go to buy a next one and I keep my first one. And so that’s one big phenomenon. And all of a sudden I’m a real-estate investor. And at the same time, institutional money’s been cheap. There’s a lot of news about the big private-equity funds buying up homes, but it’s actually the individuals who are driving most of it. So in the last decade we’ve taken 8 million homes out of the resale cycle and moved them into the investment rental part of the pool. And that’s, you know, 9% of all the single-family homes.

I know everyone wants to complain about BlackRock buying all of the homes in this country, but 90% of residential rental units are owned by individuals in the United States.

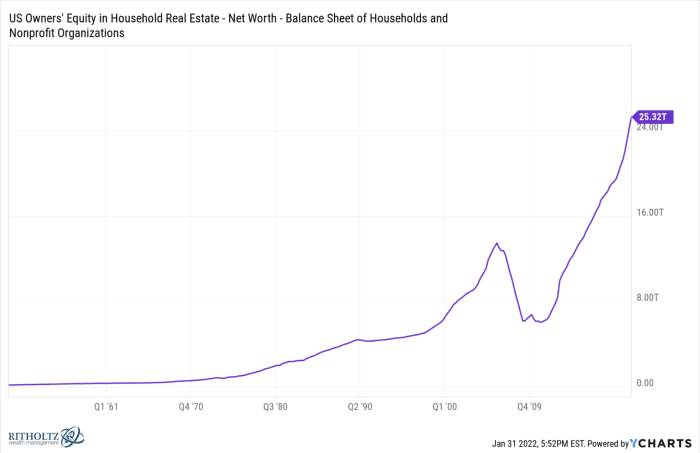

And this number is growing because of an abundance of home equity, the strength of consumer balance sheets and the prevailing low mortgage rates.

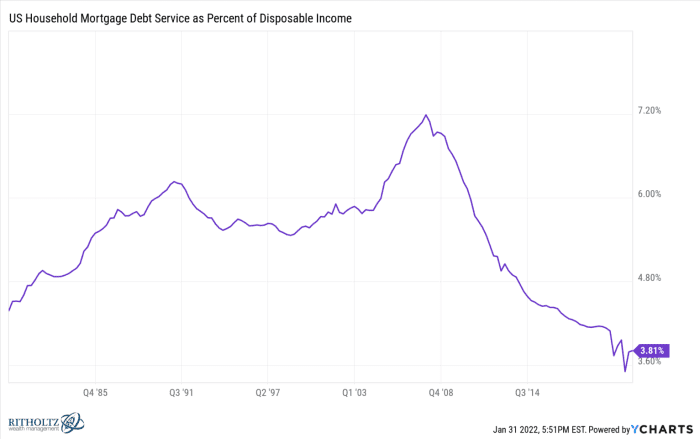

Low mortgage rates have made monthly payments as affordable as they’ve ever been:

Home equity has skyrocketed from rising housing prices:

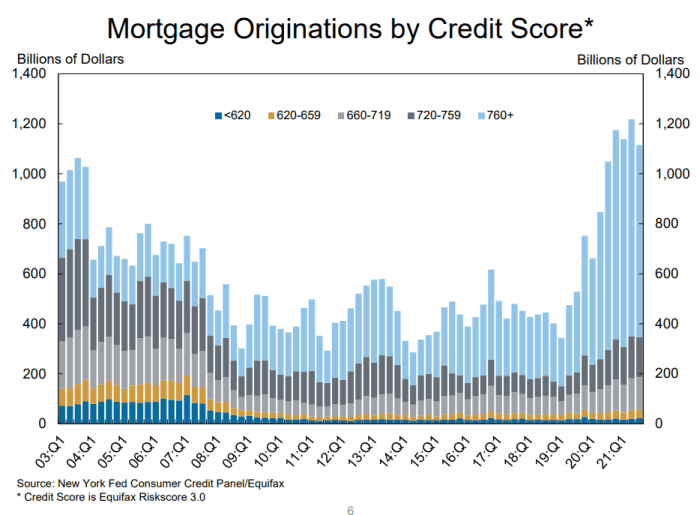

Plus look at the credit-worthiness of homebuyers these days:

The people buying homes today have excellent credit scores. This wasn’t the case in the subprime boom of the early-to-mid aughts when the majority of buyers came from people with low credit scores.

Just imagine you’ve owned your home for five years or more. By now you’ve certainly refinanced at least two to three times and likely have a borrowing rate of 3% or less. You’re also sitting on some nice equity through a combination of principal payments and rising prices.

It sure doesn’t seem like housing prices are going to stop rising any time soon and rents are also on the rise, so it makes sense people are choosing to hold onto their original property even after buying something new. They can simply charge enough rent to cover the mortgage, insurance and taxes and still come out ahead by slowly paying down a cheap mortgage and seeing their house go up in value.

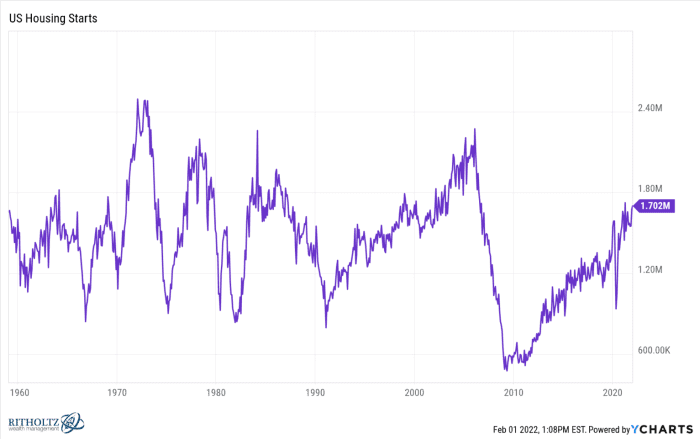

If I had to guess it’s going to be years until we see anything approaching a “normal” housing market. We simply didn’t build enough homes following the last housing crash to meet the demand coming from millennials reaching their household formation years.

Things are finally picking up, but we have years and years of underbuilding to make up for. And it’s not like the supply-chain problems, government regulations and COVID are making it any easier to build homes any faster.

In the meantime, rising rates could slow things a bit if mortgage rates get high enough. Rising housing prices and higher borrowing rates would at the very least make it not as attractive for people to hold onto their old homes and rent them out.

However, rising rates would also likely keep a lid on housing supply because so many people have locked in low rates. Why sell to buy a house for a higher price with higher borrowing costs?

Obviously, people will still move for new jobs or family or a change of scenery or any of the other reasons people decide to sell.

But it’s probably going to take a long time until we see some sort of equilibrium between supply and demand in the housing market.

Also from Ben Carlson: Should I sell my stocks so I can pay cash for a house?

Ben Carlson is the author of the investing blog “A Wealth of Common Sense,” where this was first published. It is reprinted with permission. Follow him on Twitter @awealthofcs.