Drugstores struggle to keep Covid at-home tests in stock as omicron rages across U.S.

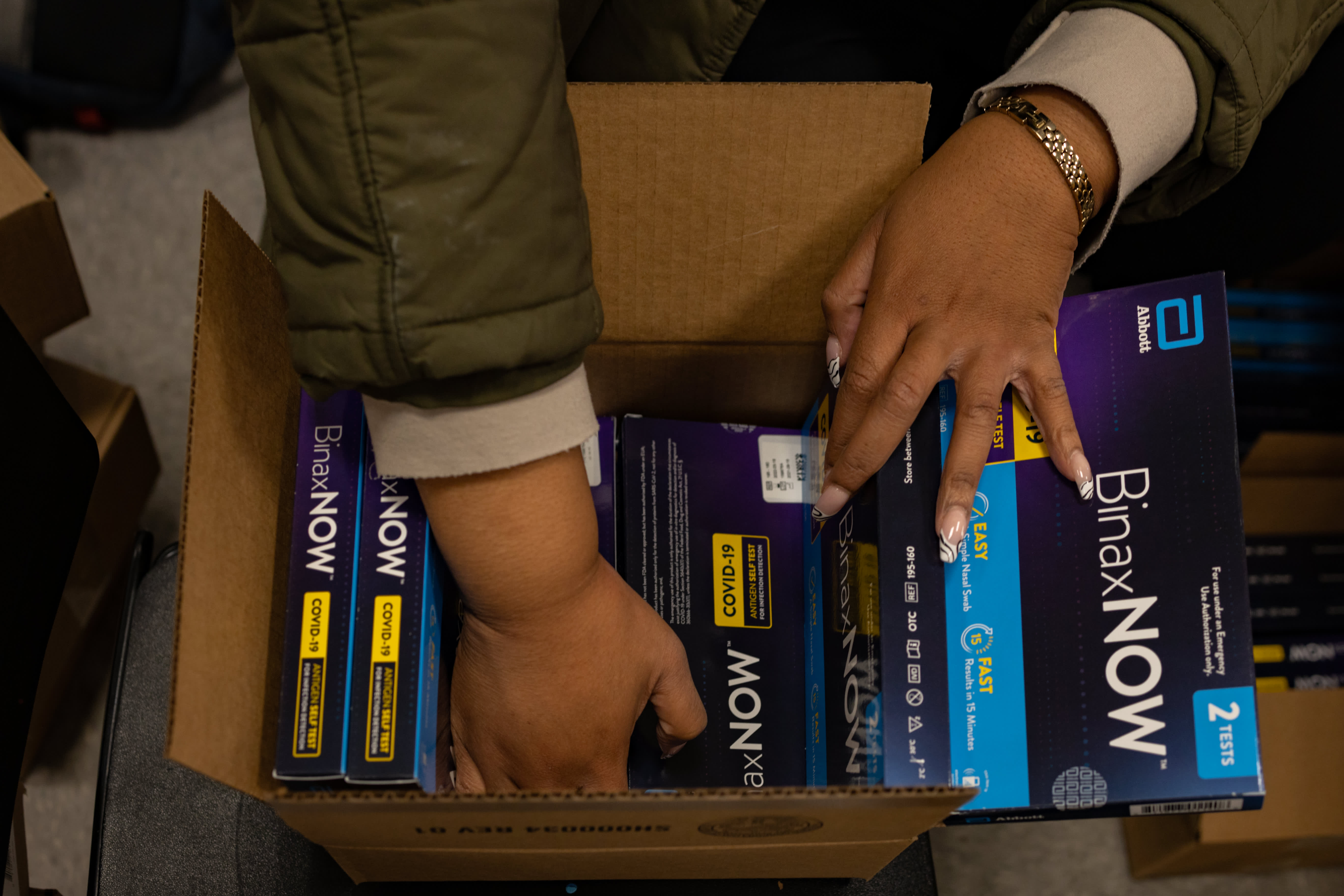

Health workers distribute free rapid at-home Covid-19 test kits at a vaccine clinic in Philadelphia, Pennsylvania, U.S, on Monday, Dec. 20, 2021.

Hannah Beier | Bloomberg | Getty Images

George Panagiotopoulos has been struggling to keep at-home Covid-19 tests in stock at neighborhood pharmacy Broadway Chemists in New York City as cases surge to record highs across the state and in the U.S.

A shipment of 200 tests received the Saturday before Christmas sold out “within a couple of hours,” he said.

Panagiotopoulos, who owns the pharmacy, had a list of 110 people waiting for him to restock at-home tests the Tuesday before Christmas. The 150-kit shipment arrived two days late and sold out within 48 hours, he said. Broadway Chemists received another shipment of 150 tests last Thursday, but most of them were gone in a day.

As of Friday afternoon, the pharmacy had just 20 to 30 tests left in stock. Panagiotopoulos expects demand to remain high as schools reopen after the holidays and parents rush to get their kids tested.

His experience is playing out in Covid hotspots across the country as infections have reached all-time highs in the U.S., driven largely by the highly contagious omicron variant.

‘Tsunami of demand’

Bidding war

Abbott, which received emergency approval from the FDA for its BinaxNOW home test in March, is experiencing “unprecedented demand,” said spokesman John Koval.

“We’re sending them out as fast as we can make them,” he said. “This includes running our U.S. manufacturing facilities 24/7, hiring more workers and investing in automation,” he said.

Shaz Amin, the founder of a company that sells at-home tests online, said the surge in demand has allowed distributors to hike prices as buyers like his company, WellBefore, are basically locked in a bidding war to secure limited supply.

“Whatever we were paying for test kits a week ago, we’re paying 25% higher today,” said Amin. “Someone is in line behind us saying, ‘I’ll give you 25 cents more to take what WellBefore’s allocation is.'”

Amin said the shortage means that Covid test kits are sold before they even arrived.

Payment up front

Ryen Neuman, vice president of logistics at Sunline Supply and Arnold’s Office Furniture, a company that turned to supplying PPE and test kits for clients during the pandemic, said they normally pay a 10% deposit on an order for health and safety products and then the rest when it arrives.

But for Covid test kits, they “have to pay 100% of the product prior to even seeing it, looking at it, smelling it, anything,” because tests are in such high demand, he said, noting that he thinks the market for test kits will be “tight” for at least six months.

“It just seems as though the production is not able to ramp up to what the American population needs right now,” he said.

Several wholesale buyers said they are trying to stock some of the lesser-known brands that have been approved for sale by the Food and Drug Administration and work similarly to name-brands Covid tests like Abbott’s BinaxNOW and Quidel’s QuickVue. Neuman, for example, said some distributors of the more popular tests are overcharging, making the lesser-known brands more appealing.

Shortage of raw materials

Matt Regan, president and CEO of medical goods distributor Code 1 Supply, said Thursday that components for test kits dried up over the previous seven to 10 days. Regan said business partners have told him say there’s a shortage of raw materials for the test kits. They’ve also told him that distributors are prioritizing orders from federal agencies over other buyers, he said.

Three other companies that sell Covid at-home tests that spoke with CNBC, including iPromo, Sunline Supply and nonprofit Project N95, said they were similarly told the Biden administration’s new plan to supply 500 million at-home tests to the public was delaying their own shipments. But the White House said its plans should not hamper existing agreements between private parties.

“Because we have this additional capacity, we can make this purchase without disruption to supply to existing manufacturers’ commitments to states or organizations,” a White House official said in a statement to CNBC.

Quickly ramping up test manufacturing, however, is difficult, said Steven Tang, CEO of rapid test manufacturer OraSure Technologies. There’s a shortage of several test components, he said, and staffing up to add more shifts to churn out more tests is a challenge when demand fluctuates so much.

“Way back in in in May and June, when we thought that vaccines were going to take care of everything, people began to decrease the amount of supply and decrease the amount of labor and shifts,” Tang said. Demand for testing started to rise again heading into the fall, he said. “Businesses, particularly ones that are scaling up, thrive when there is there is consistency of demand and the predictability. We are not in a consistent predictable situation right now,” he said.

Ramping production

To be sure, test kit manufacturers are ramping up production, and new companies are awaiting approval from the FDA to start selling their tests to the public. So some wholesalers are hopeful Covid tests should be more readily available in the coming months.

Amin, of WellBefore, said the nation will be in a “better place” on testing by the second quarter, if not sooner if the FDA authorizes more tests in the coming weeks.

Anne Miller, executive director of nonprofit Project N95, thinks the testing crunch will begin to ease by the middle of this month.

Meanwhile, one of the nation’s largest test makers, Abbott, is ramping up supply. It’s targeting 70 million BinaxNOW rapid tests in January, up from 50 million in December, spokesman Koval said, adding that the company can also “scale significantly further in the months ahead.”

-CNBC’s Sevanny Campos contributed to this report.

WATCH: Biden administration to distribute 500 million free at-home Covid tests