Inflation has knocked back the market. Here are the key S&P 500 and tech stock levels one strategist fears.

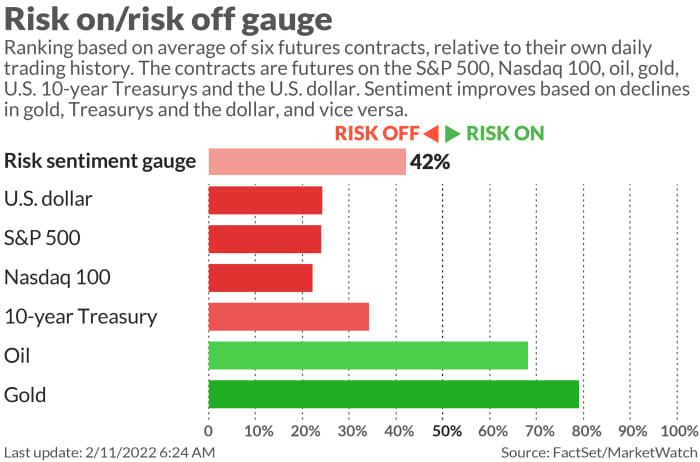

Investors are still trying to come to grips with that double whammy of nosebleed consumer prices and 100-basis-point increase talk from St. Louis Federal Reserve President James Bullard.

Fiery speculation over how many hikes are coming and even the possibility of an emergency interest-rate increase have been making the rounds as well.

Read: Oil is the hottest sector, and Wall Street analysts see upside of up to 48% for favored stocks

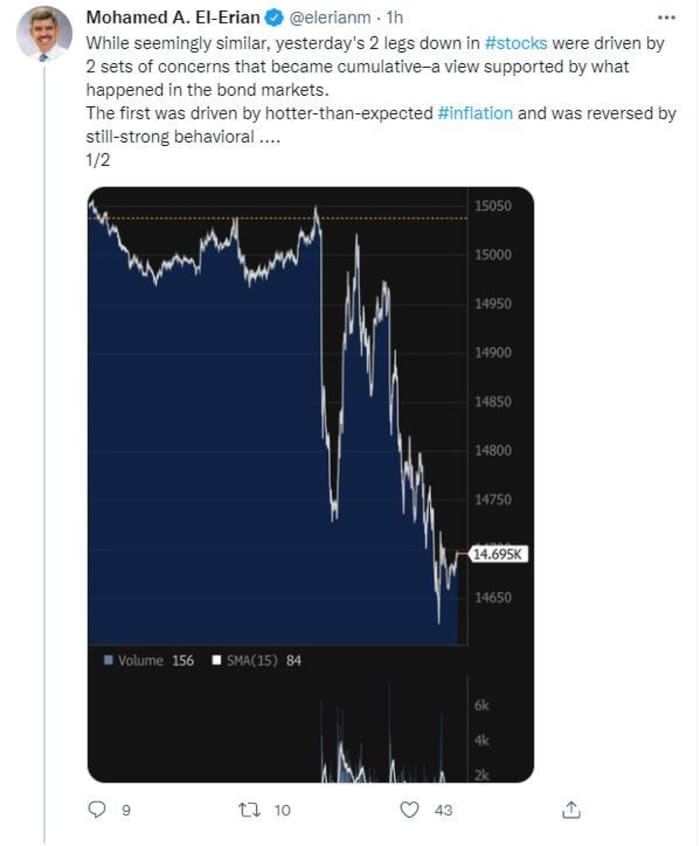

Summing up Thursday’s “2 legs down” equity action, Mohamed A. El-Erian, chief economic adviser for Allianz, said inflation was, of course, the first arrow, but then stocks rebounded on “still strong behavioral conditions and confidence in earnings.”

“The second was driven by worries about a higher probability of a Fed policy mistake — that of first calling inflation wrong for so long, then not moving on policies, and now risking a ‘slamming of the policy brakes,’” he tweeted.

Our call of the day is from Mark Newton, Fundstrat’s head of technical strategy, who says the equity pullback Thursday doesn’t cancel the rally, but was a clear warning sign.

“Near-term, this dip should be bought until/unless SPX 4451 is broken, which would cause some downward volatility into late February, before a March rally. At present, insufficient damage has been done to warrant concern technically, but the risk levels are easily identifiable for this trend,” Newton told clients in a note, as he provided this chart:

As for technology stocks, they still haven’t suffered enough to “expect a meaningful period of lagging,” he said, but advised keeping watch on the $157.44 level for the Technology Select Sector SPDR ETF XLK,

Newton offered up one sector that he thinks “deserves a second look” — cannabis — following a rally back to multiweek highs after Sen. Majority Leader Chuck Schumer proposed a bill to legalize marijuana at a Federal level and make that a “priority.”

The analyst suggested ETFMG Alternative Harvest ETF MJ,

“Specifically, the act of having climbed over early February peaks is bullish technically, and MJ has broken minor three-month downtrends that have been in place since November 2021. Furthermore, weekly MACD (as a gauge of intermediate-term momentum) is crossing back to positive this week, exceeding the signal line,” said Newton.

While the sector will need further strength to get over the long-term downturn in place since its February 2021 peak, “it looks appealing to buy and own MJ technically given this progress as a 2022 rebound candidate, expecting some mean reversion higher after such a lengthy decline,” Newton said.

He’s looking at an initial target for the ETFMG Alternative Harvest ETF of $15.78, a November 2021 peak, adding that a drop back under $9 would postpone that rally. Other stocks of interest include Canopy Growth CGC,

Read: Cannabis sales set to rise ahead of Super Bowl Sunday

The buzz

Twitter TWTR,

Zillow Z,

Also up is Expedia EXPE,

The University of Michigan February consumer sentiment index along with expectations for five-year inflation are due at 10 a.m. Eastern.

Sunday’s Super Bowl will be the “biggest sports betting event in the country’s history,” an executive from betting site FanDuel told MarketWatch. Indeed, $1 billion is expected to be wagered among fans this year. If you’re in it for the ads, there will be crypto, and check out Dr. Evil and the gang reunited to plug General Motors’ GM,

Plus: 5 fun Super Bowl prop bets, including ‘will there be an octopus?’ and ‘Gatorade shower color’

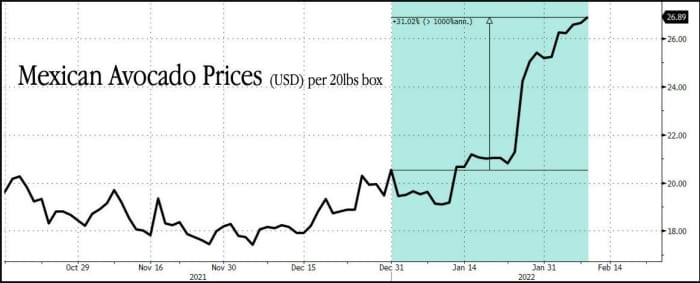

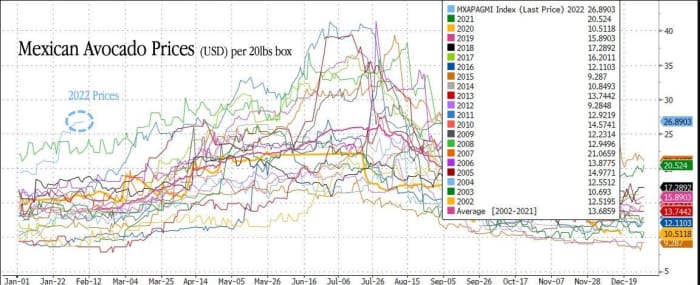

The chart

Check out our holy guacamole chart from ZeroHedge that shows avocado prices at their highest ever ahead of the Super Bowl amid soaring food costs. They point to Bloomberg data that reveal a 20-pound box of avocados will set you back more than $26, a record for this time of year stretching back to 1998:

The markets

Stocks DJIA,

Gold GC00,

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| FB, |

Meta Platforms |

| NIO, |

NIO |

| AAPL, |

Apple |

| NVDA, |

Nvidia |

| AFRM, |

Affirm Holdings |

| AMZN, |

Amazon.com |

| SET, |

SET Group |

Random reads

Man battles to keep his emotional support pet — Ellie, a potbellied pig.

Australia declares koalas are an endangered species.

The original Soup Nazi weighs in on Georgia Rep. Marjorie Taylor Greene’s gazpacho confusion.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.