Copper price heads for biggest weekly fall in three months

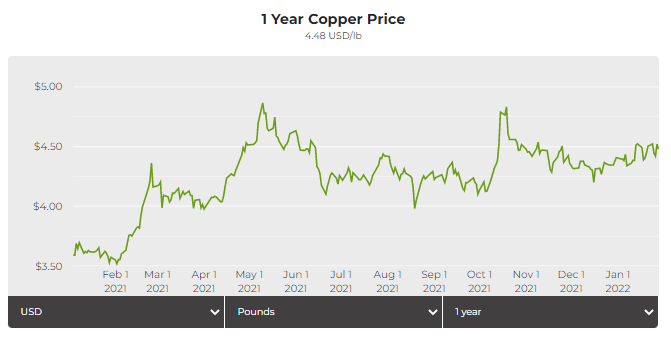

March delivery contracts were exchanging hands for $4.31 a pound ($9,482 a tonne) on the Comex market in New York, down 2.5% compared to Thursday’s closing.

Benchmark copper on the London Metal Exchange (LME) was down 1.9% at $9,598 a tonne by 1201 GMT and down by about 3.5% this week.

Mining stocks also slid, with Freeport-McMoRan down 12.9% from the previous week, First Quantum Minerals down 12.6%, and Ivanhoe Mines down 10.8%.

“Price weakness could last through China’s New Year public holiday next week, typically a time of low demand,” said Saxo Bank analyst Ole Hansen.

“However, the longer-term outlook remains positive, with a global transition from fossil fuels to copper-intensive electrification likely to boost demand.”

Related Article: Add another 1m tonnes to annual copper demand from EVs

UBS analysts said they still expect industrial metals prices to rise by 10–15% this year.

“We expect almost all metal markets to be undersupplied,” they said.

(With files from Reuters)