Restaurant stocks are on the menu for investors as the pandemic’s end nears

Omicron is ripping through the population at a shocking rate, but there’s an upside.

The coronavirus variant is milder and on track to leave the U.S. faster than delta.

If so, this will favor “reopening” plays in the stock market. Especially restaurants, since people have been reluctant to spend time in closed spaces with others wearing no masks.

Besides this factor, here are five reasons why restaurant stocks look attractive, according to Bank of America analysts. Below, I single out five restaurant stocks to consider.

1. Restaurants benefit from jobs and income growth

As people earn more, they go for the convenience of dining out. This trend particularly benefits full-service restaurants as opposed to fast food and take out. So, I favored full-service eateries when hunting for names, singled out below.

In 2019, the share of disposable personal income spent on restaurants was 5.2%. It’s currently 6% below that, at 4.9% of income. Getting back to 2019 levels would add $60 billion in restaurant spending, about 10% of 2020 restaurant spending, according to Bank of America.

2. Tailwinds from capacity reduction will continue

Unfortunately, around 10% of restaurants had to close during the pandemic, especially smaller, independent operators. It will take a while to rebuild. After the 2008-2009 financial crisis, capacity did not fully rebound until 2012, says Bank of America. This benefits the survivors — particularly those that have aggressive growth plans to fill in the capacity. So, I favored chains with big growth plans.

3. Grocery store food prices are going up faster than restaurant prices

This benefits restaurants, since they become relatively cheaper. Fast casual restaurants benefit the most from this discrepancy, so I favored them.

4. Inflation may be peaking right now

Supply-chain and transport issues are getting worked out. This suggests we have seen the worst of food and wage inflation. If so, this favors restaurants since their two main costs will be falling faster than the overhead at other kinds of companies.

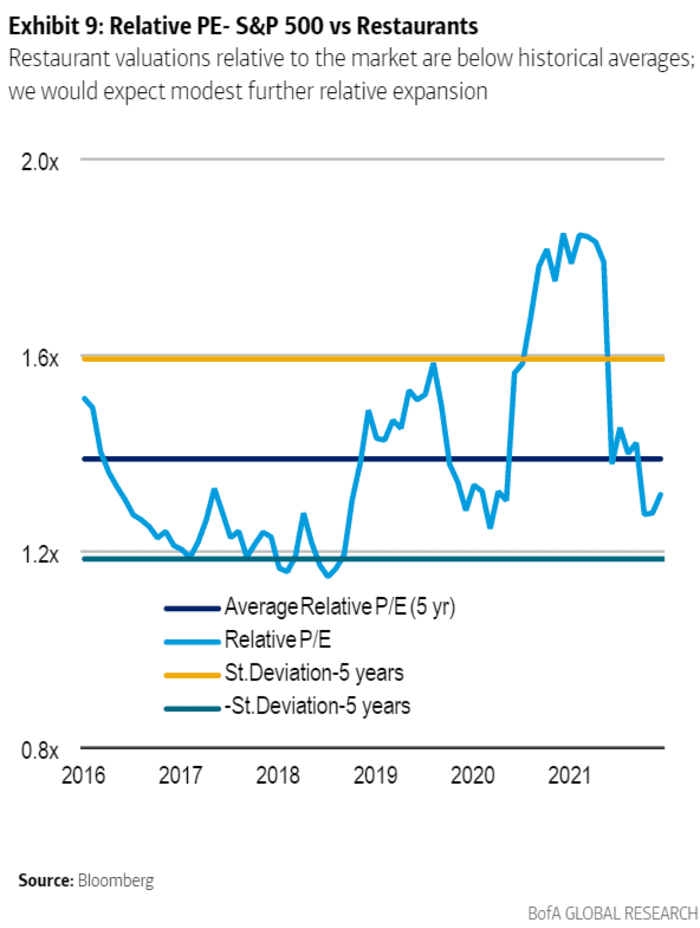

5. Restaurants look cheap compared to the market

Eateries on average are trading below their historical levels relative to the market. The S&P 500 Restaurants index’s relative price-to-earnings ratio is below its historical average of 1.4 times the S&P 500 multiple, as you can see in this chart from Bank of America.

Stocks to consider

To find restaurants that may benefit most from these trends, I looked for three things.

* Chains with good growth trading the furthest below analyst price targets. McDonald’s MCD,

* Chains with ambitious growth plans, since they’re the ones that will fill in the gaps caused by the mass restaurant closings.

* Chains that offer sit-in dining. Dine-in restaurants were responsible for most of the Covid-era decline in the sector’s business, so they have more ground to make up. Dutch Bros BROS,

Chipotle Mexican Grill

In an era where people put a lot of emphasis on “authenticity,” Chipotle’s CMG,

In short, the chain is quite popular. So any uptick in dining will help it more than other chains. The company also has a lot of room to expand. It says it will ultimately double the 2,892 restaurant count it had at the end of the third quarter. Chipotle trades 25% below the consensus analyst price target of $2,000.

Yum China Holdings

China isn’t shy about imposing lockdowns to slow the spread of Covid — especially ahead of the winter Olympics scheduled for February. This hurts Yum China YUMC,

Yum China has a lot of expansion potential because its brands are so popular. KFC is the largest quick-service restaurant brand and Pizza Hut is the largest casual dining restaurant brand in China, by sales. Yum has been in China since 1987, so it understands how to expand there. In the third quarter it added 524 stores bringing the count to 11,415 in over 1,600 cities. Yum posted third-quarter sales growth of 9%, even though same-store sales declined 7% because of the delta variant. Yum China stock trades at 30% below the consensus analyst price target of $68.50.

Brinker International

This company’s EAT,

Sales growth is on the low end of the names listed here, at 5.5% in the third quarter compared to 2019. Its store-opening plans are fairly modest, too — 15 to 21 outlets this year on a base of around 1,650. But Brinker is worth considering since its stock goes for 27% below consensus analyst estimates of $51.90. As a low-end restaurant, it stands to benefit more from income growth. “Chiliheads” paid $8-$20 for entrées last year.

First Watch Restaurant Group

I always tell subscribers of my stock letter Brush Up on Stocks (link in bio below) to wait for initial public offerings (IPOs) to turn into busted IPOs before buying. This means they trade below their IPO price. That is what we have with First Watch Restaurant Group FWRG,

Founded in 1987, First Watch specializes in serving fresh breakfast, brunch and lunch dishes. Its motto is “Yeah, It’s Fresh.” No microwave ovens, heat lamps or deep fryers here. Menu items include Quinoa Power Bowl, Avocado Toast and Vodka Kale Tonic. First Watch appeals to younger, healthier and more affluent diners.

Before Omicron, growth was on fire. Third-quarter 2021 same-restaurant sales grew 46.2% compared to 2020 and 19.7% compared to 2019. That gives you an idea of how fast growth might be if the pandemic really does turn into an epidemic. The chain is small, with 428 restaurants as of the end of the third quarter, suggesting a lot of room for rapid growth. It expects to open more than 130 company-owned restaurants through 2024. First Watch trades 42% below consensus price target of $26.20.

Portillo’s

Portillo’s PTLO,

Third-quarter same-restaurant sales increased 6.8%. The chain is small with around 70 restaurants — suggesting room for lots of growth. It plans to grow its outlet count by 10% a year and eventually boost it 10 times to 600 in its core Midwest market and beyond. Portillo’s trades at 42% below consensus price target of $51.30.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested MCD and CMG in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.