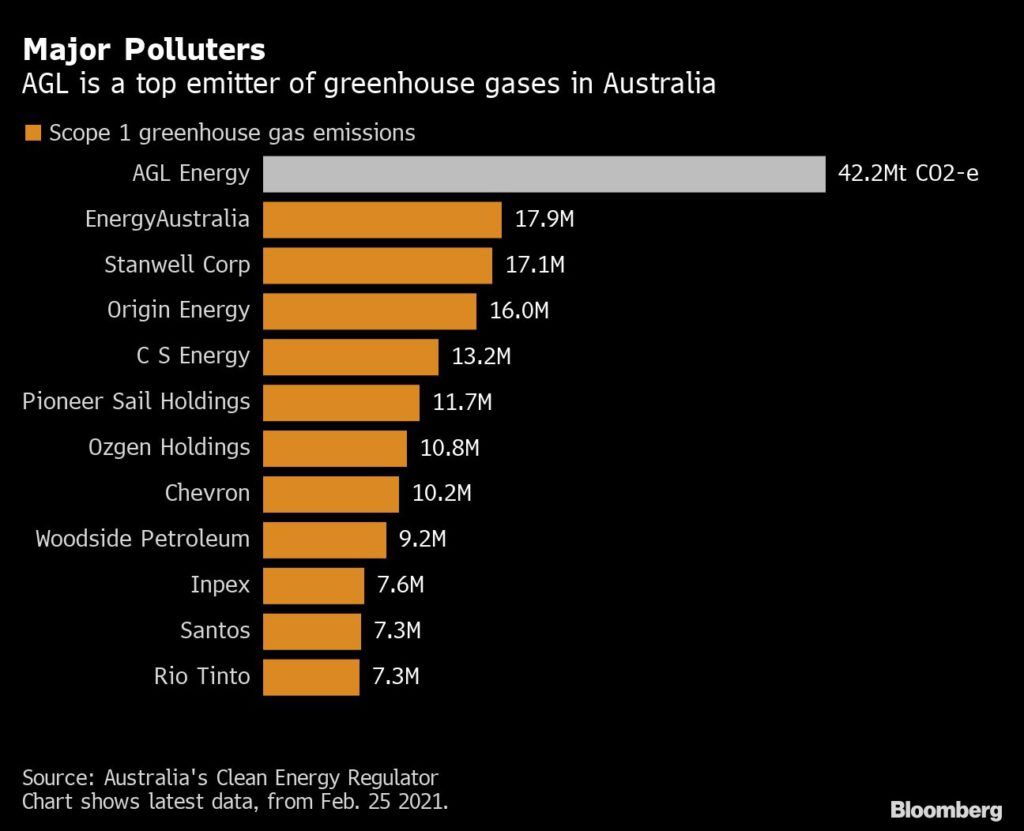

The utility is responsible for the largest share of Australia’s scope one greenhouse gas emissions, and this month disappointed climate advocates when it announced plans to bring forward the decommissioning of two giant coal plants by only a few years.

Brookfield and Cannon-Brookes, Australia’s second-richest person and a co-founder of software business Atlassian Corp, have a A$20 billion ($14 billion) transition plan to shift AGL to clean energy and “remains optimistic that an agreement can be reached,” the consortium said in a statement.

Sources familiar with the matter told Financial Times on Wednesday that Brookfield and Cannon-Brookes’s investment firm Grok Ventures had bypassed the AGL board and was now speaking on to the utility’s largest traders.

The consortium declined to comment on whether or not it is contemplating sweetening its A$8 billion ($5.8bn) offer.

If successful, Brookfield will replace seven gigawatts of AGL’s fossil fuel generation capacity with at least eight gigawatts of clean energy and storage capacity, enabling the utility to hit net zero emissions by 2035, it said.

AGL is not wasting time as news of the company seeking about A$1 billion ($725 million) from potential partners to transition its coal-fired power plants to low-carbon sites hit the wires on Wednesday.

Citing people familiar with the matter, Bloomberg reported the utility has already held preliminary talks with prospective investors in its planned Energy Transition Investment Partnership fund, which will head the conversion of plants to greener energies.

Public debate on climate change in Australia and the role of coal, which still provides most of the country’s electricity, reached a new level following wildfires in late 2019 and early 2020. Though Prime Minister Scott Morrison set a net-zero emissions target last year, his government has long favoured fossil fuels, and even touted a “gas-fired recovery” from the coronavirus pandemic.

(With files from Bloomberg, Reuters)