Used historically as a pigment, due to its luminous blue colour, the metal’s main use today is in the precursors and cathodes of rechargeable batteries (56% of total consumption as of 2021). Employing cobalt as the cathode of rechargeable batteries efficiently improves their energy density, power, and performance as compared to batteries that lack cobalt.

Cobalt is also used in the manufacturing of nickel‐based alloys (13% of total consumption) which are used extensively in the aerospace industry, tool manufacturing (8% of total consumption) and finally smaller amounts in pigments, soaps and as catalysts.

The end use of cobalt is primarily in portable electronics (36.3% of global consumption), such as smartphones and laptops, while automotive applications also account for a major share (23%) and Fitch expects the latter to drive cobalt demand in the coming decades.

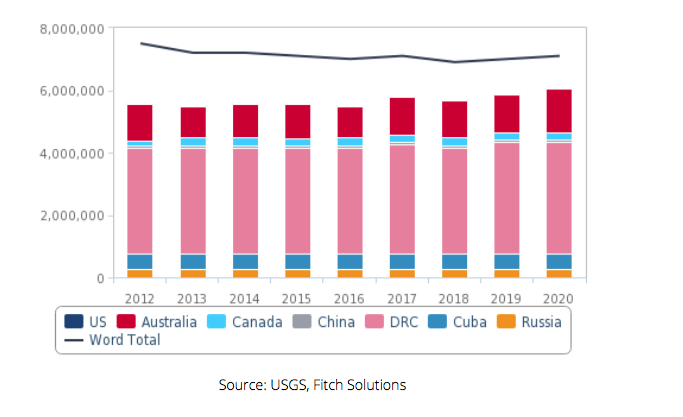

Cobalt is recovered mainly as a by-product of copper and nickel mining, with its availability dependent on the ongoing mining of its host metals. Stratiform sediment-hosted copper-cobalt deposits, mostly in the DRC and Zambia, represent the world’s largest source of cobalt, followed by nickel-cobalt laterite deposits (mainly found in Australia, Cuba, New Caledonia, Madagascar, Papua New Guinea and the Philippines) and lastly magmatic nickel-copper-cobalt-PGM deposits (mainly Canada, Russia and South Africa), Fitch notes.

While cobalt-rich crusts on the ocean floor could contain as much as 1bnt of cobalt resources, deep-sea mining is still in its infancy given obvious technological and economic constraints.

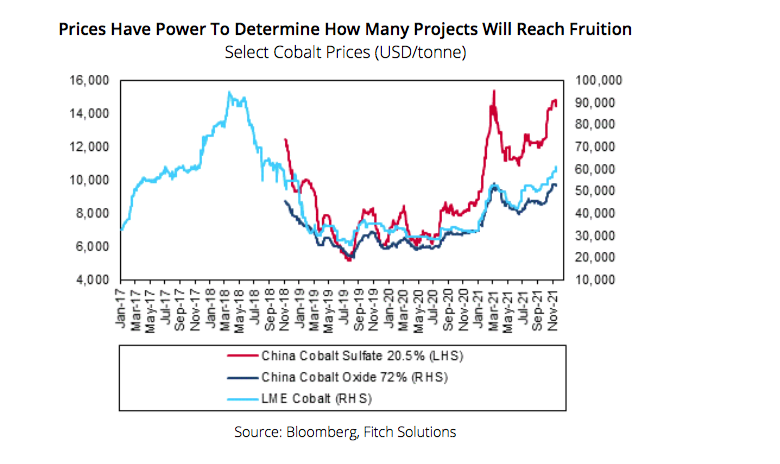

Upward price trajectory to boost production

Fitch expects prices of cobalt sulfate will remain on an uptrend in the coming 2-3 years as demand from battery manufacturers continue to outstrip supply despite a healthy pipeline of cobalt sulfate projects set to come online from 2023-2024 onwards. This, the analyst says, will support production and investment into new projects.

China’s accelerated New Electric Vehicles uptake will largely drive global cobalt sulfate demand in the short to medium term, Fitch says, while increasing EV penetration in Europe in the coming decade will support demand over the longer term. While Fitch expects a production boost to occur from existing projects in the pipeline coming online in three-five years onward, prices will remain on an upward trajectory as demand will also accelerate in tandem.

However, there is currently a solid global project pipeline, due to the rise in cobalt prices and the expected demand boom amid the proliferation of battery manufacturing projects, which will aim to diversify to some extent production channels, Fitch says.

Australia holds significant growth potential in the cobalt-producing landscape, with multiple integrated cobalt projects in the pipeline. Fitch sees limited production growth in Europe and North America in the coming years due to the lack of resources and projects. The battery revolution, the analyst points out, will increasingly dictate cobalt production trends, with most of global refined cobalt being converted to chemical forms that are used in rechargeable batteries as opposed to cobalt metal that is mainly used in other industries.

While Fitch holds an optimistic view on new cobalt projects that are expected to come online over the next decade, the analyst highlights that risks to the completion of these projects are abound. Many are still in the pre-feasibility stage, especially in Australia, and may not reach fruition in the end due to lack of finance or environmental opposition for instance. Global cobalt projects are also likely to face environmental scrutiny, Fitch says, whereas the possibility of batteries without cobalt might dampen the metal’s demand outlook and prices altogether.

(Read the full report here)