Iron ore price rise to $150 after China eases steel’s green targets

“This is a big adjustment to the timetable, which gives more room for the steel sector to reach peak emissions in an orderly way,” said Xu Xiangchun, an analyst with researcher Mysteel. A rush to meet carbon goals could lead to “unbearable economic costs”, he said.

President Xi Jinping said last month that climate targets shouldn’t compromise supplies of commodities that “ensure the normal life of the masses.”

Related Article: China plans to increase iron ore output, boost use of steel scrap

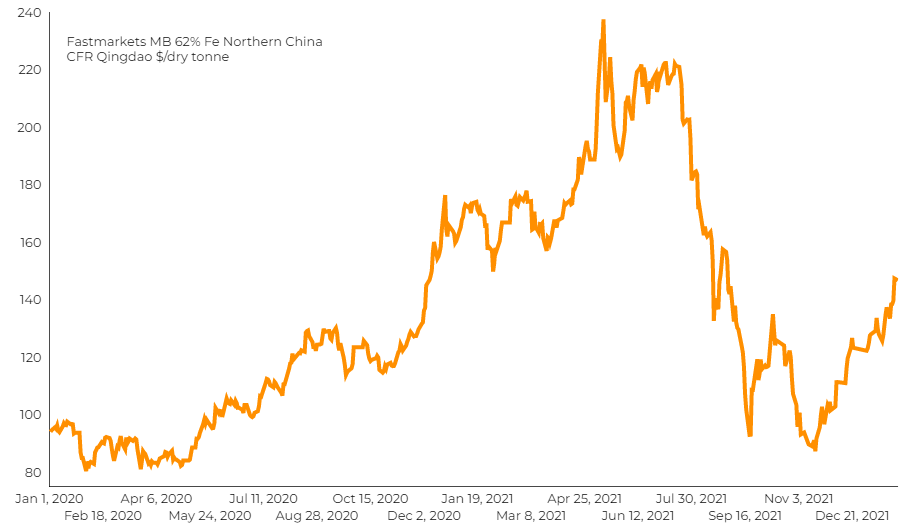

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $149.64 a tonne during morning trading, the highest since August 31. The metal has rebounded more than 70% from November’s plunge on expectations of steadier growth in 2022.

Iron ore futures in Singapore rose as much as 3.8% to $153 a tonne, the highest level since Aug. 31, and traded at $148.20 by 4:20 p.m. local time.

The policy shift may put China’s overall target of reaching peak emissions by 2030 at risk, according to Li Shuo, analyst at Greenpeace East Asia.

“Traditional sectors such as steel will need to peak much earlier to make space for sectors such as transportation that are still developing,”

(With files from Bloomberg)