Home building gains slip amid calls to boost Canada’s housing

Housing starts slow 3% in January from month before

Article content

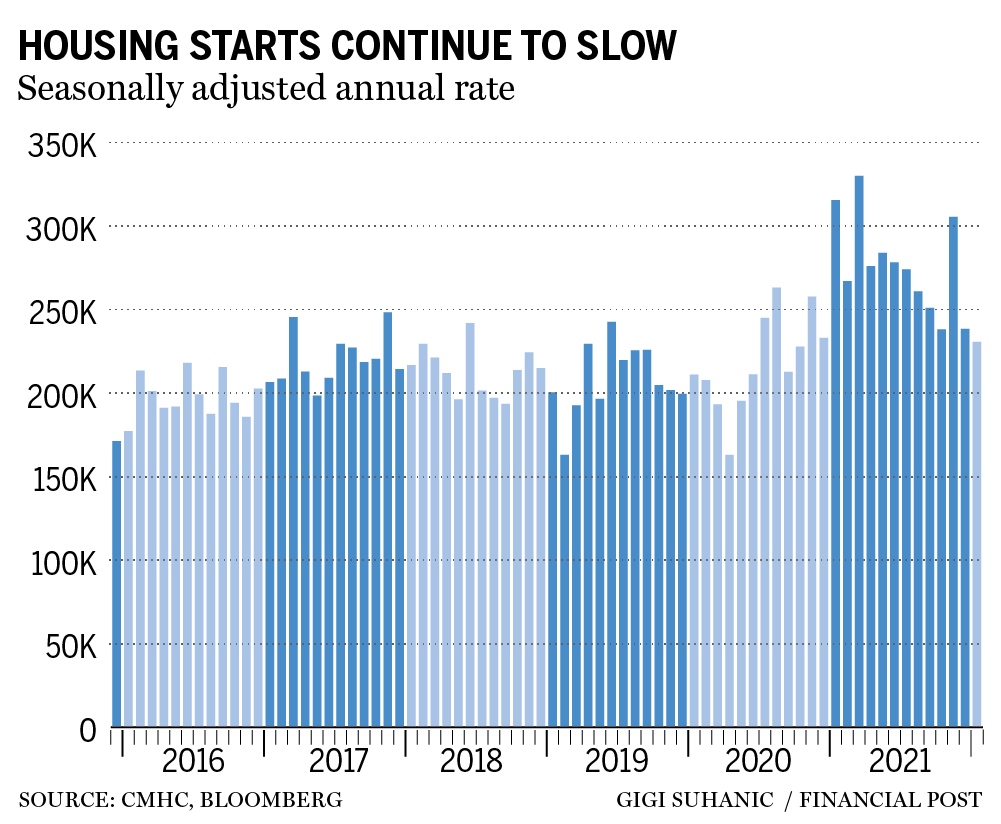

The speed at which new homes are built in Canada slowed even further in January, despite rising calls to boost supply to address a national housing shortage.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Housing starts came in at 254,133 units in January, an approximate three per cent decline from the 261,352 units during December, according to data from the Canada Mortgage and Housing Corporation.

“On a trend and monthly (seasonally adjusted annual rate) basis, the level of housing starts activity in Canada remains historically high,” CMHC chief economist Bob Dugan said in a release. “However, the six-month trend in housing starts was lower from December to January.”

Dugan added that among Canada’s urban areas, single-detached starts were higher overall while multi-family units lagged in January. Montreal, however, was the only one of the three major urban areas (Toronto and Vancouver are the others) to post a gain in housing starts largely due to higher single-detached and multi-family starts.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

A lack of supply has been an often-quoted culprit of the country’s housing affordability crisis. In an interview with Financial Post’s Larysa Harapyn, RE/MAX Canada president Christopher Alexander pointed to record-low inventory as a factor keeping prices lofty, particularly in recent months.

“The frenzy that we’ve put in for the last six, seven months with inventory being so tight and demand being so strong, it has been frenetic in a lot of ways and, nationally in January, we had less than 1.6 months of inventory across Canada,” Alexander said. “That is huge. We’ve never seen anything like that.”

Alexander added that high demand and low inventories are putting buyers in a difficult position when it comes to finding a home.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“If we can, you know, get that inventory up to just over two months to three months on average would be a good thing for everybody,” he said. “You don’t get into buyer’s market territory unless you have over six months of inventory and we haven’t seen those levels in Canada for a very long time.”

Royal Bank of Canada senior economist Robert Hogue also identified lack of supply as a problem in his late January RBC Economics report, estimating that the Canadian market was short between 180,000 to 250,000 listings at the end of 2021, and would need to triple active listings to bring the market back to more of a balance.

“The supply side will continue to be crucial to Canada’s housing story. So far in the pandemic, supply has been dwarfed by supercharged demand.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

RBC analysts expect that much of the supply increases and market cooling will take place in the second-half of 2022, though it’s expected to remain a strong year for the market.

-

Canada’s home prices post record monthly surge in historically tight market

-

Pandemic exodus of Canadian families from cities could fuel wage inflation

-

Ontario must double housing production to improve affordability, task force says

-

CMHC wants market share back, but some observers wonder if timing is right

A more recent RBC report revealed that Toronto recently took the top spot as the country’s priciest market, which had been held by Vancouver for decades. The Greater Toronto Area’s composite MLS HPI benchmark edged over Vancouver with a $1.260 million average price compared to Vancouver’s $1.255 million.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Supply issues have prompted the recently formed Ontario Housing Affordability Task Force to recommend 55 new measures in their report released in early February to aggressively build more homes. Some of these measures include pushing past NIMBYism (not in my backyard) to fast-track housing development and to override municipal policies that prioritize preserving “neighbourhood character” over bringing new developments to market.

Overall, it would be a strategy to reduce red tape and tackle exclusionary zoning. It’s a strategy that Alexander argues is a step in the right direction.

“There sounds like there’s going to be some out-of-the-box thinking when it comes to zoning,” Alexander told Harapyn. “So, on the surface, it all sounds very encouraging because we have such a backlog to get projects approved for development and finding a way to speed those up is a huge step in the right direction.”

• Email: [email protected] | Twitter: StephHughes95

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.