The steelmaking ingredient’s most-traded May contract on China’s Dalian Commodity Exchange ended daytime session 7.6% higher at 829 yuan a tonne, after earlier touching 830 yuan, its strongest since Aug. 31.

Front-month March iron ore on the Singapore Exchange leapt as much as 7% to hit a contract high of $147.25 a tonne.

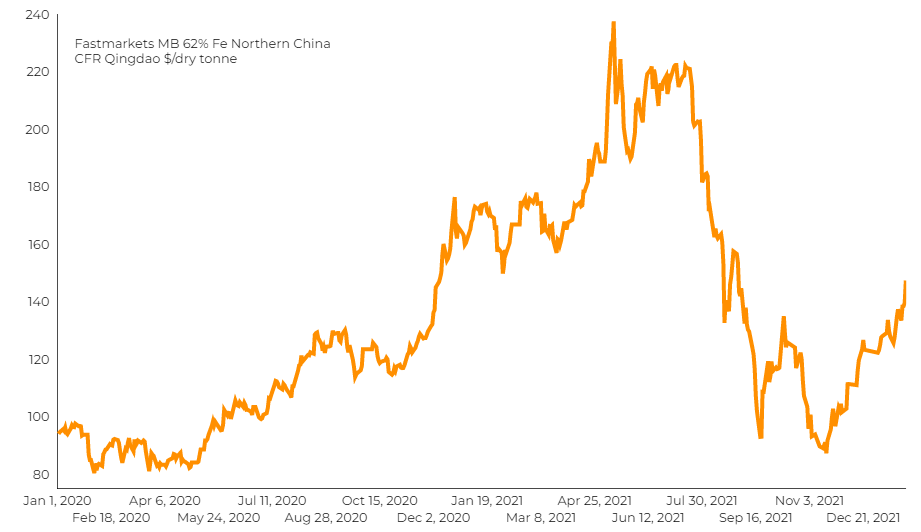

Spot prices also rebounded strongly, with the benchmark 62%-grade material climbing to $140 a tonne on Thursday, the loftiest since Sept. 3, according to SteelHome consultancy data.

China’s output is expected to rise in the first half of 2022, before declining in the second half, S&P Global Platts reported citing industry sources and market participants.

Despite China’s ambitious low-carbon goals, President Xi Jinping has said “reducing emissions is not about reducing productivity, and it is not about not emitting at all.”

Related Article: China jails almost 50 steel executives for faking emissions data

“This has once again ignited hopes for a revival in raw material demand, which would be more visible post-February,” after the Beijing Winter Olympics, ING commodities strategists said in a note.

Warnings by major miners Fortescue Metals Group, BHP Group and Rio Tinto of coronavirus-led labour shortages in Australia added fuel to iron ore’s rally.

(With files from Reuters)