But recent events, such as the resignation of the first vice-president of the national assembly, Jean-Marc Kabund, on January 15, 2022, following an alleged raid on his home in Kinshasha by the Republican Guard, signal that divisions are growing within Félix Tshisekedi’s ruling party and point to headwinds to policymaking.

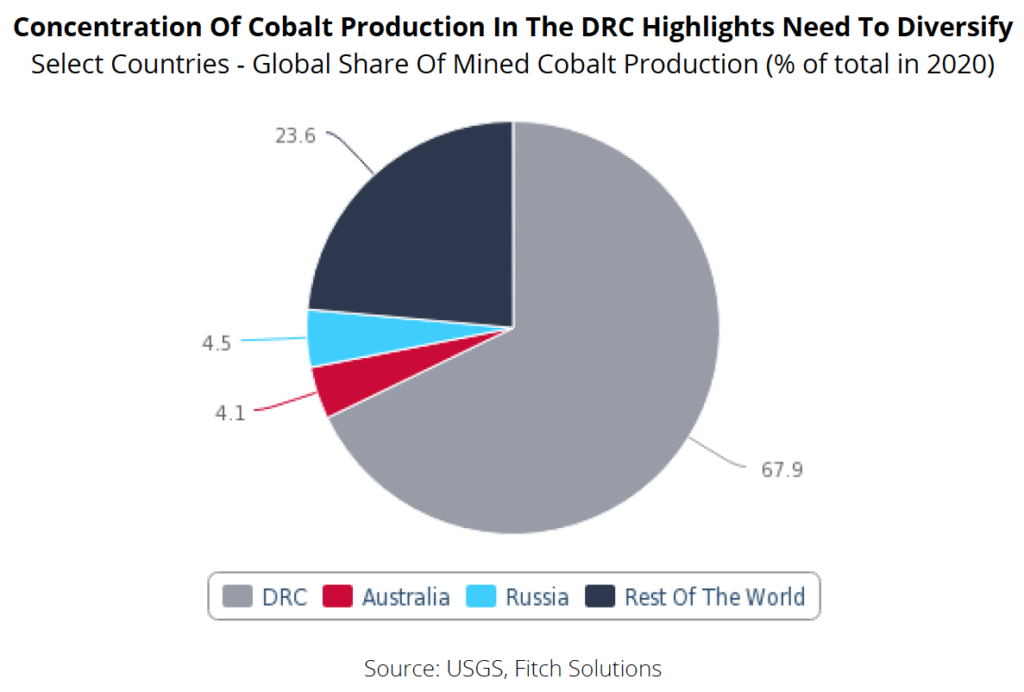

“Along with this comes high supply chain risks as there are concerns linked to the DRC regarding political stability, labour issues, corruption and transparency,” Fitch’s report states. “The next largest producers, Australia and Russia, account for just 4% of global cobalt mine output each. This also indicates that it will be very difficult for battery producers and automakers alike to source cobalt if their supplies from the DRC are disrupted. Additionally, we note that due to the already tight nature of the global battery supply chain, any disruption to cobalt production in the DRC will have a noticeable impact on battery supplies globally.”

In the view of the market analyst, the global cobalt supply chain is set to remain highly geographically concentrated in the coming years – in the DRC for mine production and in China for refining -, a situation that will likely pose procurement challenges for battery manufacturers.

Fitch’s experts point out that although there are a number of new cobalt projects expected to come online in the next decade, risks to the completion of these projects abound. They believe that since many of such projects are still in the pre-feasibility stage, especially in Australia, they may not reach fruition in the end due to a lack of funding or environmental opposition.

Within this context, the research firm expects automakers and battery producers to increasingly look for creative solutions such as batteries that do not require cobalt and nontraditional sources of cobalt such as battery recycling and mine waste processing.

“Indeed, in December 2021, Cobalt Blue signed an agreement with Australia to assess the potential for the recovery of cobalt and any coexisting base and precious metals from mine waste,” the document reads.

Recycling

Although recycling is seen as a valid alternative to low cobalt supply and as a mechanism to diversify the global battery supply chain, Fitch believes that it will take several years to establish and ramp upscale.

“We forecast that there will be 16 operational recycling projects globally in 2022 with a total capacity of 55.4GWh,” the report states. “However, when the current recycling capacity is compared with the global demand for EV batteries, which we expect will reach 336.7GWh in 2022, it becomes clear that recycling is not currently able to provide automakers with sufficient metals supplies in the near term.”

Fitch remarks that these limited recycling capabilities have led some battery manufacturers such as China’s GEM to renegotiate deals with commodity suppliers to ensure a steady supply of essential metals.

“In the case of GEM, they are currently negotiating with Glencore to secure a third of their total cobalt supplies,” the dossier details.