Alumina from the plant is transported to the Bratsk, Krasnoyarsk and Sayanogorsk smelters in Russia, which together produce 2.5 million tonnes a year.

“A halt in alumina shipments doesn’t mean an immediate cut in smelter output although the supply chain in Russia is tight, with weeks of alumina stocks on site rather than months,” Shivkar, said.

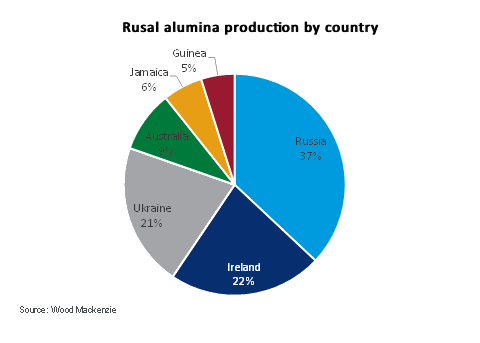

The expert noted that Rusal may divert some cargoes from its 2 million tonnes a year Aughinish refinery in Ireland to feed its Russian smelters.

With Russia among the top five global producers of aluminum, steel and nickel, reduced metal shipments threaten to further tighten a market that’s already short on supply.

Turkey was the single largest buyer of Russian aluminum in 2020, ahead of China, Japan and Germany, according to UN Comtrade data. Italy and Greece are also major importers.

“As a result of sanctions, should counterparties be unable to transact with UC Rusal as was the case in 2018, then there is a risk that all of UC Rusal’s overseas alumina assets could be impacted,” Shivkar said.

Rusal accounts for about 6% of global aluminium supplies estimated by analysts at around 70 million tonnes this year.

US sanctions on the company imposed in April 2018 – and lifted in early 2019 – created major disruptions for firms in the transport, construction, and packaging industries. The resulting scramble for aluminium saw prices jump 30% in just a few days.

Aluminum prices rose 2.7% to $3,448 a ton on the London Metal Exchange, leading other metals higher. Prices hit an all-time high of $3,525 earlier Monday, and analysts say they expect further gains after the unprecedented package of western sanctions against Russia announced over the weekend.

(With files from Reuters, Bloomberg)