Copper price highest since October on supply squeeze

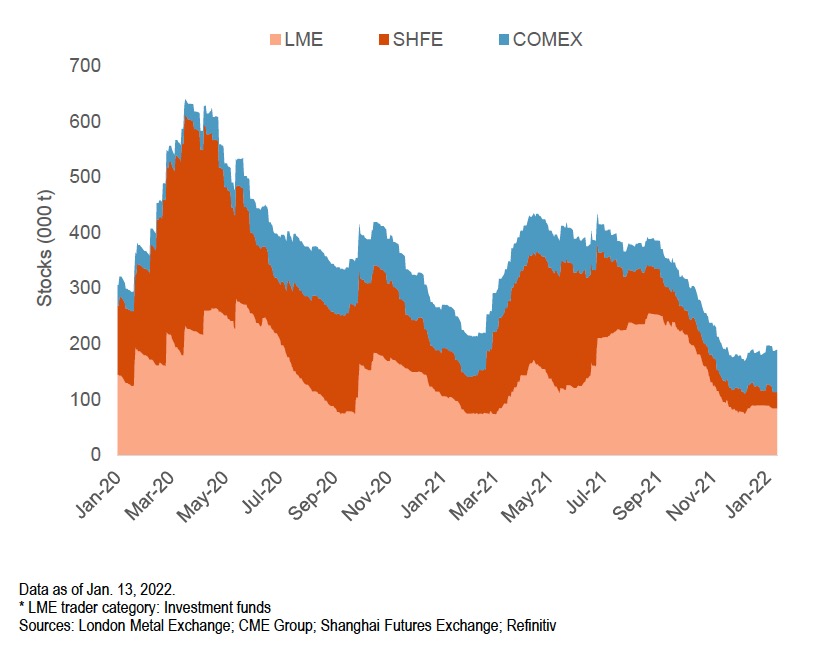

“Copper held on major exchanges is now at alarming levels, representing just three days of global supply,” the ANZ strategists said.

Read more: Copper price: Global stocks are down to three days’ consumption

“LME copper stocks give every appearance of experiencing a second grab-it-while-you-can impulse wave,” wrote Reuters columnist Andy Home.

Copper for delivery in March rose on the Comex market in New York, touching $4.7065 per pound ($10,354 per tonne), up 2.1% compared to Wednesday closing, the highest since October.

Shanghai copper climbed 4% to 73,030 yuan a tonne, after earlier hitting 73,040 yuan, also its highest since Oct. 21.

“Copper could be heading towards supercycle territory in the medium term, with price levels expected to reach above $5 per pound in the medium term,” economist and commodity market specialist Patricia Mohr told the audience at the AME conference in Vancouver last week.

Meanwhile, Fitch Solutions said in its outlook for 2022 that the tightness in copper inventories will ease a tad this year, with Chinese smelters increasing production again after the cuts during the power crisis in October.

[Click here for an interactive chart of copper prices]

(With files from Reuters)