Dow falls about 200 points as worst market sell-off since March 2020 continues

The market is set to wrap up a roller-coaster week with the S&P 500 headed for its worst month since March 2020.

The Dow Jones Industrial Average fell about 230 points, or 0.7%. The S&P 500 fell 0.4%. The Nasdaq Composite dipped 0.4%.

The S&P 500 is wading into correction territory, down more than 10% from its intraday record. The Nasdaq sits more than 18% from its high.

The major averages have experienced outsized swings each day this week — including the Dow making up a more than 1,000-point intraday deficit to close higher on Monday for the first time ever.

“It has been a frustrating week for investors. It’s kind of this push-pull or tug-of-war between bulls and bears,” Darrell Cronk, chief investment officer for wealth and investment management at Wells Fargo, told CNBC’s “Squawk on the Street.” “The lows may not be in yet on this kind of correction.”

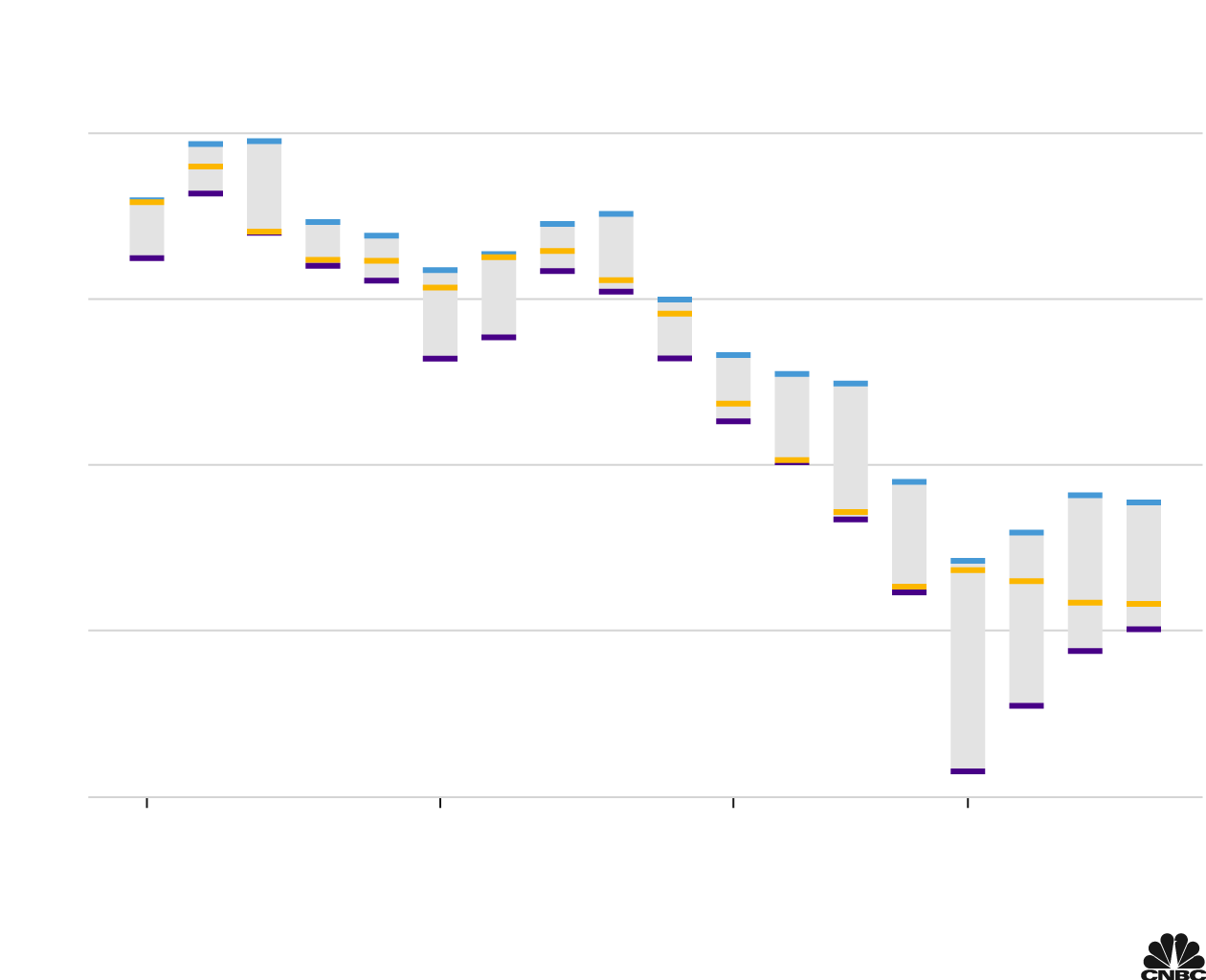

The Dow’s daily swings

High, low, and closing levels for the Dow Jones Industrial Average

Chart: Nate Rattner / CNBC

Source: FactSet. As of Jan. 27, 2022.

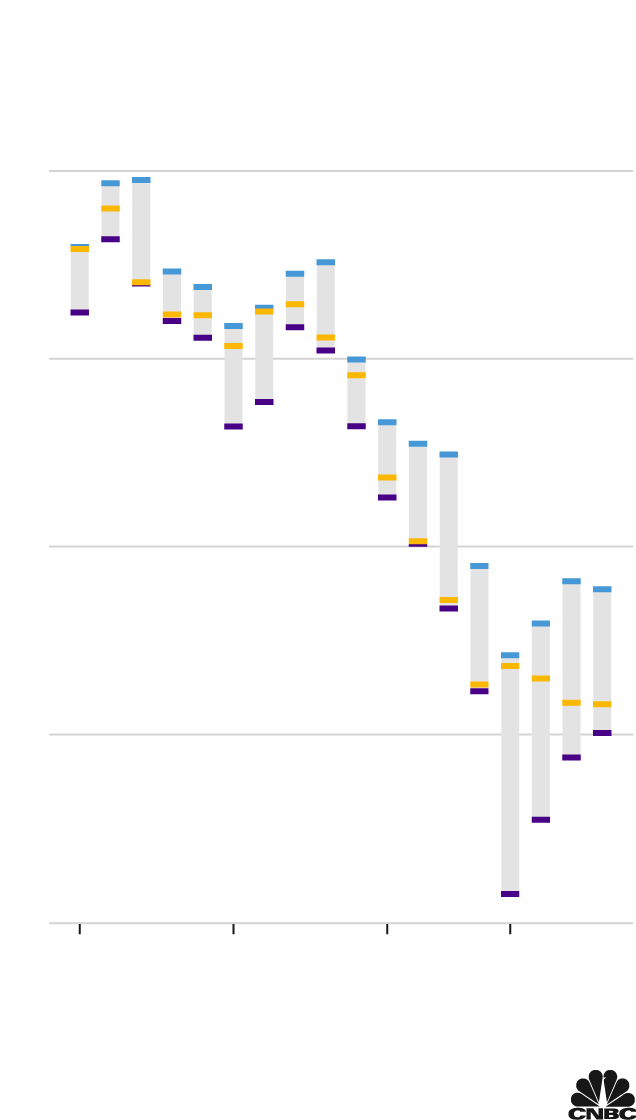

The Dow’s daily swings

High, low, and closing levels for the Dow

Jones Industrial Average

Chart: Nate Rattner / CNBC

Source: FactSet. As of Jan. 27, 2022.

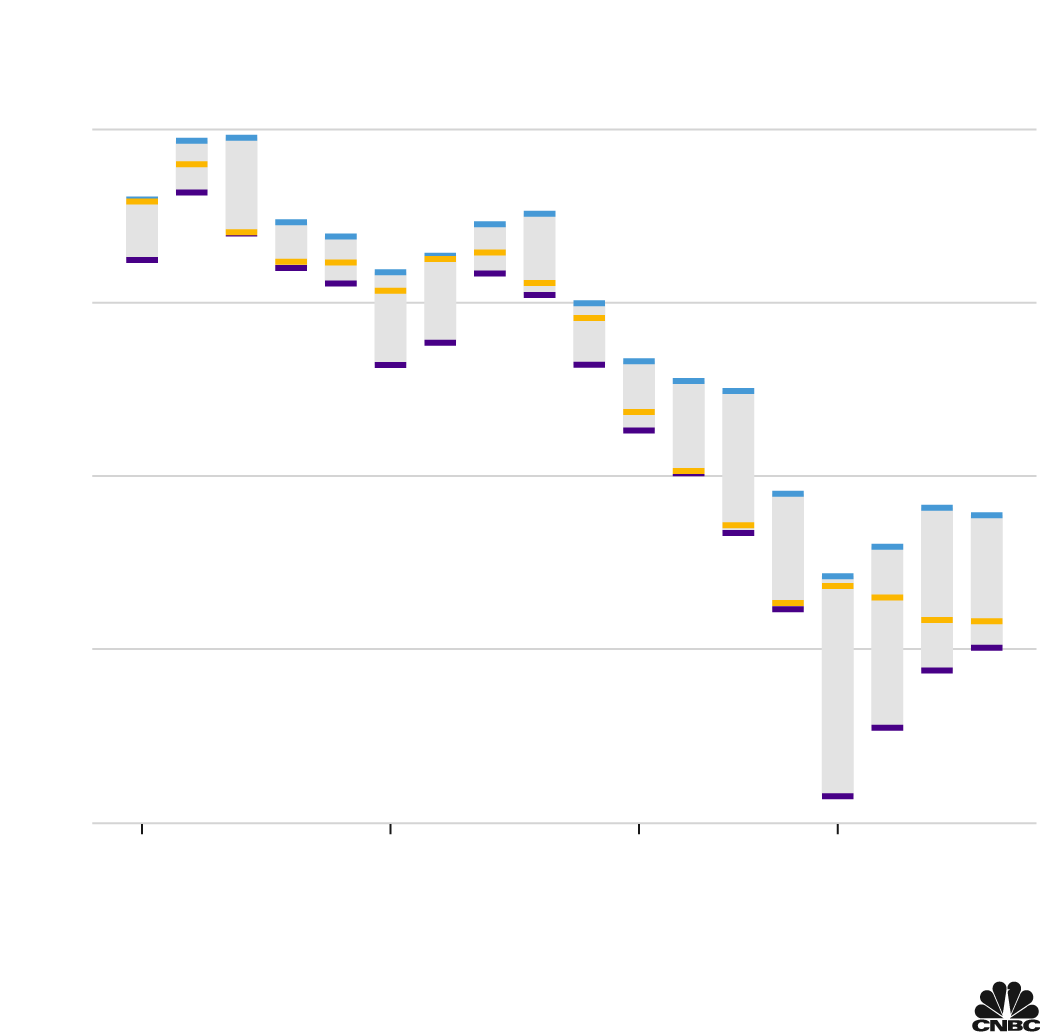

The Dow’s daily swings

High, low, and closing levels for the Dow Jones Industrial Average

Chart: Nate Rattner / CNBC

Source: FactSet. As of Jan. 27, 2022.

The Dow and S&P 500 are both headed for four consecutive losing weeks. The Nasdaq Composite has dropped 3% this week, on track for its fifth straight negative week.

The Russell 2000, the small-cap benchmark, is in a bear market, finishing Thursday down 20.9% from its record close.

With January ending Monday, the tech-heavy Nasdaq is headed for its worst month since October 2008 and worst first month of the year of all time. The S&P 500 is on pace for its weakest month since March 2020 and weakest January of all time. The Dow could see its worst month since March 2020 and worst January since 2009.

Loading chart…

The market’s fear gauge, the Cboe Volatility Index, shot up to its highest level since October 2020 earlier this week and has traded above 30.

Investors continued to digest the Federal Reserve’s pivot to tighter policy.

The Federal Open Market Committee indicated Wednesday that it likely soon raise interest rates for the first time in more than three years as part of a broader tightening of historically easy monetary policy. Markets are now pricing in five quarter-percentage-point interest rate hikes in 2022, though the long-range expectation for rates is little changed.

“The FOMC meeting did not bring any surprises in terms of monetary policy, however, it may be perceived as more hawkish than expectations owing to Chair Powell’s suggestion of a need to enter a ‘steady’ phase of policy normalization,” Chris Hussey, a managing director at Goldman Sachs, said in a note.

Shares of Apple rose more than 3% after the company reported its largest single quarter in terms of revenue ever even amid supply challenges and the lingering effects of the pandemic. Apple beat analyst estimates for sales in every product category except iPads.

Chevron shares fell more than 3% after missing Wall Street earnings expectations. Dow component Caterpillar dipped more than 4% even after it topped profit estimates.

December’s core personal consumption expenditures price index, the Fed’s preferred inflation gauge, jumped 4.9% from the year prior, the Commerce Department reported Friday. The PCE jump is higher than economists expected and the hottest reading since September 1983. Along with the inflation numbers, personal income rose 0.3% for the month, a touch lower than the 0.4% estimate.