More ETF Alternatives To ‘ARKK’

With growth stocks stumbling out of the gates this year, the ARK Innovation ETF (ARKK) has been hit hard, losing more than 50% off of its 52-week highs.

It is also now significantly underperforming the passively managed Invesco QQQ Trust (QQQ) over the trailing three years, casting doubt on the ability for Cathie Wood’s active approach to add alpha over the long term.

Assets under management for the firm have fallen to $25 billion, making it the 17th largest ETF issuer by brand. And while this asset level is still impressive, especially taking into account that ARK only offers nine ETFs, this is a substantial drop from last February, when ARK was the seventh largest.

As noted by ETF.com in October, investors have no shortage of other ETFs to choose from that target the next generation of disruptive technology space. And several of these ETFs have weathered the recent market storm better than ARKK.

New Kid On The Block

One of the newest entrants to the space is the Goldman Sachs Future Tech Leaders Equity ETF

(GTEK). The fund launched in September 2021 and has gathered $250 million in assets so far.

Like ARKK, the fund is actively managed and takes a global view, investing in potentially growing technology companies that are expected to drive tech innovation around the world.

As far as past performance, GTEK has not sunk nearly as much as ARKK. Since launch, GTEK has dropped by 13.8%, while ARKK is down 32.4% in the same time frame.

Looking ahead, GTEK’s portfolio could benefit from an environment where international equities are positioned to potentially outperform domestic equities. A third of GTEK’s portfolio is invested outside of the U.S.

Courtesy of FactSet

Due to ARKK’s go-anywhere approach, its regional allocation could shift rapidly. But in spite of its global flexibility, nearly all of ARKK’s portfolio is currently held within U.S. companies.

Another Global Option

The Innovator Loup Frontier Tech ETF (LOUP) is another global take on the space, tracking an index of developed and emerging market stocks that are involved in new technologies such as AI, robotics, VR and autonomous vehicles.

This fund launched in July 2018, giving it more than three years of performance history. And while the fund didn’t experience gains to the same degree ARKK did over the course of 2020, the fund is now ahead of ARKK since its inception.

Both GTEK and LOUP seek to avoid mega-cap tech giants, excluding companies above a certain market cap. GTEK draws the line at $100 billion, while LOUP excludes companies that have over $250 billion in market cap.

On a somewhat contradictory note, the ETF Comparison Tool shows that LOUP is skewed toward smaller companies relative to GTEK.

(For a larger view, click on the image above)

Katie Koch, co-head of the Fundamental Equity business within Goldman Sachs Asset Management, explains why excluding mega-cap tech names is important.

“We passionately believe the list of the dominant tech franchises 10 years from now is going to look very different from the list today,” she explained. “Specifically, it’s going to be more global, and it’s going to be from parts of the tech ecosystem that aren’t as represented at the top of the league table.”

BlackRock’s Active Take

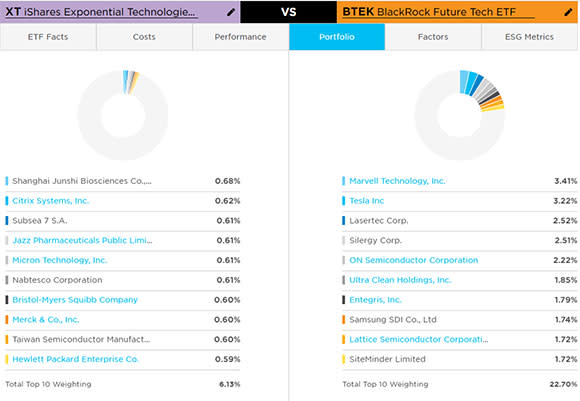

While BlackRock has had success with the passive iShares Exponential Technologies ETF (XT), BlackRock also offers an active take on the space. The BlackRock Future Tech ETF (BTEK) targets global technology companies that develop innovative and emerging technologies.

“When we look at the growth of the space, we think there’s room for active and index here,” said Jeff Spiegel, iShares’ head of megatrend and international ETFs. “We’re the only major player that offers both, and we want to be positioned for the growth of both whichever way this market evolves.”

Similar to GTEK, about one-third of BTEK’s portfolio is invested outside of the U.S.

Courtesy of FactSet

Since the fund’s launch in September 2020, BTEK has outperformed ARKK, gaining 12.0%, while ARKK has fallen by 13.1%.

XT has risen by nearly 28.0% over that same time frame, with recent performance in particular allowing it to outperform BTEK’s active approach.

However, these ETFs offer different exposures, with no overlap between the top holdings of either fund.

Courtesy of FactSet

(For a larger view, click on the image above)

This leaves open the possibility to combine these ETFs, employing both an active and passive approach to the disruptive technology space within an investor’s portfolio.

Crowded Market

The disruptive tech ETF space has become increasingly crowded, and while ARK has unparalleled name recognition and star power, a prolonged period of underperformance is likely to dull its shine. As other ETFs continue to do a better job weathering the market chop, funds such as those mentioned above could appeal to investors who are choosing to jump ship.

Contact Jessica Ferringer at [email protected] or follow her on Twitter

Recommended Stories