Why did the Bank of Canada and Fed hold and what’s next?

Check here for the latest news and analysis as the Bank of Canada and the U.S. Federal Reserve hold rates at historic lows

Article content

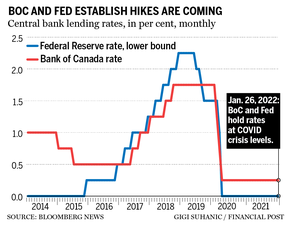

Both the Bank of Canada and the U.S. Federal Reserve held their key interest rate at historic lows, despite raging inflation. Full coverage of the decisions, the press conferences and the market reactions right here.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

4:07 p.m.

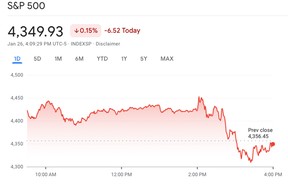

Stocks erased gains and Treasury yields spiked after Jerome Powell signalled the Federal Reserve will steadily remove support for the economy as it battles rampant inflation.

The S&P 500 fell after rallying more than 2 per cent earlier Wednesday, the dollar rose while 10-year yields topped 1.8 per cent.

Powell said he backs a March liftoff and won’t rule out a hike every meeting, while noting the inflation situation is “slightly worse” than it was in December.

The S&P 500 lost 6.65 points, or 0.15 per cent, to end at 4,349.80 points, while the Nasdaq Composite gained 0.2 per cent The Dow Jones Industrial Average fell 121.83 points, or 0.36 per cent, to 34,175.90.

The TSX was up 4.91 at 20,595.

3:45 p.m.

‘Damage has already been done in financial markets’

Simon Harvey, a currency strategist at Monex Europe is back, this time with his thoughts on the Fed:

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“The Federal Reserve today took the final steps needed to signal a (quarter-point) rate hike at March’s meeting. However, with markets expecting such a policy move and three more subsequent rate hikes by the U.S. central bank in 2022, the release of January’s policy statement didn’t come as a shock to markets and therefore generated little volatility.

“The one slight shock was the release of a supplementary market notice entitled Principles for Reducing the Size of the Federal Reserve’s Balance Sheet. Such a notice was last published in 2014, with an addendum in 2017. Its issuance suggests the Fed is laying the groundwork for quantitative tightening following December’s meeting minutes noted that discussions over the timing and pace in which to allow Treasury and MBS purchases to roll off the balance sheet began within the FOMC.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“Volatility picked up across markets as Chair Powell stressed the strength of the U.S. labour market and the room provided by its recovery to raise rates without impacting the return to pre-pandemic employment levels. By stating that ‘there is plenty of room to raise rates,’ Powell, who is known for his select choice of words to cast a relatively neutral tone, sparked a further sell-off in the U.S. bond market, which sent front-end yields to fresh post-pandemic highs of 1.09 per cent and intermediate yields back up towards recent highs near the 1.7 per cent level. The increased expectation of rate hikes by the Fed, as evidenced in the rise in U.S. Treasury yields, weighed on U.S. equity markets.

“Despite being fairly noncommittal for the remainder of the press conference with regards to the timing, pace and impact of quantitative tightening, the damage has already been done in financial markets due to the commentary suggesting a steeper rate path relative to that of four rate hikes this year prior to the meeting in what was meant to be one of the plainer sailing Fed meetings.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Kevin Carmichael

3:35 p.m.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

3:30 p.m.

The U.S. Federal Reserve press conference has now ended, but coverage continues.

3:15 p.m.

Wall Street was mixed, surging but then paring earlier solid gains after the Fed released its statement.

All three indexes were green throughout the session but briefly jumped higher after the Federal Open Markets Committee announced it left key interest rates near zero.

But those gains evaporated when the Fed warned in its statement that it would soon begin raising the Fed Funds target rate to combat persistent inflation related to the COVID-hobbled supply chain.

Stocks pared further and the Dow dipped into the red once Fed Chairman Jerome Powell’s subsequent Q&A got under way, during which he warned that inflation remains above its long-run goal and supply problems are bigger and more long-lasting than previously thought.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“The Fed provided some clarity on the prospect of rate hikes but not all the clarity markets were looking for,” said Russell Price, chief of economics at Ameriprise Financial Services in Troy, Michigan. “There’s still some uncertainty when it comes to the balance sheet roll off. The market’s glad to get a little more clarity given the uncertainty that accompanies transition periods like this.”

The Dow Jones Industrial Average fell 52.98 points, or 0.15 per cent to 34,244.75, the S&P 500 gained 10.65 points, or 0.24 per cent, to 4,367.1 and the Nasdaq Composite added 91.99 points, or 0.68 per cent, to 13,631.29.

— Reuters

3:05 p.m.

Michael Gregory, who keeps an eye on the United States for Bank of Montreal, is sticking to his outlook for U.S. interest rates after digesting the latest from the Federal Reserve , although he says there’s a risk that the Fed could decide to pick up the pace.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“We’re calling for four rate hikes this year (March, June, September and December), with another four in the same sequence next year until we move into the bottom of the FOMC’s longer-run 2 per cent to 3 per cent neutral range,” Gregory said in a note. “Given what we read and heard today, we still judge that the net risk lies on the side of a quicker cadence to a higher terminus.”

— Kevin Carmichael

2:34 p.m.

U.S. Federal Reserve chair Jerome Powell is currently giving a press conference on today’s decision. Watch the live feed below.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

2 p.m.

BREAKING Fed signals rate hike in March, on hold for now

1:31 p.m.

Checking in on stocks ahead of the Fed decision at 2 p.m. and it’s a sea of green. The S&P 500 is up 67 points, the Dow up 307 points and Nasdaq up 337 points. The TSX is up 232.

Fed funds futures have fully priced in a quarter-point tightening for the Fed’s March meeting, and about three more for 2022.

12:53 p.m.

The economics team at Royal Bank of Canada probably is having a good day. While Bank of Nova Scotia and other Bay Street stalwarts bet the Bank of Canada would raise interest rates today, RBC stuck to its guns and said the central bank would wait until April. That call looks good today, although Josh Nye was sounding wobbly on the likelihood that Governor Tiff Macklem will wait two more months to start down the path to higher borrowing costs.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“The fact that its next meeting is a short five weeks away may have contributed to the BoC’s patience,” Nye said in a note to clients. “Holding steady today also allows for a more graceful exit from its forward guidance than if the BoC hiked in January after reiterating its “middle quarters of 2022” guidance in December.”

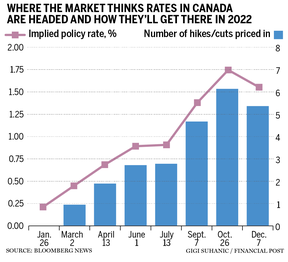

Nye added: “Our call has been for the BoC to begin raising rates in April, though three months looks like a long time when the economy is already at full capacity and inflation is expected to remain elevated over the first half of the year. The BoC has made it clear that rate hikes are coming and likely wants to send a message to Canadians — sooner rather than later — that it is acting to control inflation. Our forecast has been for three rate hikes this year though we see upside risk to that call if the BoC does get an earlier start. That said, we continue to think the market is over-priced for more than five rate increase in 2022 and the BoC’s patience today increases our confidence that the central bank won’t be overly aggressive in its pace of tightening.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Nye talked to the Financial Post’s Larysa Harapyn earlier today. Keep an eye on the website for the video.

— Kevin Carmichael

12:20 p.m.

The Conference Board of Canada weighed in on the Bank of Canada’s rate announcement today, saying the move to keep rates steady wasn’t a shock to the organization.

“The Bank of Canada’s decision to keep interest rates unchanged came as a surprise to the market. But it didn’t surprise us. It is indeed true that inflation has been above the Bank’s upper target rate of three per cent for nine months. Besides, there is little slack left to absorb in the labour market. Both employment levels, hours worked, and vacancies exceed pre-pandemic levels,” the report said.

The Bank of Canada’s decision to keep interest rates unchanged came as a surprise to the market. But it didn’t surprise us

“Having said that, we knew that Omicron-induced restrictions will undoubtedly slow the economic recovery, making the Bank of Canada cautious. An increase in rates when two of Canada’s biggest provinces are under strict restrictions might have sent the wrong signals.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Stephanie Hughes

12:00 p.m.

Prepare for rate hikes just five weeks from today

Bank of Montreal chief economist Douglas Porter:

“We don’t believe that today’s decision to hold steady at all deflects from the fact that rates are going higher in a relatively forceful fashion this year.This specific decision was likely driven by the fact that a) the economy is dealing with a serious short-term hit from Omicron-driven restrictions, and b) the Bank had consistently guided to rate hikes a bit later on, and did not want to so abruptly run against their guidance,” he wrote in a client note.

“We believe this was a prudent decision, even as we see the need for higher rates (and with pace) as much as any forecaster. Assuming restrictions begin to lighten in the weeks ahead, prepare for rate hikes just five weeks from today.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

11:51 a.m.

What about hot housing?

The Bank of Canada expects the housing market will still be going strong this year, but could see some easing from current highs.

“Housing market activity is anticipated to remain elevated but ease from its current levels,” said the Monetary Policy Report, adding that resales would slow as pandemic-induced demand fades, borrowing rates climb and savings decline.

“Meanwhile, the easing of supply chain disruptions should support residential construction over 2022. The resulting growth in supply combined with easing demand should help rebalance housing markets and contribute to a moderation in house price growth,” it added.

However, the report pointed to some ongoing risks in the market surrounding consumption, which the central bank hopes will be assuaged by growing consumer confidence amid declining pandemic uncertainty.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“Consequently, households could spend more of their accumulated savings. Consumption and residential investment would then be stronger than projected and would contribute to greater inflationary pressures.”

— Stephanie Hughes

11:45 a.m.

The Bank of Canada press conference has ended, but coverage continues.

11:40 a.m.

Bank of Canada Governor Tiff Macklem wants to make one thing clear: interest rates are on a “path” higher. Where that path ends remains to be seen. “How far, how fast? Those are decisions we’ll take at each meeting,” the governor said at a press conference.

The next interest rate announcement is March 2. After that, the opportunities this year are: April 13, June 1, July 13, Sept. 7, Oct. 26, and Dec. 7.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“A path is not one move,” Macklem said. “A path is a number of moves.” He stopped there, emphasizing that he and his deputies aren’t on autopilot, and that it’s possible a few increases could be followed by a pause.

— Kevin Carmichael

11:29 a.m.

The loonie tumbled to a low of 79.19 US cents from its 79.62 high this morning after the Bank of Canada announced that it would be leaving the overnight rate unchanged at 0.25 per cent. The loonie has since pared some of that loss and is, overall, trading higher for the day as a volatile session unfolds.

“Clearly, markets were positioned for a hike today… and so we’ve seen some position adjustment on the front end of the curve as a result of the surprise,” Karl Schamotta, chief market strategist at Cambridge Global Payments, told the Financial Post this morning.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“But if you look at the overwhelmingly hawkish language and the monetary policy report, a strong set of forecasts when it comes to inflation, growth, and employment – all of that points to increase tightening over the year.”

As the U.S. Federal Reserve is set to make its own policy announcement this afternoon, Schamotta adds that the banks’ announcements in tandem will have continued effects on the currency markets.

“The Fed is expected to put a March rate hike on the table later this afternoon. That is going to mean that interest rate curves in Canada and the U.S. are going to largely move in symphony with one another,” he said. “What that should mean is that the loonie remains relatively range-bound. It also means that volatility expectations in currency markets are likely to subside somewhat.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Stephanie Hughes

11:25 a.m.

The first question at Bank of Canada governor Tiff Macklem’s press conference was the obvious one: why didn’t you raise interest rates?

The governor said Omicron is “weighing on the economy,” and even though the current COVID-19 wave looks less severe than previous ones, the future remains uncertain. He also indicated that an interest-rate increase today might have added more chaos to an already chaotic situation.

“We’re trying to cut through the noise so monetary policy is a source of confidence and it’s not another source of uncertainty,” he said.

— Kevin Carmichael

11:17 a.m.

Here are the key messages from Bank of Canada governor Tiff Macklem’s opening statement at his quarterly press conference:

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

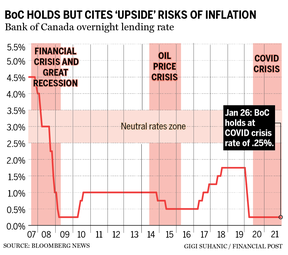

“First, the emergency monetary measures needed to support the economy through the pandemic are no longer required and they have ended. Second, interest rates will need to increase to control inflation. Canadians should expect a rising path for interest rates. Third, while reopening our economy after repeated waves of the COVID-19 pandemic is complicated, Canadians can be confident that the Bank of Canada will control inflation. We are committed to bringing inflation back to target.

Canadians can be assured that the Bank of Canada will control inflation

“We want to clearly signal that we expect interest rates will need to increase. A lot of factors are contributing to the uncomfortably high inflation we are experiencing today, and many of them are global and reflect the unique circumstances of the pandemic. As the pandemic fades, conditions will normalize, and inflation will come down. However, with Canadian labour markets tightening and evidence of capacity pressures increasing, the Governing Council expects higher interest rates will be needed to bring inflation back to the (two per cent) target.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“Canadians can be assured that the Bank of Canada will control inflation. Prices for many goods and services are rising quickly, and this is making it harder for Canadians to make ends meet — particularly those with low incomes. Prices for food, gasoline and housing have all risen faster than usual. We expect inflation will remain close to (five per cent) through the first half of 2022 and then move lower. There is some uncertainty about how quickly inflation will come down because we’ve never experienced a pandemic like this before. But Canadians can be assured that we will use our monetary policy tools to control inflation.

“Of course, we discussed when to begin increasing our policy interest rate. Our approach to monetary policy throughout the pandemic has been deliberate, and we were mindful that the rapid spread of Omicron will dampen spending in the first quarter. So we decided to keep our policy rate unchanged today, remove our commitment to hold it at its floor, and signal that rates can be expected to increase going forward.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“We take our communication with Canadians very seriously. For almost two years now we have told Canadians we would keep our policy rate pinned at its floor until economic slack is absorbed. With slack absorbed more quickly than expected, it is time to remove our extraordinary forward guidance. This ends our emergency policy setting and signals that interest rates will now be on a rising path. This is a significant shift in monetary policy, and we judged that it is appropriate to move forward in a deliberate series of steps.”

11:10 a.m.

Rate hike in March and three more in 2022: TD

“Even with growth being impacted by Omicron, inflation should be the main concern for the Bank. Consumer prices are growing at 5 per cent and financial imbalances (housing) continue to rise on the back of low interest rates. From our lens, the BoC needs to move quick. We expect a rate hike in March and three more in 2022. This should lift government bond yields and mortgage rates. Hopefully this will cool some of the froth,” said James Orlando, senior economist at Toronto-Dominion Bank.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

11:00 a.m.

Watch the press conference on now.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

10:51 a.m.

‘Policy misstep’

Simon Harvey, senior analyst at Monex Europe:

“The decision, in our view, is a policy misstep from the Governing Council and is one that could prove costly later down the line. By effectively loosening financial conditions at today’s meeting, the BoC risks emboldening near-term inflation expectations and flaming the fire underneath the housing market. This could result in lift-off taking the shape of a 50bps hike at March’s meeting should inflation expectations continue to rise and labour market metrics remain resilient to Omicron impacts in Q1.

“In analogous terms, should the data continue to print in a similarly robust fashion to Q4, the bank has effectively swapped out a soft landing for the Canadian economy in favour of cutting the strings and reaching for the emergency parachute.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“With a 25bps hike unlikely to have caused too much damage to the economic recovery even at a time of activity restrictions in Ontario and Quebec, the bank now runs the risk of having to put the genie back in the bottle with regards to inflation expectations.

“With real rates in negative territory, core inflation at a 30-year high, and financial markets giving the BoC a free pass, the question is why didn’t they take it? Governor Macklem will have a lot of explaining to do in what is set to be his hardest press conference to date.”

— Kevin Carmichael

10: 47 a.m.

The press conference with Bank of Canada governor Tiff Macklem and Carolyn Rogers, senior deputy governor, is up next at 11 a.m. Watch it here and get live analysis from Kevin Carmichael.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

10:40 a.m.

Tu Nguyen, economist at RSM Canada:

“Amid a strong recovery with robust demand, striking labour shortages, and inflation at 30-year high, a rate hike in March will be all but necessary to tame inflation and inflation expectations.

“Demand for labour is at the highest level in two decades, and the economy is well on track to achieve maximum sustainable employment. While wage gains still trail inflation for now, they are picking up rapidly across industries.

“Increased economic activity and geopolitical concerns will increase the demand for energy at a time of limited supply, and as a result, the Canadian dollar will remain strong.

“In a world still plagued by the pandemic and uncertainties, the Bank of Canada proves to still favour an orderly and gradual approach in its monetary policy. ”

— Kevin Carmichael

10:30 a.m.

The Bank of Canada could lift interest rates as soon as its next meeting in March, said Capital Economics senior economist Stephen Brown.

“The Bank of Canada kept policy unchanged today but now judges that the conditions to start raising interest rates have been met, suggesting that it will hike its policy rate at the next meeting in March,” he wrote in a client note.

Markets had placed bets that the central bank would lift rates today as inflation soars, gross domestic product appears stronger than expected and the labour market has now recovered to the point where it’s tightening and adding wage pressures.

Policy-makers also telegraphed they expect inflation to run above the bank’s two per cent target in 2023, which could suggest a faster pace of hiking. Some economists expect the bank to lift rates as much as six times in 2022.

— Bianca Bharti

10:28 a.m.

Bond yields immediately took a dip following the Bank of Canada announcement after the central bank kept the overnight lending rate unchanged at 0.25 per cent.

The 5-year bond fell by over 0.060 per cent from 1.632 per cent in the minutes following the announcement while the 10-year bond fell over 0.040 per cent from the 1.794 per cent rate it held this morning.

“Short-end bond yields were outperforming just prior to the announcement, and bonds are now rallying across the curve in the wake of the decision to hold rates,” wrote Royce Mendes, managing director and head of macro strategy at Desjardins, in a note. “The announcement might be having some market participants rethinking their bets for an aggressive hiking cycle this year.”

10:11 a.m.

The Bank of Canada has gone against market expectations and held its benchmark rate at 0.25 per cent. But it set the stage for a hike in coming meetings, saying that economic slack has been absorbed and forecasting that inflation will remain higher than expected.

Read the Bank of Canada’s official statement here.

Here are the highlights from the Bank’s quarterly report on the economy:

Key paragraph: “While the upside and downside risks to the bank’s inflation projection are viewed as roughly balanced, the upside risks are of greater concern. Until inflation moves significantly lower, there is an elevated risk that Canadians will start to believe that inflation will stay high over the long term. Higher inflation expectations could in turn lead to more pervasive labour costs and inflationary pressures could become embedded in ongoing inflation.”

Inflation outlook: The Bank of Canada sees year-over-year increases in the consumer price index (CPI) averaging 5.1 per cent in the first quarter, and then settling down over the rest of the year. The two-year outlook sees CPI inflation of 4.2 per cent this year and 2.3 per cent in 2023. The central bank’s target is two per cent.

The growth outlook: The Bank of Canada cut its forecast for economic growth in 2022 to four per cent from an estimate of 4.3 per cent in October. Policy-makers actually feel pretty good about the state of the economy. They concluded that the labour market has fully recovered from the damage caused by the COVID recession, and they described exports and investment intentions as “robust.” They predict the economy will push through the headwinds caused by the fifth wave of COVID-19 and grow at an annual rate of two per cent in the first quarter. Their calculations suggest gross domestic product accelerated to annual rate of growth of 5.8 per cent in the fourth quarter, much better than the four-per-cent rate they were anticipating in the fall.

Output gap closes: One of the ways the Bank of Canada assess whether inflationary pressures are building is its estimate of the “output gap,” which is the difference between actual economic output and the level of GDP that the central bank associates with the economy’s non-inflationary speed limit. Policy-makers reckon the gap has now closed, putting the estimate at something between -0.75 per cent and 0.25 per cent.

China stumbles: The Bank of Canada slashed its outlook for Chinese economic growth this year to 3.8 per cent from a previous estimate of 5.3 per cent — a huge drop from 8.1 per cent in 2021. Canada’s central bankers anticipate that the correction in China’s property markets will result in some of the weakest growth the country has experienced in decades.

— Kevin Carmichael

10 a.m.

It’s a hold!

9:28 a.m.

Money markets this morning see a roughly 65 per cent chance the Bank of Canada will boost the overnight rate to 0.5 per cent from the current record low 0.25 per cent. Analysts surveyed by Reuters are less certain, with 77 per cent seeing the central bank holding until at least March.

9:18 a.m.

The era of ultra-low pandemic interest rates, which has helped drive Canadian home prices to all-time highs, could end today. That could put Canadians, one of the most indebted populations, at risk.

Just how significant of an effect higher rates will have will depend on how quickly the central bank moves.

Mortgage expert Rob McLister told the Financial Post that those holding variable-rate mortgages will be hit first, with the costs passed along between one day and one week following a rate hike.

McLister added that a 0.25 per cent rate increase, which is the amount the market is expecting as a first hike, would have no impact on qualifying for a mortgage since the minimum qualifying rate is already more than 235 basis points over five-year fixed rates.

“For prospective prime borrowers, discounted five-year fixed rates would have to jump over 36 basis points for borrowers to start facing qualification challenges. And it would only be an issue for more highly indebted mortgage applicants (I’d estimate roughly 1 in 5 mortgage applicants),” McLister wrote in an e-mail.

Stephanie Hughes’ breaks down how homeowners will fare during the hiking cycle.

9:03 a.m.

What will higher interest rates do to Canada’s already lacklustre business investment?

Some might call Canada’s business investment disastrous, especially since oil prices collapsed in 2014. Company spending on machinery, software and non-residential property, like factories, was under 10 per cent of Canada’s $2-trillion gross domestic product (GDP) in the third quarter, down from 13 per cent in 2014.

In the U.S. it’s nearly 15 per cent.

The pandemic hasn’t helped, with executives remaining more fiscally conservative amid the chaos. As the Bank of Canada moves to tame price pressures by raising borrowing costs, there’s a risk that higher interest rates could dampen investment intentions.

But economists said that Bank of Canada Governor Tiff Macklem probably can avoid a negative shock to business sentiment by communicating clearly and ratcheting up borrowing costs slowly.

Read more from the Financial Post’s Bianca Bharti .

8 a.m.

What?

The Bank of Canada’s first interest-rate announcement of 2022 .

When?

The Bank of Canada will release its policy statement and quarterly economic report at 10 a.m. Ottawa time . Keep an eye on financialpost.com for real-time coverage throughout the day.

Who?

Bank of Canada Governor Tiff Macklem took over from Stephen Poloz in June 2020. By then, the central bank had done about all it could to reverse an epic recession. It had dropped the benchmark interest rate to 0.25 per cent from 1.75 per cent at the start of year. It had pledged to swap hundreds of billions of dollars worth of financial assets for cash. It had begun creating money to buy government bonds, Canada’s first experiment with quantitative easing, or QE. But there was still one weapon left in the arsenal that Macklem liked. He used his first interest-rate announcement to pledge to keep the benchmark rate near zero until sometime in the second half of 2022, conditional on the outlook for inflation. Central banks typically avoid making explicit promises of that nature. Among the reasons, as Macklem has experienced in recent weeks: the future is hard to predict.

Who else?

Carolyn Rogers , the former international financial regulator who was appointed senior deputy governor last year and started her job officially in mid-December, participated in her first round of policy deliberations. For the first time, Governing Council has seven members instead of the usual six. That’s because in July Macklem appointed Sharon Kozicki as a deputy governor to add some diversity to an all-male group as he waited for Rogers to finish her work at the Basel Committee on Financial Supervision in Switzerland. Macklem opted to leave a team of seven in place until one of his deputies resigns, at which point Governing Council will return to its typical roster of five deputies and one governor.

Why all the excitement?

The consumer price index (CPI) surged 4.8 per cent in December from a year earlier, the most in more than 30 years. The Bank of Canada’s agreement with the government requires it to keep the CPI advancing at an annual rate of about two per cent, the midpoint of a comfort zone of one per cent to three per cent. Inflation has been outside the high end of that band since April. That’s a long time to be so far off target. Prices of financial assets linked to short-term interest rates suggest that most traders anticipate an interest-rate increase today to keep inflation from getting even more out of hand. The biggest worry at the central bank is probably that consumers and suppliers will begin demanding higher wages and more money for the goods and services , respectively, because they think current price spikes are permanent. That’s how inflationary spirals start. The central bank probably wants to break that psychology.

Why aren’t Bay Street expectations of a rate increase universal?

One hundred and eighty-nine people died of COVID-19 on Jan. 24 , pushing total deaths since the start of the pandemic to 32,786. The health crisis isn’t over and Macklem might dislike the optics of raising interest rates while much of the country is in a state of semi-lockdown. There’s also his and the central bank’s reputations to consider . Remember that promise to keep the benchmark rate at 0.25 per cent until the second half of 2022? The Bank of Canada has already backtracked once; last fall, revised forecasts showed the economy was on track to reach its non-inflationary speed limit sooner than expected, and policy-makers advanced the timing of the first interest-rate increase since the start of the pandemic to the “middle quarters” of this year. The Bank of Canada’s next two policy announcements are March 2 and April 13. Would waiting another couple of months really make that much difference, especially when the central bank’s credibility could be at stake? Economists at Royal Bank of Canada, the country’s biggest lender, are among the minority of holdouts who think Macklem will wait until the spring. Much of the inflation is coming from supply-side factors such as China’s zero-tolerance policy for COVID-19 infections, which disrupts factory production and has forced the temporary closure of ports, and terrible weather in important agricultural regions. Higher interest rates in Canada will do nothing about any of that.

Where will interest rates be at the end of the year?

Higher than they are now , that’s for certain. Even the economists who think it would be a mistake to panic reckon the benchmark rate will need to rise by at least one percentage point this year. The jobless rate fell below six per cent in December , a rate many economists associate with full employment. Monetary policy is currently is set for an economic emergency and the emergency is over.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.