Amundi’s Cash-Rich Gulf Clients Look Beyond U.S. to China, India

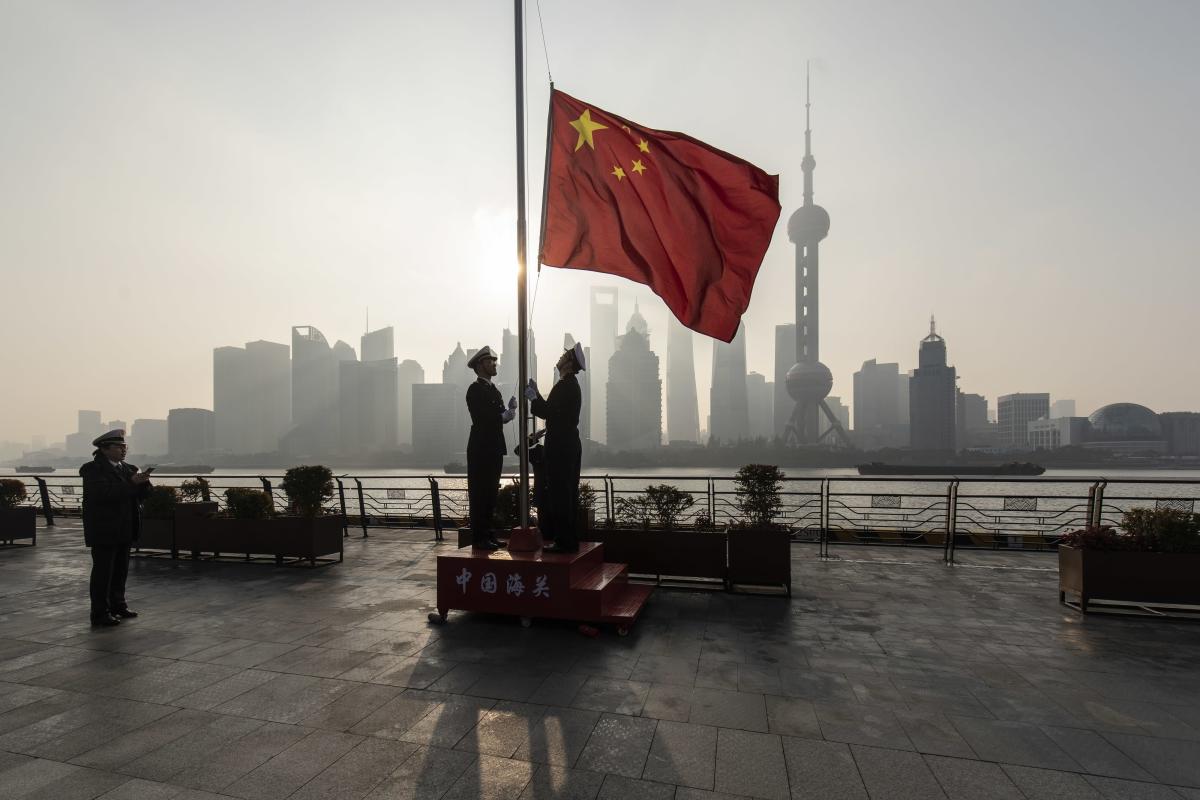

(Bloomberg) — Europe’s largest asset manager said its wealthy clients in the Persian Gulf are looking beyond U.S. markets and instead focusing more on equities in developing nations like China and India.

Most Read from Bloomberg

Institutional investors in the region are looking “to raise portfolio diversification and really gain exposure to these country-specific stories and take advantage of internal demand growth,” Nesreen Srouji, Amundi SA’s chief executive officer in the Middle East, said Monday in an interview with Bloomberg Television.

Some regional sovereign wealth funds are also taking large positions in exchange-traded funds, targeting sector plays including infrastructure and real estate, she said, adding that many more clients in the Gulf are looking at ESG investments.

With sovereign investors worldwide adding to their exposure to equities, the rally in global stocks and higher oil prices helped the wealth fund industry exceed $10 trillion in assets last year for the first time.

The focus for some is increasingly drifting away from the U.S. and toward Asia, according to data provider Global SWF, with the Saudi wealth fund applying for a Qualified Foreign Institutional Investor license in China late last year.

Assets under management for Amundi’s Gulf clients grew in 2021 as they became more active in investing in stock markets around the world, according to Srouji. With a boost in oil prices, “they’re sitting on a lot of liquidity,” she said.

Read more: Traders’ Emerging Stocks Dreams Are Dashed by Late January Curse

U.S. equities soared last year, with key benchmark gauges hitting record highs as solid earnings and steady growth encouraged investors at a time when developing-nation stocks were under pressure. This year, emerging-market equities are faring better than their U.S. peers, which have stumbled over an increasingly hawkish Federal Reserve.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.