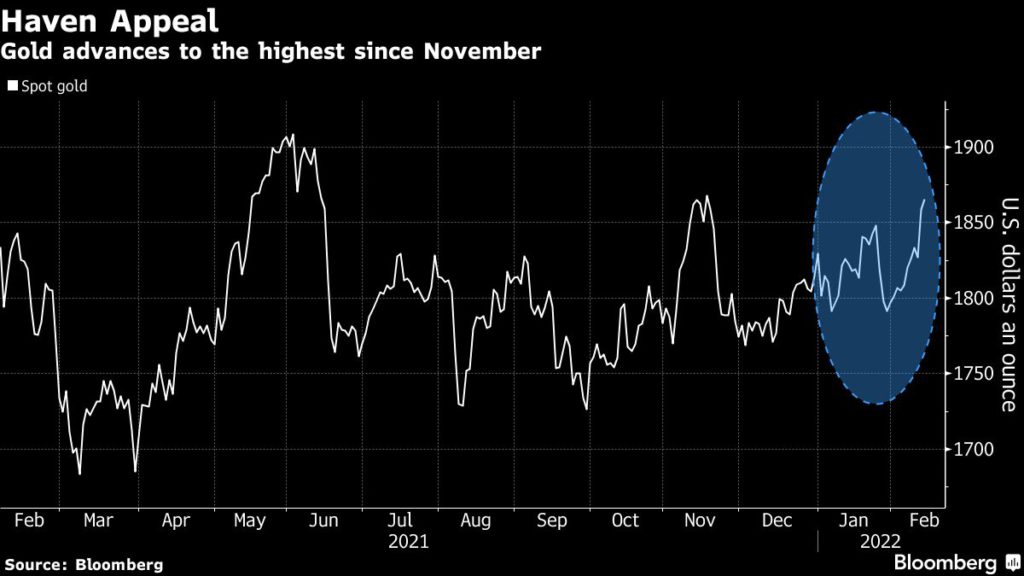

Gold price nears 3-month peak as Ukraine tension lifts haven demand

[Click here for an interactive chart of gold prices]

On Sunday, US officials warned that a Russian invasion of Ukraine may be imminent, possibly within days, though Moscow dismissed that as “hysteria.” Russia had repeatedly denied it plans to invade Ukraine.

Russia President Vladimir Putin then countered these warnings by staging televised meetings with his foreign and defense ministers, emphasizing the de-escalation of tensions and continued efforts to find a diplomatic resolution to the security crisis.

The Russia-Ukraine tensions are bringing investors back to gold as a store of value, despite growing expectations the US Federal Reserve will aggressively raise rates to curb the hottest inflation in 40 years.

“The markets are reacting by seeking safe-haven assets in a dynamic that strongly supports the precious metal,” Ricardo Evangelista, senior analyst at ActivTrades, said in a Bloomberg report.

Exchange-traded funds have recorded inflows for four weeks straight, while hedge funds trading gold on the Comex also boosted their bullish bets in the week through Tuesday.

Still, Evangelista sees gold’s gains to be limited partly by the pace and timing of the Fed’s monetary tightening. According to the analyst, the US dollar would continue to strengthen if the Fed acts more aggressively, and thus weigh on bullion due to the inverted correlation between the two assets.

“We got flight to safety going into gold at the moment as equity markets are selling off. We also have a lot of big economic data coming out this week and the main focus is the inflation,” Bob Haberkorn, senior market strategist at RJO Futures, told Reuters.

Meanwhile, the latest developments in the Ukraine also lifted other metals whose production can be linked to Russia, including palladium, nickel and aluminum.

Russia is one of the world’s largest palladium-producing countries, and any escalation in conflict between Russia and Ukraine could lead to supply disruptions, analysts said.

“It looks like the percentage of palladium they (Russia) export as a percentage of the global production is pretty close to 50%, and that obviously does make the metal extremely exposed to any temporary reductions in supplies from Russia should the conflict escalates from current levels,” said Saxo Bank’s Ole Hansen.

(With files from Bloomberg and Reuters)