Iron ore price plummets 9% as China warns traders to avoid fake pricing

On China’s Dalian Commodity Exchange, prices dropped as much as 9.7% — very close to their daily limit.

Several iron ore companies were reportedly called to a meeting with the economy’s top planning body in Beijing, while the official China Daily newspaper railed against what it called “guerrilla war” by speculators in China and outside.

“The government’s rhetoric on cracking down on iron ore prices is expected to drive trading for the near term as the market awaits more specific measures,” Wei Ying, an analyst with China Industrial Futures, said by phone.

The fresh regulatory attention highlights a difficult balancing act for Beijing, which wants to steady the economy – boosting steel consumption – without reprising last year’s damaging bout of commodity inflation.

“Beijing will focus more on growth and increased infrastructure spending in 2022,” according to Mike Henry, CEO of BHP.

Headwinds for iron ore including steel-output curbs will relax this year, according to Henry, who spoke after the company posted record half-year earnings. Iron ore prices will remain extremely volatile long into the future, he said.

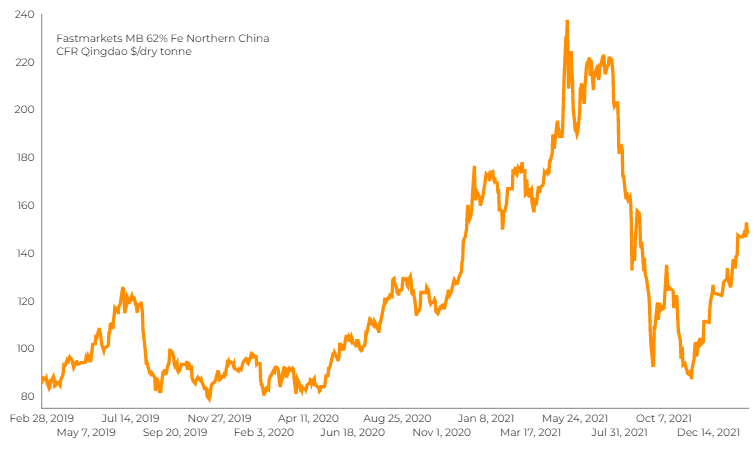

Iron ore had risen more than 60% from mid-November to smash through $150 a ton last week, triggering initial actions by regulators including port checks, higher futures trading fees and a warning against disinformation.

China’s state planner will hold what it called a “reminding and warning” symposium with domestic and foreign iron ore traders on Feb.17 in an effort to ensure market stability, according to two sources and a notice reviewed by Reuters.

“History has taught us that these sharp plunges after Chinese rhetoric on investigating and supervising iron ore prices are short and temporary,” said Atilla Widnell, managing director at Navigate Commodities.

A fall in supplies from Australia and Brazil – together with rising steel production – have created a very finely balanced market, he said.

(With files from Reuters and Bloomberg)