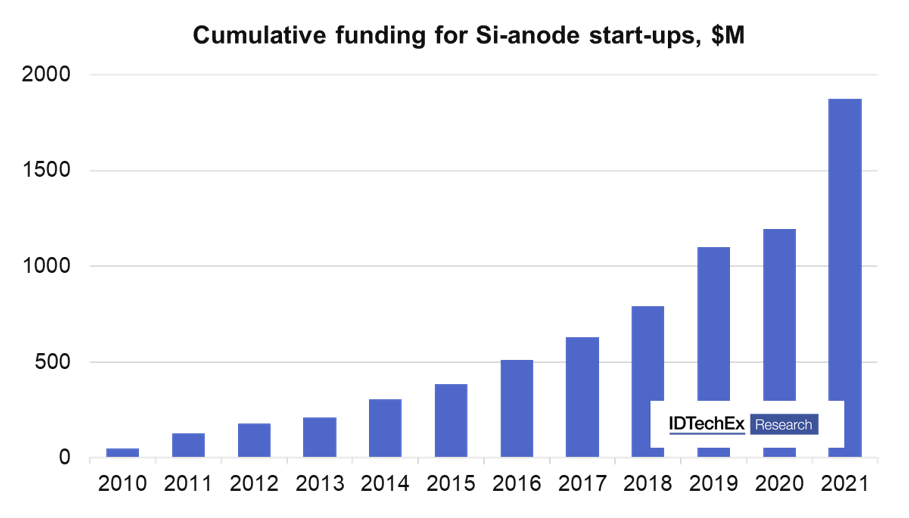

Silicon anode startups snagged $1.9bn in funding over the past decade – report

As examples of the companies in this realm, IDTechEx mentions Enevate, a firm that entered into a license agreement with battery manufacturer EnerTech International; Enovix, which went public via a SPAC that valued the company at $1.1 billion; Elkem, which established a separate silicon anode company Vianode; Group 14, a company that entered into a joint venture with SK materials for the supply of silane gas, and Sila Nano, which launched their battery technology in the Whoop fitness wearable.

“The above examples of commercial development and investment highlight the ongoing and significant interest in silicon anode technology,” the report reads. “Much of this stems from the potential for silicon to significantly improve energy density. But beyond energy density, silicon anodes also have the potential to improve fast charge capability, cost, and safety.”

The document explains that fast charging is feasible due to the high porosity inherent to silicon anode solutions, while costs can be reduced because of silicon materials’ high capacity, which results in lower material requirements.

Silicon anodes are also considered safer because they help reduce the risk of lithium plating and dendrite formation, even though cycle and calendar life may need to be further demonstrated.

“Silicon anodes present a highly valuable proposition for electric vehicles and indeed the largest opportunity for silicon anode material lies in BEVs with the possibility of silicon being used as an additive or as the dominant active material,” the dossier states. “Demand from other EV segments and consumer devices still represent a significant opportunity for silicon anode material and IDTechEx forecast that by 2032, demand for silicon anode material will reach $12.9 billion.”

The analyst, however, points out that with nearly 30 startup companies looking to commercialize silicon anode solutions, combined with developments taking place at more established materials and battery players, competition in the silicon anode space is intensifying and junior players are finding themselves in a race to lock in investments, partnerships, and orders.

Despite the competition, the firm’s experts believe that those who stay the course and succeed will see significant rewards, while consumers will see a ramp-up in the commercialization of better, cheaper, and environmentally friendlier batteries for EVs and electronic devices.