Value stocks have pulled ahead of growth in recent weeks. Is it a head-fake?

U.S. value stocks are beating growth equities in the first week of 2022, extending their outperformance in December and faring better through the broad market slump sparked Wednesday by investor concern the Federal Reserve was considering more hawkish steps toward combating high inflation.

The Russell 1000 Value index RLV,

James Solloway, chief market strategist and senior portfolio manager at SEI Investments Co. is favoring higher quality, cyclical value bets in the stock market over growth equities. While the stock market may become bumpy as the Fed starts to raise rates to tame the rise in inflation, “underneath the surface it will be those cyclical and financial stocks that are leading the way while tech and growth lag,” Solloway said in a phone interview Thursday.

Investors have at times seen a tug of war between growth and value during the pandemic, after a long stretch of underperformance for value stocks following the global financial crisis of 2008.

It’s hard to know whether the latest shift will hold or prove a head-fake, with the larger question being to what extent has the market priced in a tightening of monetary policy, according to Sunitha Thomas, national portfolio advisor at Northern Trust Wealth Management.

“Definitely there are some parts of the growth universe that have benefited from interest rates being very, very low, and very, very accommodative monetary policy,” Thomas said by phone Thursday. “The economy has been awash in liquidity” that had to go somewhere, she said, and “it really bid up valuations of companies that may or not have had solid earnings right now.”

Minutes of the Fed’s December meeting, released Wednesday, showed officials considering raising rates sooner and faster in the face of high inflation as well as discussion around shrinking the central bank’s balance sheet as another form of monetary tightening.

The tech-heavy Nasdaq Composite index COMP,

Read: Here’s what stock and bond market strategists say after Fed minutes point to the end of easy money

“The new information this week that the market is responding to is that the language has changed quite a bit,” Thomas said of the Fed meeting minutes.

“Even the doves on the committee seem to agree that inflation won’t go away naturally and that the Fed should move,” she said. “The minutes were pretty clear about saying they’re going to need to use all of their tools,” maybe even reducing their balance sheet, which was a “new piece of information” for the market to digest.

But Northern Trust is keeping a balance between value and growth stocks, while overweighting equities, according to Thomas. Large-cap growth stocks with strong current cash flows may continue to do well, she said, in contrast to high-growth tech stocks whose valuations became “very inflated” as investors looked far out into the future for profits as they bid up their shares.

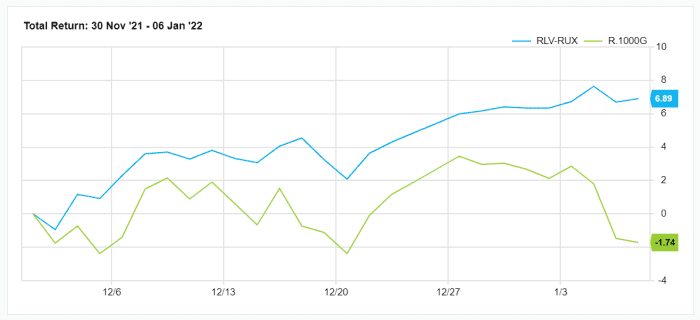

The Russell 1000 Value index has outperformed the Russell 1000 Growth index by 8.6 percentage points on a total return basis since the end of November through Jan. 6, FactSet data show.

“We’ve had a long period of time” in which growth stocks have beaten value, leaving value stocks comparatively “very cheap,” said Bob Doll, chief investment officer of Crossmark Global Investments, during a webinar Thursday on his 2022 market predictions. “Not too often do you see this dichotomy by this magnitude.”

Crossmark prefers cyclical over defensive stocks, value over growth, and small over large-cap stocks, according to Doll. He said more cyclical areas, such as financials, industrials, materials and energy, tend to outperform when interest rates rise. Doll also expects international stocks to beat U.S. equities in 2022, saying they are cheaper and tend to do well in “cyclically-powered” times.

SEI’s Solloway told MarketWatch that international equities in developed markets “look very much like a big value stock.” He said the composition of stock markets in Europe and the U.K. tend to be “heavily weighted towards financials, industrials and materials, with “very little weight in technology.”

“From a macro-perspective we’re still optimistic” that U.S. and global economic growth will continue to be good in 2022, even as it slows from last year, Solloway said.