China’s new rules on overseas IPOs will apply to Hong Kong, securities regulator says

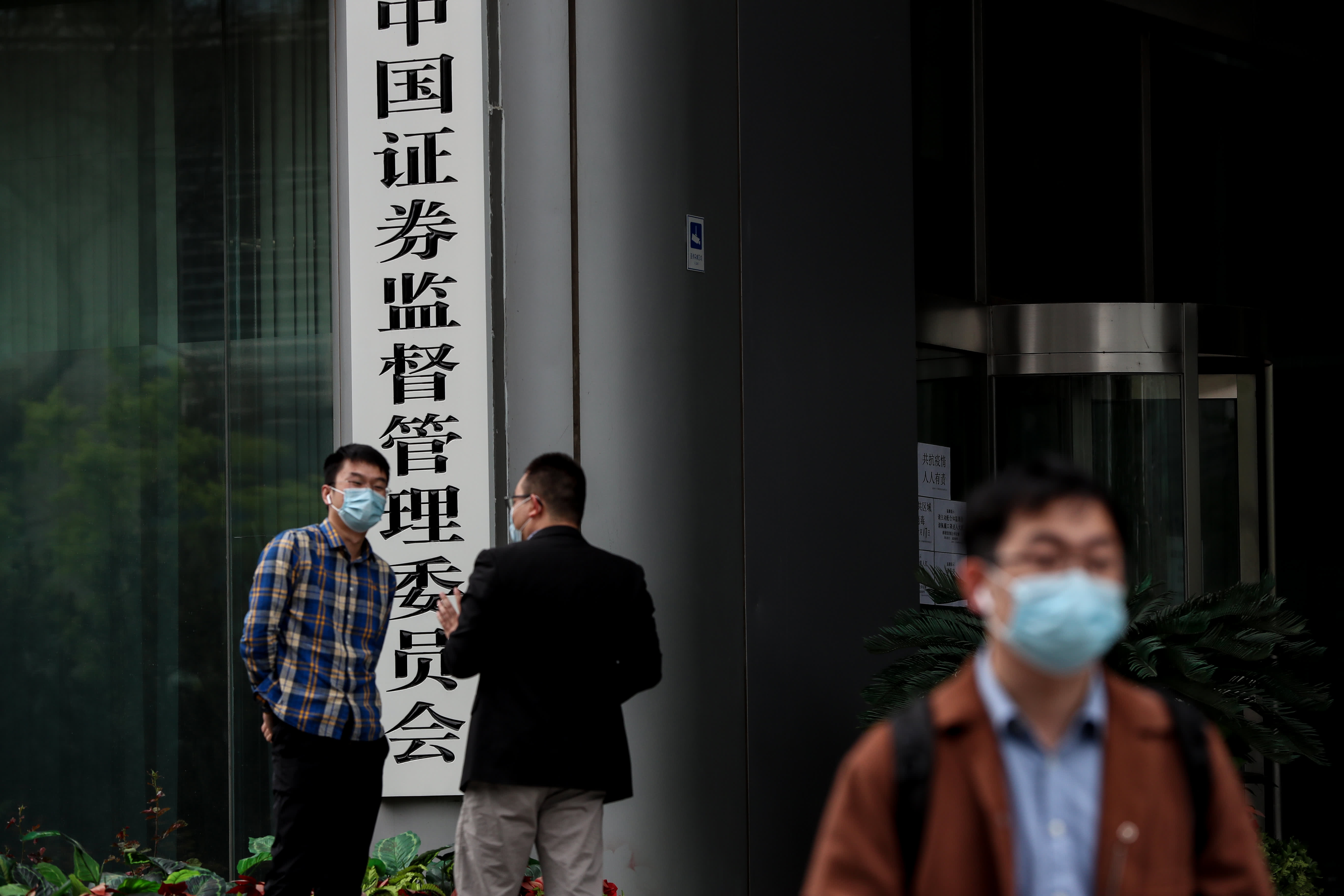

People wear protective masks as they stand outside of the China Securities Regulatory Commission (CSRC) in the Financial Street on April 17, 2020 in Beijing,

Emmanuel Wong | Getty Images News | Getty Images

BEIJING — China’s forthcoming rules on overseas IPOs will apply to Chinese companies that want to list in Hong Kong, the China Securities Regulatory Commission told CNBC on Friday.

In an exclusive interview with CNBC, the commission’s director-general of the international affairs department, Shen Bing, spoke about what draft rules will mean for Chinese companies that are planning to list in the U.S. and other markets following last summer’s crackdown.

“By overseas, we mean, of course, you know, anywhere besides mainland China,” Shen said in a wide-ranging interview. “Of course it includes Hong Kong.”

Shen said the rules would apply not only to Chinese companies wanting to offer H-shares in Hong Kong, but also a category called “red chips,” which previously did not need the CSRC’s approval. H shares refers to stocks issued by mainland China companies that trade in Hong Kong, and red chips are Hong Kong-trade shares of companies that conduct most of their business in the mainland but are incorporated outside mainland China.

Since July 2021, a rush of Chinese IPOs to the U.S. has dried up. In the last several months, Beijing has overhauled the process for letting domestic companies raise money outside its borders through stock offerings.

One reason cited for the changes is national security, which Washington has also cited when it blacklisted some Chinese companies and moved to reduce U.S. investor exposure to stocks allegedly tied to the Chinese military in the last few years.

From Feb. 15, the increasingly powerful Cyberspace Administration of China will officially require data security reviews for certain companies before they are allowed to list abroad.

The CSRC and the State Council — the top executive body in China — have released more comprehensive draft rules, and the public comment period ended on Sunday. As proposed, the rules will require Chinese companies to file with the CSRC before listing overseas, and the commission said it would respond within 20 working days of receiving all materials.

The draft rules state that overseas listings are prohibited in some of the following situations:

- when other government departments consider the offering a threat to national security;

- if there are disputes over the ownership of the company’s major assets; or

- if there’s criminal offense by a controlling shareholder or executive within the last three years.

However, Shen said the rules would “not necessarily” prevent a Chinese company from listing overseas if it operated in an industry subject to restrictions or bans on foreign investment within mainland China.

The CSRC’s priority in 2022 is opening China’s market further to foreigners, Shen said. “Overseas listing is one part of the opening up regime, so I think [that] in itself would also be our priority.”

Slowdown in overseas IPOs

In April 2021, about 60 Chinese companies were looking to go public in the U.S. That rush of New York listings essentially halted in the summer.

Just days after Chinese ride-hailing app Didi‘s roughly $4 billion U.S. IPO in late June, China’s cybersecurity regulator ordered the company to suspend new user registrations and remove its app from app stores.

The regulator had said one reason for the cybersecurity probe was to maintain national security. It is unclear when Didi can resume adding new customers.

We noticed the slowdown of overseas listing since the second half of last year, and we hope that with these new rules, things will resume.

Shen Bing

international department director, CSRC

The company announced in December it plans to delist from the New York Stock Exchange and pursue a listing in Hong Kong, but did not disclose a timeframe.

“We noticed the slowdown of overseas listing since the second half of last year, and we hope that with these new rules, things will resume,” Shen said, declining to comment on specific companies. “We hope the companies would make full use of these new rules, and to resume their listing in any overseas market.”

Shen said he recognized a strength of the U.S. market is “strong inclusiveness for new start-ups in new industries,” even as markets in Greater China have been catching up.

More communication, clearer rules

Another event that rocked foreign investors’ confidence in Chinese stocks and markets was the sudden suspension of Alibaba-affiliated Ant Group’s IPO. The news came less than two days before what would have been a record-setting listing in Shanghai and Hong Kong.

When asked whether the new rules would eliminate the possibility of any IPO being suspended two days before an expected listing, Shen said: “One of the purposes of these rules is to avoid such a situation, [with] more communication and more clear rules.”

Shen confirmed again that Chinese IPOs overseas could use the variable interest entity (VIE) structure. “If they comply with relevant rules and regulations, they can still file with CSRC,” he said. “We will use the inter-departmental regime to verify the compliance issues before giving their filing a response.”

A VIE creates a listing through a shell company, often based in the Cayman Islands, which prevents investors in the U.S.-listed stock from having majority voting rights over the Chinese company.

Many Chinese companies have used the structure to list in the U.S.

Overall, Shen emphasized how the commission would like to keep the filing process “as efficient as possible” and said the commission is working with relevant departments to include more detailed guidance on how companies should communicate with regulators in order to list overseas.

“In this course, we may provide regulatory advice to [the] firms so that they do not waste time to do something that eventually would not be possible,” Shen said. He noted the CSRC’s 20-day response time would be separate from other departments’ review period.

Shen did not say when exactly the final rules would come out or be implemented.

“Relevant authorities have reached quite [a] high degree of consensus over the rules, so we would expect the procedural process for approval would be quite efficient,” he said, and added that he hoped for “early publication” of the final rules.

Investment banks’ concern

Some analysts have raised concerns about how the proposed rules might increase compliance issues for foreign banks that want to work with Chinese IPOs.

But Shen cast the rules as having a “very slight touch” approach in which investment banks need to alert the CSRC when they enter the business of underwriting Chinese IPOs, and annually disclose how many of those overseas listing projects they completed.

“We need to consolidate information [on overseas listings] from different sources,” he said. “From this report of the financial institution, we’ll know that there’s no kind of escape from the regulation.”

Before national security concerns came to the forefront in the U.S. and China, some Chinese companies like Luckin Coffee were forced to delist from overseas markets due to fraud.

In 2018, the American documentary “The China Hustle” estimated that more than a decade ago, pension funds and retirement funds lost at least $14 billion to Chinese stocks that turned out to be frauds. The film called for more regulation based on increased connections between Chinese financial markets with the global system.