Here’s one take on how to catch a falling knife after the growth stock crash

It was in this column on Wednesday morning that we quoted George Saravelos, global head of currency research at Deutsche Bank, warning the market should be more focused on the Federal Reserve’s balance sheet, and how quickly it decides to unwind it, than the central bank’s forecasts on interest rates.

Minutes from the December Federal Open Market Committee, released later in the day, proved that warning correct, as they showed that not only could the balance sheet get reduced soon after rates started rising, but at a faster pace than the previous winddown effort. The Nasdaq Composite COMP,

Bonds also fell, though less drastically as the heavy selling occurred earlier in the week. (Proving the adage that the smart money is in the bond market correct once again.)

Tim Duy, the chief U.S. economist at SGH Macro Advisors, said his read of the minutes is it won’t take much now for the Fed to declare victory on the employment front — particularly with a big report due Friday — that will clear the way for an interest-rate hike in March.

Duy also remarked that were no more dovish voices on inflation. “It matches our view that the consensus has moved markedly in a hawkish direction and most likely any new personnel will fall in line with that consensus,” said Duy. On the balance sheet, he remarked that “this conversation indicates the Fed is considering going sooner, faster, and further with [quantitative tightening] than in the last cycle.” Remember during the last balance sheet tightening, the Fed waited until rates were at 1% before reducing the balance sheet.

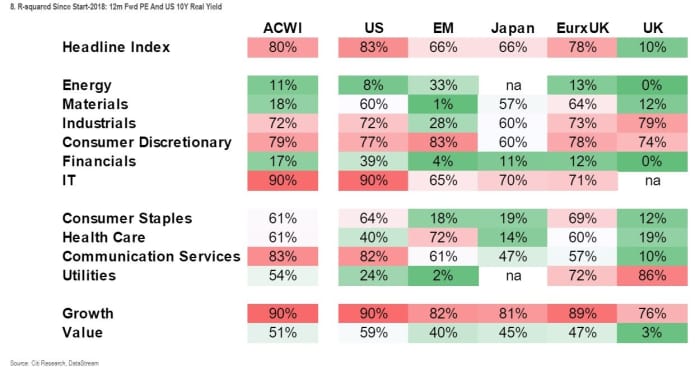

In a report in November, strategists at Citi ran a correlation of the 10-year Treasury inflation-protected security yield to price-to-earnings ratios, since 2018. By far the highest correlation was in U.S. techs, while the least correlated were U.K. energy and financials. So the pain for growth companies may continue for some time.

The correlation of real yields to stock market sectors.

An interesting take came from Michael Batnick, director of research at Ritholtz Wealth Management, who wrote a blog on rules about buying crashing growth stocks.

First, he sounded a note of buyer’s regret, twice buying Robinhood HOOD,

“Fundamentals didn’t keep a ceiling on these stocks when they were rising, and fundamentals won’t put a floor on these stocks when they’re falling. When high multiple stocks are being liquidated, it’s best just to stay away,” he said.

Wait, forever?

“If you’re going to put on a full position, whatever that is for you, you have two choices. Either give the position a tight leash, say 10-15%, or whatever you’re comfortable with. Or, give yourself multiple years for this thing to bounce back. Not months. Years. And understand that it might never come back,” he said.

The buzz

Reaction to the Fed meeting, and positioning ahead of Friday’s jobs report, is likely to still dominate Thursday’s session.

Jobless claims rose a seasonally adjusted 7,000 to 207,000, while the U.S. trade deficit was wider than forecast in November at $80.2 billion.

Speeches from San Francisco President Mary Daly and St. Louis Fed President James Bullard, and more economic data including on services, will come after the open.

Bed Bath & Beyond BBBY,

Walgreens Boots Alliance WBA,

Stryker SYK,

The unrest in Kazakhstan has led to the deaths of dozens of protesters and at least a dozen police officers.

On the first anniversary of the Capitol Hill riot, former President Jimmy Carter warned of a widening abyss and a genuine risk of a civil conflict.

Tennis star Novak Djokovic spent a day in a hotel room waiting for a court ruling on whether he will be deported from Australia before the Australian Open tournament.

The market

Markets weren’t doing terribly in the early hours, following Wednesday’s selloff. Nasdaq-100 NQ00,

Top tickers

Here are the most active stock-market tickers on MarketWatch, as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| NIO, |

NIO |

| AAPL, |

Apple |

| BABA, |

Alibaba |

| NVAX, |

Novavax |

| NCM, |

Newcrest Mining |

| NAKD, |

Cenntro Electric |

| AMZN, |

Amazon.com |

Random reads

The weird story of the man who stole unpublished book manuscripts, but didn’t seem to sell them.

Women are thriving as stand-up comics in China (subscription required).

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.