Co-CIO at Ray Dalio’s Bridgewater on how much deeper the S&P 500 would need to dive to get the Fed’s attention

U.S. stocks are moving higher, as investors continue to chew over the outcome of the Federal Reserve policy meeting on Wednesday.

Some saw rather hazy guidance from Chairman Jerome Powell, who said he was “of a mind” to hike interest rates in March, but made no commitment. Then he also hinted at a rate hike at each coming meeting, if needed. Clear as mud?

Here’s one problem, according to Northman Trader’s Sven Henrich: “The Fed having been wrong and being behind the curve, yet afraid to upset markets further with decisive and quick action, is making things worse as it prolongs the damage from inflation becoming more entrenched. It’s like waiting for cancer to metastasize.”

So for now, maybe investors should just count on choppy markets in the foreseeable future.

What kind of market selloff would it take to get alarm bells ringing at the Fed? Try another 20% or so, says our call of the day from Greg Jensen, a co-chief investment officer alongside Ray Dalio and Bob Prince at Bridgewater Associates.

“Some decline in asset prices is not a bad thing from the Fed’s perspective, so they’re going to let it happen,” Jensen told Bloomberg in an interview that published Thursday. “At these levels, it would take a much bigger move to get the ‘Fed put’ into the money. They’re a long way from that.”

Jensen estimates a 15% to 20% drop would get the Fed’s attention, and that it depends on how fast that happens, as he noted recent declines have been “healthy” as they’ve taken out bubbles in cryptocurrencies and elsewhere.

The S&P 500 SPX,

For now, lots of analysts and investor have written off a so-called “Fed put” option on the view that Powell and Co. are boxed in by soaring inflation and have no choice but to tighten up monetary policy. A figurative put option would see the central bank stepping in with monetary easing in the case of a bear market that threatened instability in the financial system.

Many have lobbed criticism at central banks for getting investors and markets hooked on cheap money over the years. They have warned that an adjustment will be hard, especially for the new investors that have come into the market since the start of the pandemic.

Jensen said the recent rout hitting stocks and bonds has been caused by a “liquidity hole,” with “excess liquidity” that had shored up risk assets now being pulled by central bankers, and too few buyers to fill the gap.

He warned that the shape of the economy now means a Fed rescue isn’t likely, as opposed to 2018, when inflation was far lower and companies were pouring on buybacks and raising wages. “We’re at a turning point now and things will be much different.”

Jensen also sees the 10-year Treasury yield hitting 3.5% or 4% before all the excess bonds can be soaked up, and predicts a stagflation type environment, which means investors need more commodities, international equities and Treasury breakevens, and can’t depend on that traditional 60/40 portfolio.

The buzz

Fresh data shows U.S. GDP grew an annual 6.9% in the fourth quarter, but durable goods dropped 0.9% in December. Initial jobless claims fell 30,000 to 260,000. Pending-home sales are still to come.

McDonald’s MCD,

Read: 8 tech stocks poised to bounce after Nasdaq plunge, according to AI platform

Late Wednesday, Tesla TSLA,

Opinion: Why isn’t profit enough for Elon Musk?

Also reporting late, Intel stock INTC,

Netflix NFLX,

Facebook FB,

Shares of Block SQ,

Rocker Neil Young’s music is no longer on Spotify SPOT,

Kyiv Mayor Vitali Klitschko said he was left “speechless” by a German offer of 5,000 helmets for his country, that’s facing down thousands of Russia troops along its borders.

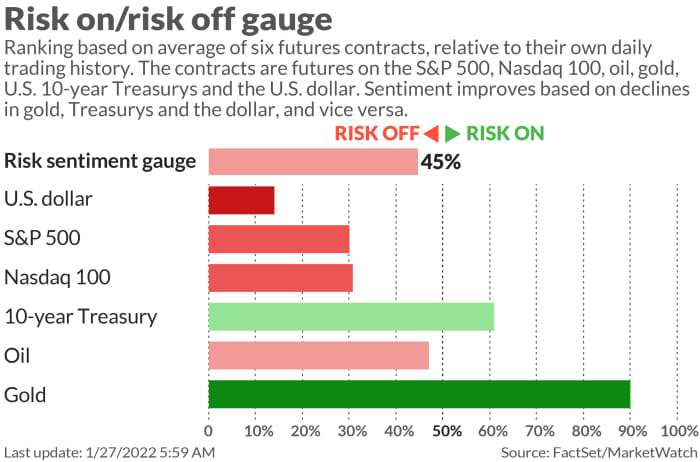

The markets

Wall Street stocks DJIA,

The chart

The selloff in growth stocks over recent weeks may be reaching an end, says Mark Newton, head of technical strategy at Fundstrat, who provides this chart.

“The chart of IShares Small-cap Growth ETF IJT,

Top tickers

Here are the most active stock market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| NIO, |

NIO |

| AAPL, |

Apple |

| NVDA, |

Nvidia |

| MSFT, |

Microsoft |

| XELA, |

Exela Technologies |

| BABA, |

Alibaba |

| NFLX, |

Netflix |

Random reads

Scientists spot “spooky, spinning” pulsating object in the Milky Way

Debris from one of Elon Musk’s SpaceX rockets will crash into the moon in March, says this astronomist.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.