Charting the Global Economy: Inflation’s Grip Tightens Further

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Most Read from Bloomberg

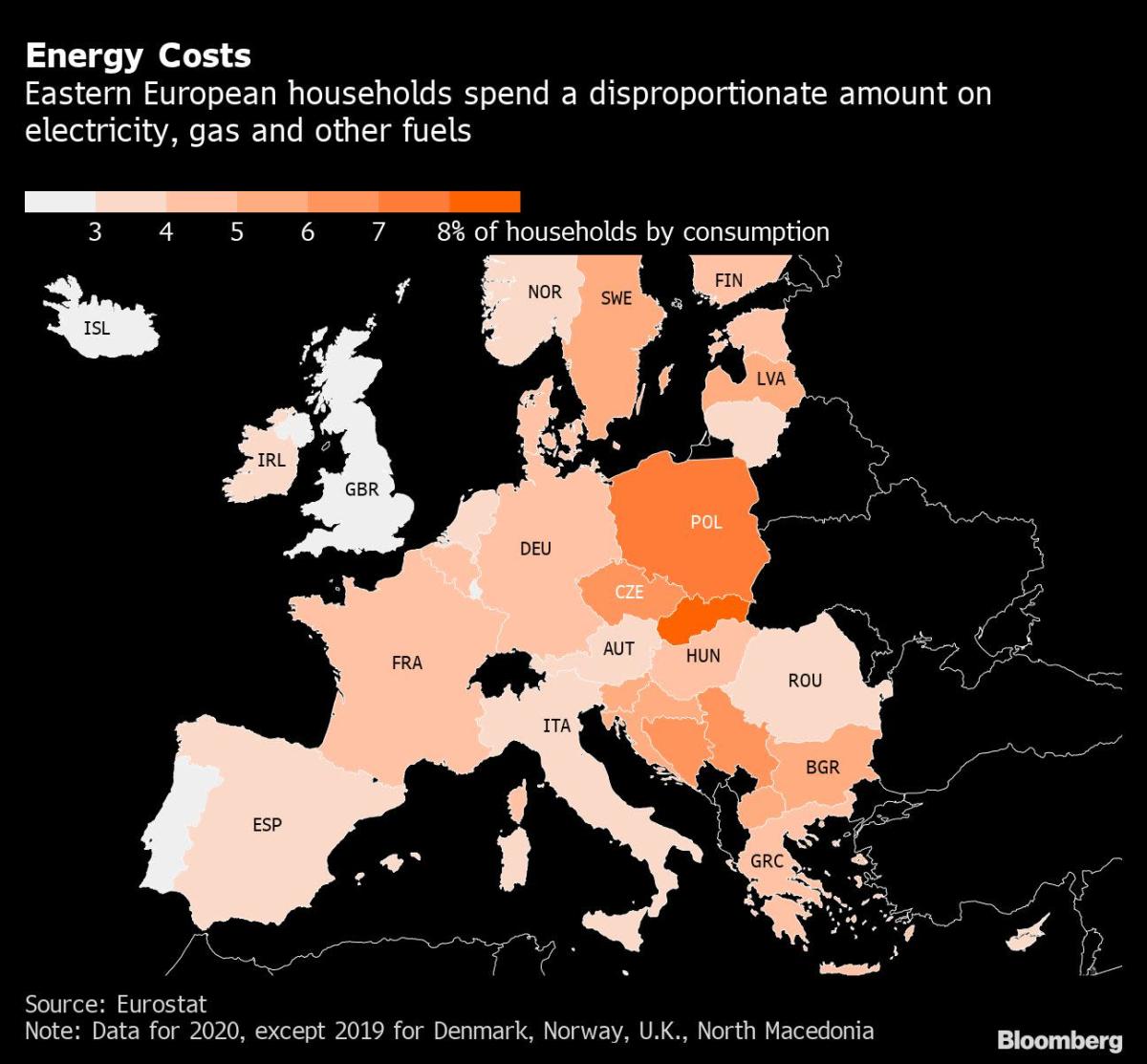

U.S. inflation is at an almost four-decade high, price expectations are rising in Japan and soaring energy costs are squeezing European households.

Germany’s economy may have shrunk in final three months of 2021, while the World Bank shaved global growth estimates for this year because of the coronavirus, persistent supply chain disruptions and less fiscal support. In Brazil, inflation clocked in at about 10% last year.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

Consumer prices are likely to extend their eye-popping gains after soaring last year by the most in nearly four decades, further burdening Americans and ramping up pressure on Federal Reserve policy makers to act. Last year, the increase in the consumer price index was largely due to high goods inflation. Excluding food and energy, the price index of goods surged 10.7%, the largest 12-month advance since 1975.

Consumer sentiment declined in early January by more than forecast amid mounting concerns about soaring inflation and the fast-spreading omicron variant. Americans expect prices will rise at an annual rate of 3.1% over the next five to 10 years, the most since 2011.

Mortgage rates in the U.S., tracking a jump in yields for 10-year Treasuries, rose for a third straight week, reaching the highest point in almost two years. Signs point to borrowing costs rising further, which would increase the burden on home buyers who are already stretching to afford a purchase.

Europe

Soaring energy prices are putting the squeeze on European consumers desperate for some relief after two years of coronavirus, lockdowns and job worries. The financial pain is taking a toll on households, who are more worried about prices than at any time this century, and feel less inclined to splurge, according to a European Commission survey.

Germany is headed for its second recession of the pandemic after the emergence of the coronavirus’s omicron strain compounded drags on output from supply snarls and the fastest inflation in three decades.

For five years, Emmanuel Macron has been fending off challenges from the fringes of mainstream French politics. But as he seeks reelection in April, the president who was nurtured in the top echelons of the French technocracy has a potential knockout punch to throw: the robust economy.

Asia

Inflation expectations for Japanese households jumped to the highest in 13 years, showing how costlier energy is influencing sentiment even as overall price gains remain far below the Bank of Japan’s target.

Emerging Markets

Brazil’s consumer prices rose more than expected last year, dogging the central bank and its efforts to bring inflation back to target.

World

What do workers really want in a job? The answer depends in part on where they’re from, according to a global survey from management consultant Bain & Co.

Covid-19 flare-ups, diminished policy support, and lingering supply-chain bottlenecks will see the global economic recovery cool more than previously estimated in 2022, after last year’s expansion clocked the fastest post-recession pace in eight decades, the World Bank said.

Stockpiles of metals including aluminum and nickel tracked by the market’s biggest exchange fell again, stoking worries about tighter supplies that’s sent prices rallying recently. Metals prices have climbed lately as production outages and smaller inventories revive worries about global supplies of materials crucial to manufacturing and the green-energy transition.

Central bankers in Romania and South Korea increased interest rates by 25 basis points this week, following peers in South America and eastern Europe to use their first monetary policy meetings of the year to increase borrowing costs to temper surging inflation.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.